Introduction to Outsourcing Insurance BPO Teams

Insurance carriers and agencies today face unprecedented operational challenges: rising costs, persistent staffing shortages, and increasingly demanding client expectations for service excellence. These pressures are compelling agencies of all sizes to reevaluate their operational strategies, particularly regarding back-office functions. Insurance agency back office outsourcing (or insurance BPO) has emerged as a strategic solution that enables agencies to enhance efficiency, substantially reduce operational costs, and redirect focus toward core revenue-generating activities.

No longer limited to enterprise-level players, insurance industry outsourcing has become an essential growth strategy for agencies of all sizes. This comprehensive guide explores how insurance back office process outsourcing works, what tasks are ideal for delegation, integration best practices, compliance considerations, and how to select the perfect insurance outsourcing company for sustainable success.

The Growing Importance of Insurance BPO Services

The insurance industry has witnessed a significant shift toward specialized back-office support and outsourcing solutions over the past decade. According to industry analyses, nearly 68% of insurance agencies now leverage some form of insurance BPO services to streamline operations and boost competitiveness in an increasingly digital marketplace.

This trend has accelerated due to several converging factors:

- Industry-wide digital transformation: Legacy systems and manual processes are being rapidly replaced by automated solutions that specialized outsourcing partners can implement more efficiently.

- Evolving customer expectations: Today’s insurance customers demand faster service, 24/7 availability, and seamless digital experiences that require specialized technological expertise.

- Regulatory complexity: Increasing compliance requirements demand dedicated resources that many agencies struggle to maintain in-house.

- Talent acquisition challenges: The specialized skills needed for insurance back-office support are increasingly difficult to source and retain, particularly for small to mid-sized agencies.

Insurance outsourcing services now range from basic administrative support to sophisticated, technology-driven solutions that transform entire operational models.

What Does Back Office Outsourcing Do for an Insurance Agency?

Insurance BPO providers take ownership of routine yet critical administrative tasks, freeing your internal teams to focus on client relationships and business development. Insurance support services typically includes these commonly outsourced functions:

- Policy administration: New business entry, renewals, policy issuance, thorough policy checking, and cancellation warning notices

- Billing and accounts receivable: Invoice creation, payment processing, and collections management

- Data entry and management: Precise data recording, document indexing, and database maintenance

- Premium accounting: Reconciliation of premium payments with insurer statements

- Claims processing: Initial claims intake, documentation gathering, and follow-up coordination

- Compliance and reporting: Regulatory filings and adherence to evolving industry standards

- Insurance quotes: Generating and processing accurate quotes for prospective clients

- Bookkeeping: Meticulous management of financial records and transactions

- Underwriting services: Risk assessment and policy issuance support

- Quoting and proposals: Preparation of accurate and competitive quotes for potential clients

The Value of Specialized Back-Office Support

When evaluating insurance outsourcing services, it’s essential to understand the distinct advantages specialized back-office support can provide compared to generic business outsourcing. Insurance-specific back-office support teams bring industry expertise that translates to several competitive advantages:

- Regulatory Compliance Expertise: Insurance back-office support specialists stay current with evolving regulations across multiple jurisdictions, reducing compliance risks for your agency.

- Industry-Specific Software Proficiency: Back-office support teams are already trained on industry-standard platforms like Applied Epic, AMS360, and other agency management systems, eliminating costly training periods.

- Insurance Terminology Fluency: Specialized back-office support personnel understand complex insurance terminology and concepts, minimizing miscommunications and errors that commonly occur with general outsourcing providers.

Efficiency Comparison: In-House vs. Outsourced Operations

| Task | In-House Challenges | Outsourced Advantages |

|---|---|---|

| Policy Administration | Time-consuming, prone to manual errors, staffing dependencies | Efficient, automated processes, specialized expertise |

| Billing & Collections | Labor-intensive, inconsistent follow-up, slow processes | Rapid turnaround, automated collection systems, consistent protocols |

| Data Entry | Frequent inaccuracies, resource-intensive, costly delays | Enhanced accuracy, automated validation checks, faster processing |

| Premium Accounting | Complicated reconciliations, time constraints | Precise reconciliation, experienced accounting professionals |

| Claims Processing | Slow response times, documentation backlog | Streamlined processing, timely client communication |

| Insurance Support Services | Resource-intensive, inconsistent quality, training challenges | Specialized expertise, consistent performance, scalable resources |

| Cancellation Notice | Notice period before termination | Do Not Alter |

What Impact Insurance BPO Can Have for an Agency - Cost and ROI

Insurance business process outsourcing services deliver significant financial benefits while simultaneously improving productivity and service quality. Agencies implementing agency outsourcing typically realize cost reductions between 30%-40% compared to maintaining equivalent in-house operations.

Calculating Your insurance BPO ROI

To determine your agency’s potential return on investment from insurance BPO management services:

- Current Cost Assessment: Calculate total expenses including salaries, benefits, training, technology infrastructure, and overhead costs.

- Outsourced Cost Analysis: Evaluate vendor fees, initial setup expenses, and ongoing management costs.

- Efficiency Gains Valuation: Quantify reduced errors, improved turnaround times, and higher customer satisfaction rates.

Practical ROI Example:

A mid-sized insurance agency previously spending $150,000 annually on back-office operations could reduce this expenditure to approximately $90,000 through strategic insurance agency outsourcing, achieving a $60,000 annual saving while simultaneously improving accuracy and enhancing client satisfaction.

Total CSR enhances these cost savings further by minimizing training and onboarding expenses through targeted training solutions, ensuring outsourced insurance professionals deliver maximum value from day one.

Beyond Cost Savings: Strategic Benefits of Insurance BPO

While the financial advantages of insurance outsourcing services are compelling, forward-thinking agencies are increasingly recognizing the strategic value that extends beyond direct cost savings:

- Business Continuity Enhancement: Insurance outsourcing services provide operational redundancy that protects against local disruptions, staff turnover, or unexpected absences, ensuring continuous service delivery for clients.

- Scalability on Demand: Back-office support through outsourcing enables agencies to rapidly scale operations during peak periods (such as renewal seasons or after catastrophic events) without the long-term commitment of permanent hiring.

- Technology Modernization: Many insurance outsourcing services include access to advanced technologies and platforms that would otherwise require significant capital investment and specialized in-house expertise.

- Competitive Agility: By transitioning routine tasks to outsourced teams, agencies can redirect internal talent toward innovation and client experience enhancements that differentiate them in increasingly competitive markets.

How to Integrate and Implement Insurance BPO Teams Without the Headaches

How to Integrate and Implement BPO Teams Without the Headaches

- Comprehensive Process Documentation: Clearly define roles, workflows, and expectations with detailed documentation.

- Strategic Timeline Creation: Develop realistic transition timelines with buffer periods to prevent operational disruption.

- Proactive Stakeholder Engagement: Maintain regular communication to align expectations and operations across teams.

Implementation Best Practices:

- Conduct weekly coordination meetings to ensure alignment and address issues promptly

- Utilize project management tools like Asana or Monday.com for real-time progress tracking

- Establish clear, measurable Service Level Agreements (SLAs) for accountability

Total CSR’s platform ensures your outsourced insurance professionals receive tailored, consistent training that facilitates seamless integration into your operational framework and improves overall workload management without the common implementation challenges.

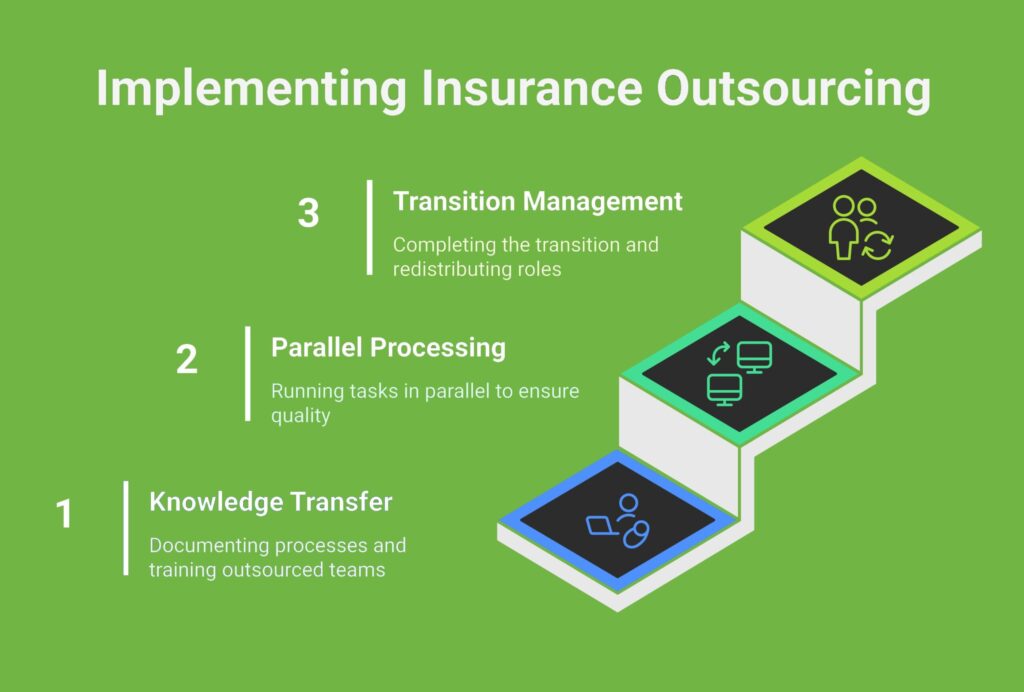

Creating a Transition Roadmap for Back-Office Support

A strategic approach to implementing insurance outsourcing services requires a well-structured transition roadmap. Consider these essential phases when developing your back-office support implementation plan:

Phase 1: Knowledge Transfer and Documentation (Weeks 1-4)

- Document existing processes in explicit detail

- Create comprehensive standard operating procedures (SOPs)

- Establish clear decision trees for common scenarios

- Schedule intensive knowledge transfer sessions with subject matter experts

Phase 2: Parallel Processing and Quality Assurance (Weeks 5-8)

- Begin with duplicative processing where both in-house and outsourced teams handle the same tasks

- Implement rigorous quality assurance protocols to verify outsourced work

- Identify and address knowledge gaps or procedural misalignments

- Gradually increase the outsourced team’s workload as quality benchmarks are consistently met

Phase 3: Transition Management and Role Redistribution (Weeks 9-12)

- Complete the full transition of routine back-office support functions

- Redistribute internal staff to higher-value activities

- Implement regular review cycles and performance evaluation frameworks

- Establish long-term governance and oversight protocols

Selecting the Right Insurance Outsourcing Service Provider

Choosing the ideal insurance outsourcing company significantly impacts your outsourcing success. Consider these critical selection criteria:

- Insurance Industry Expertise: Demonstrated knowledge of insurance-specific processes and regulations

- Comprehensive Service Level Agreements: Clearly defined performance benchmarks and accountability measures

- Technological Compatibility: Seamless integration capabilities with your existing insurance software and agency management system

- Verifiable Track Record: Positive client references, detailed case studies, and proven testimonials

- Communication Protocols: Established communication channels and transparent process documentation

- Specialized Capabilities: Expertise in insurance-specific tasks like certificate of insurance (COI) management and renewal processing

Thorough vetting of potential insurance BPO providers ensures operational alignment and long-term effectiveness. Some providers offer specialized services like reinsurance BPO for agencies with niche requirements.

Conducting Due Diligence on Insurance BPO

When evaluating potential back-office support partners, a structured due diligence process will help identify the provider best aligned with your agency’s specific needs:

Security and Compliance Assessment

- Verify SOC 2 Type II certification and other relevant security credentials

- Review data handling protocols and breach notification procedures

- Confirm compliance with industry-specific regulations (GLBA, HIPAA, etc.)

- Assess business continuity and disaster recovery capabilities

Operational Compatibility Evaluation

- Request process mapping demonstrations for key workflows

- Conduct technical integration testing with your existing systems

- Evaluate communication protocols and escalation procedures

- Assess time zone alignment and service availability hours

Cultural Alignment Investigation

- Evaluate the provider’s training methodologies and quality standards

- Assess staff retention rates and professional development programs

- Review client testimonials with specific attention to cultural fit mentions

- Request opportunities to interact with potential team members who would be assigned to your account

Measuring Success and Scaling Your Agency's BPO Efforts

Effective management of insurance back office support requires consistent monitoring of key performance indicators (KPIs):

- Client Retention Metrics: Tracking improvements in service quality and relationship management

- Operational Efficiency Data: Measuring reductions in task completion time for administrative functions

- Error Reduction Statistics: Quantifying accuracy improvements and resulting operational benefits

- Financial Impact Analysis: Documenting clear cost savings and resource optimization

Regular performance reviews enable continuous improvement and strategic scalability of your insurance back office management operations.

Risk Mitigation Strategies with Insurance BPO Teams

Successful outsourcing includes implementing proactive risk management approaches:

- Phased Implementation: Gradual rollout to identify and address potential issues early

- Regular Compliance Audits: Ensuring adherence to regulatory requirements and performance standards

- Pilot Testing Protocols: Initial testing phase to validate processes before full implementation

- Comprehensive Contracts: Clearly defined obligations, performance expectations, and remediation procedures

- Data Security Frameworks: Robust protocols for safeguarding sensitive client and agency information

These strategies establish strong risk management foundations and operational confidence in your insurance agency administration services.

Insurance agency back office outsourcing represents a strategic investment in operational efficiency, scalability, and sustainable growth. Total CSR offers an integrated development platform specifically designed to align internal and outsourced operations through customized training, seamless onboarding, and comprehensive compliance support for insurance agents and carriers alike.

Explore Total CSR’s solutions today to streamline training processes, improve operational effectiveness, and enhance your agency’s competitive advantage. Our scalable services help optimize everything from customer service to underwriting and quoting processes.

Discover more about our resources and schedule a demonstration:

- Strategies for effective staffing in insurance agencies

- Enhancing agent training for smoother operations

- Tools to assess and boost workforce skills

Book a Demo to begin your journey toward streamlined, efficient, and highly effective back-office operations. With the right insurance back office services, you can focus on growing your business while entrusting operational details to specialized outsourced insurance professionals.