What is an Acord 125 form?

Whether you’re starting a career in insurance or an insurance industry vet looking to train new hires on ACORD 125, it’s important to get comfortable with the applications used in an Agency Management System (AMS). In this article, we’ll explore the ACORD forms and specifically the ACORD 125 form. This guide will show you exactly how to fill out ACORD 125 step-by-step, while providing tips and resources for training your new hires on how to complete it as well.

The ACORD 125 form, also referred to as the ACORD commercial insurance application or business insurance application form, is used to capture general client information for ACORD business insurance. This 125 insurance form includes details like the business location/mailing address, contact information, a business description, prior insurance, and loss history. If you’re wondering whether you need to learn how to fill out an ACORD 125, the answer is definitely yes. This ACORD application is used for most commercial insurance policies, making it essential to know how to complete it correctly.

Preparing to Complete the Acord 125: Required Information & Documents

Before beginning to fill out the ACORD 125, ensure you gather these essential documents, record general client information, and collect necessary insurance data from the client:

- Business legal name and DBA (if applicable)

- FEIN or Social Security Number

- Complete business description

- All business locations and details

- Prior insurance information (carriers, policy numbers, premiums)

- Loss history for the past 3-5 years

Creating a commercial insurance application checklist helps streamline this process and prevents missing information that could delay submissions.

Key Sections of the Acord 125 Form

Below are a few key sections of the ACORD 125 (AKA the Commercial Insurance Application/Business Insurance Application form) that you’ll want to pay attention to:

Applicant Information Section - ACORD 125

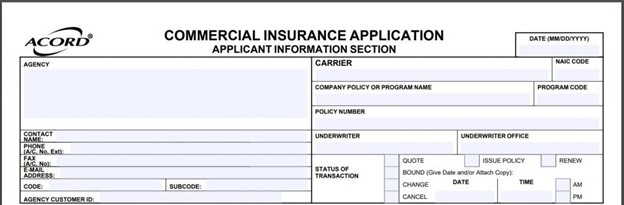

Page 1 starts with the company’s underwriting or rating basics. You’ll see fields for the agency’s details, including the National Producer Number and State Producer License No. Your AMS usually pre-fills this information, but if you’re not using an AMS, be sure to enter it manually. On the right side, you’ll also see a Status of Transaction box. If you’re sending this application to carriers along with others, you’ll mark “quote.”

Line of Business Section in the Acord 125

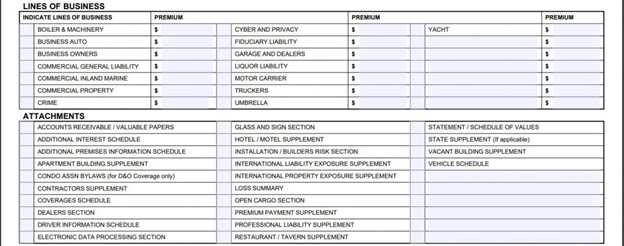

Next, check the Lines of Business section. Review the policy options and select all that apply, such as Commercial General Liability, Property, Crime, Business Auto, and Umbrella coverage. The general liability ACORD form 125 is especially significant for businesses seeking liability protection. Meanwhile, Property and Crime are often core parts of a robust commercial insurance policy.

Policy Information Section

Moving on to the Policy Information section, you’ll indicate the Proposed Effective Date and Proposed Expiration Date, billing plan details (who’s billed for the premium), and the payment plan chosen by the client. You’ll also see a box labeled “Audit,” which is usually marked “A” for annual audits.

Applicant Information Section

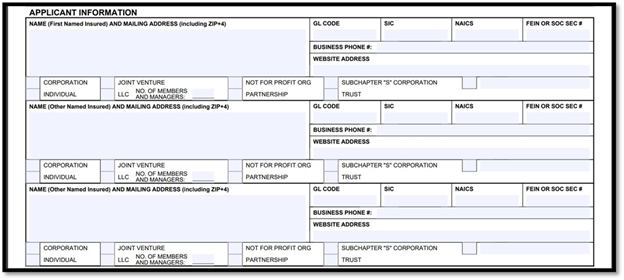

The Applicant Information Section follows, where you’ll record the Named Insured, Mailing Address, FEIN (Federal Employer Identification Number) or Social Security Number (if it’s an individual), and the main Business Phone number. The FEIN is vital for identifying businesses, so make sure it’s entered correctly. You’ll also check a box indicating the business structure. If there are additional Named Insureds, include those here as well.

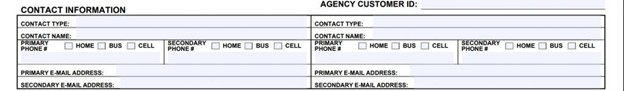

Page 2 on the ACORD 125 digs deeper into the insured’s operations. At the top, fill in the contact details under Contact Information: contact type, name, and phone number. include the contact type, contact name and phone number.

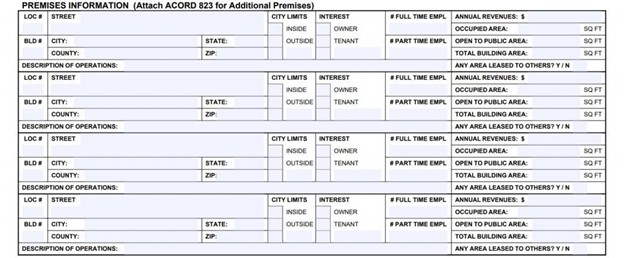

Premises Information

Next, in the Premises Information section, enter the Location and Building Number (start with #1), address details, and note whether the location is inside or outside city limits. Also indicate if the insured is an owner or tenant, and the number of employees. You’ll then list revenue and square footage specifics, including annual revenues, occupied area, open-to-public area, and total building area. Confirm whether any part of the premises is leased to others. This data helps determine the policy premium, especially for Property and Crime coverage.

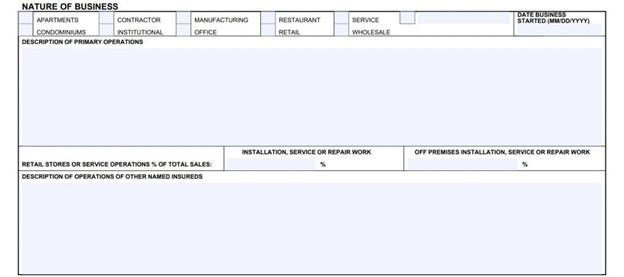

Nature of Business - ACORD 125

After that, complete the Nature of Business details. First, check the box that fits the insured’s business category. Then, in the Description of Operations, describe the company’s activities. This information is crucial for underwriters to accurately assess risk. You may also need to provide the NAICS or SIC Code if required.

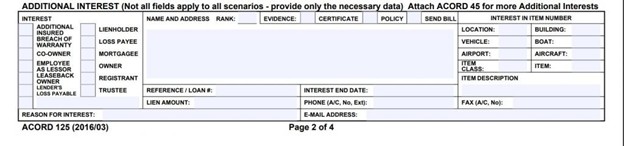

Additional Interest

As you continue, you’ll see the Additional Interest area. Here, list any parties with an interest in the insured’s business, along with their name and address.

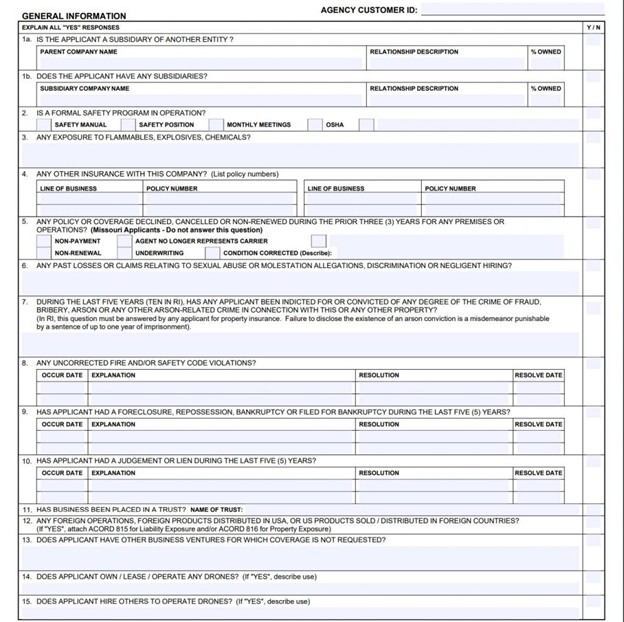

General Information and Prior Coverage

Page 3 on ACORD 125 mostly gathers General Information. There are 15 questions to answer with “yes” or “no” in the right-hand column. Some questions might require extra details if you answer “yes,” so be sure to include any necessary explanations.

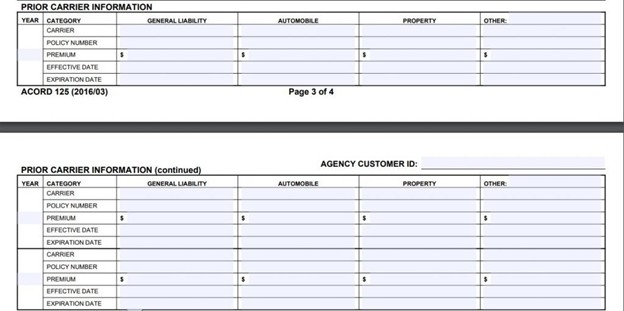

Prior Carriers and Loss History

Toward the bottom of the ACORD 125, you’ll find Prior Carrier Information. This is where you’ll enter previous coverage details, including the policy year, carrier name, policy number, premium amounts for Property, Crime, and other coverages, and the policy’s effective and expiration dates.

Loss History and Signatures

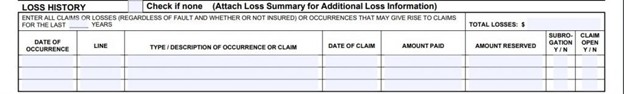

Page 4 continues the Prior Carrier Information, offering space for additional carrier history. As you go down the page, you’ll arrive at the Loss History section. Check “no” if there have been no claims in previous policy periods, or fill in the requested claim details if there have been any.

Finally, you’ll see signature fields for the Producer’s Name and Applicant’s Signature. These aren’t necessary during quoting but must be obtained once the policy is bound. The Signature area validates the accuracy of the information provided. In particular, the Named Insured’s signature confirms that all information is correct to the best of their knowledge.

Other Important Notes for ACORD 125:

An ACORD 125 (as well as the ACORD 126 and ACORD 140) is typically available in your AMS. You can fill it out and then send an ACORD 125 PDF to the client for review and signing. Many details will auto-populate in your AMS, saving time when completing the ACORD 125 form.

While this article centers on the ACORD 125, you may also need the ACORD 126 PDF or a combination of ACORD 125 and 126 or even ACORD 125, 126, and 140, depending on the commercial insurance application you’re processing. Getting familiar with these forms and how they’re used will make you more efficient in handling ACORD commercial insurance applications and business insurance application forms.

When you work with these forms, pay special attention to the Named Insured, Mailing Address, Description of Operations, and coverage details for Property and Crime. Each section is essential to representing the business accurately. By mastering the ACORD 125, 126, and 140 forms, you’ll be prepared to handle a wide variety of commercial insurance applications quickly and accurately.

Other Important Notes for ACORD 125:

Training a new hire on ACORD 125 can be frustrating—especially if your training process is inconsistent or involves manual processes. An inconsistent training process often leaves fresh team members underprepared and error-prone, risking potential E&O issues.

Comprehensive insurance onboarding workflow begins with mastering the ACORD 125 form, as it touches virtually every commercial line of business. When your new hires understand how to complete it accurately, they build confidence and reduce the risk of costly errors that could lead to coverage gaps or E&O claims.

Following insurance best practices, agencies that implement structured ACORD 125 training typically see:

- Fewer submission rejections from carriers

- More accurate premium quotes

- Reduced E&O exposures

- Faster turnaround times

- More consistent client experience

If you’re looking to automate your new hire training, check out Total CSR’s insurance agent training platform that prepares new hires with practical skills for their roles.

Frequently Asked Questions

What is the difference between ACORD 125 and 126?

The ACORD 125 is a general commercial insurance application that captures basic client information, while the ACORD 126 specifically focuses on commercial general liability details. The ACORD 125 is typically paired with the ACORD 126 when submitting a complete commercial insurance application to carriers.

Who needs to complete an ACORD 125 form?

An ACORD 125 form, also known as the Commercial Insurance Application, needs to be completed by businesses seeking to obtain commercial insurance coverage. It is typically filled out by insurance agents or brokers on behalf of the business to provide underwriters with essential information about the applicant’s business operations, risk exposure, and coverage needs.

Are there any common mistakes to avoid when completing the ACORD 125 form?

When completing the ACORD 125 form, common mistakes to avoid include providing incomplete or inaccurate information, as errors in business name, address, or classification can lead to processing delays or coverage issues. Ensure that all sections, like the loss history and exposure information, are thoroughly filled out and double-checked for accuracy. Additionally, it is crucial to attach any required supplementary forms or documentation to avoid any further complications.

Total CSR provides far more than designations. The platform includes:

- Thorough training for new hires

- Focused skill-building for account managers

- Advanced education tailored to agency requirements, covering business auto policy and commercial property

- Specialized courses on ethics, customer service, and risk management

Ready to see what Total CSR can do for your agency and its ethical responsibility? Book a Customized Demo today to discover how Total CSR can help your agency thrive in the insurance industry.