What is an ACORD 163 Form?

As you begin a career in insurance, it’s vital to become familiar with the applications used in your Agency Management System (AMS). Below, you’ll find more details about the tools you’ll use every day to manage applicant information, including the driver schedule app for commercial auto insurance.

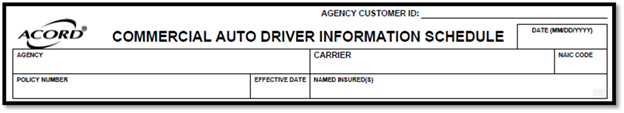

The ACORD 163 form is more commonly known as the Commercial Auto Driver Information Schedule. This one-page application is used to collect essential details on additional drivers who don’t fit on the ACORD 127. Understanding how to complete this form matters when you have an applicant with a long drivers list for scheduled autos. If you’ve already mastered the driver schedule on the ACORD 127, you’ll find the ACORD 163 straightforward. You can find a copy at the bottom of the page or click here to download.

Agency and Insured Information - ACORD 163

At the top of the form, enter the Agency Name, Agency Customer ID, First Named Insured, and Effective Date. If you know the Carrier, NAIC code, policy number, or other details, list them too. Don’t forget the applicant’s city and zip code, plus the producer’s name.

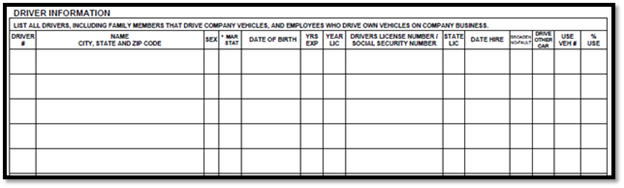

Driver Information - ACORD 163

Provide each driver’s Name, Date of Birth, year licensed, Driver’s License Number, and State Licensed. List drivers in numerical order, and include the driver’s sex, marital status, date hired, years of experience, and vehicle usage percentage. Whenever possible, avoid putting a social security number on this form to protect privacy.

Other Important Notes:

An ACORD 163 form (along with other ACORD forms like the ACORD 125) should be available in your AMS. You can complete it using the driver schedule app and then send an ACORD 163 PDF to the applicant for review. This driver list form PDF is never submitted by itself; it always goes together with the ACORD 127 for scheduled auto insurance. In many cases, certain fields will pre-fill automatically from your AMS, which saves time whenever you work on the ACORD 163 for company vehicles.

Remember, this form is a key tool for handling commercial auto insurance policies, especially if there are multiple drivers and company vehicles. Make sure you include all relevant employees and family members who may operate the insured vehicles. If any drivers have “drive other car” coverage or need to broaden no-fault coverage, note it on the form.

Frequently Asked Questions

Is used when:

- An insured has more than 13 drivers to list

- Additional driver information needs to be provided beyond what fits on the ACORD 127

Automatic creation: AMS360 automatically generates the ACORD 163 Commercial Auto Driver Information Schedule for any Commercial Inland Marine policy that includes data in the Driver Information section