What is an ACORD 127 form?

If you’re starting out in insurance, you’ll need to become familiar with the applications used in your Agency Management System (AMS), especially ACORD Forms. Also known as the commercial auto acord, the ACORD 127 is focused on securing insurance for business autos. It gathers general information like driver information, vehicle schedules, and operational details.

The ACORD 127 appears with nearly every commercial auto policy, including ACORD commercial truck insurance, so it’s essential to learn how to complete an ACORD 127. Scroll to the bottom for a copy or click here to download.

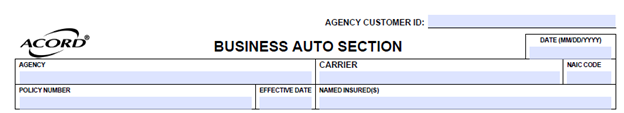

On Page 1, enter the Agency Name, the named insured, and the policy effective date. This might be done automatically in your AMS, but confirm it if you’re working outside the system.

Driver Information - ACORD 127

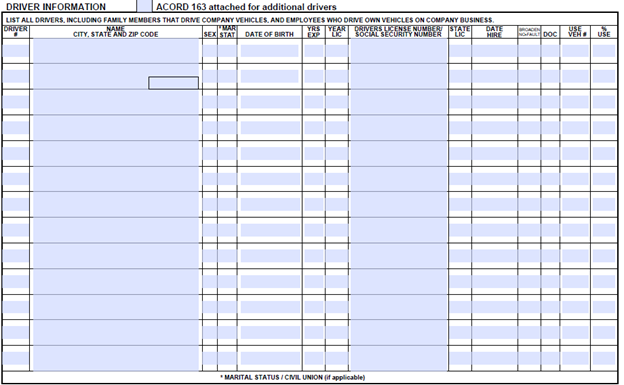

Next, the form asks for driver information. You’ll need the driver’s date of birth, year licensed, driver’s license number, and the issuing state. Some carriers may also request the driver’s social security number. If there are more than 13 drivers, you’ll need an ACORD 163 to record the extras. Certain insurance carriers may also require MVR verifications for all listed drivers.

General Information - ACORD 127

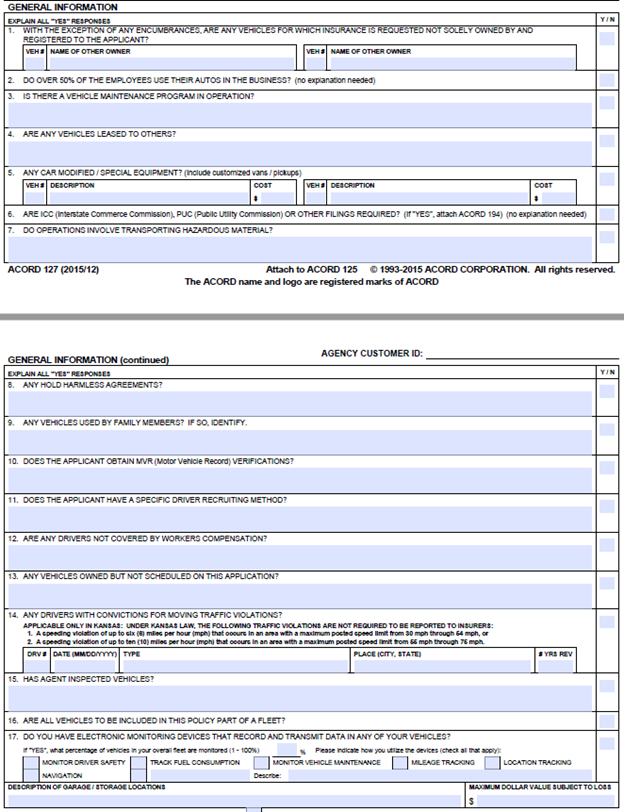

At the end of Page 3 and the start of Page 4, you’ll find a general information section with 17 questions. Each requires a “yes” or “no,” and “yes” answers need explanations. You might see questions on hazardous material transport, hold harmless agreements, ICC filings, or PUC filings, which can apply to certain commercial auto policy operations.

Additional Interest

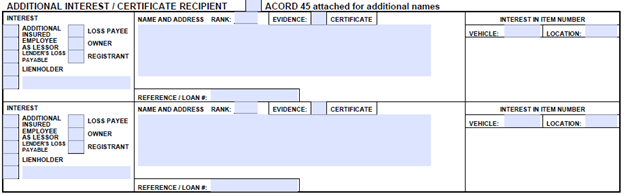

Next, in the Additional Interest/certificate recipient area, note any party with an interest in a vehicle. For example, if a lienholder financed the purchase, mark the box and add the lienholder’s name, address, and which vehicle is involved.

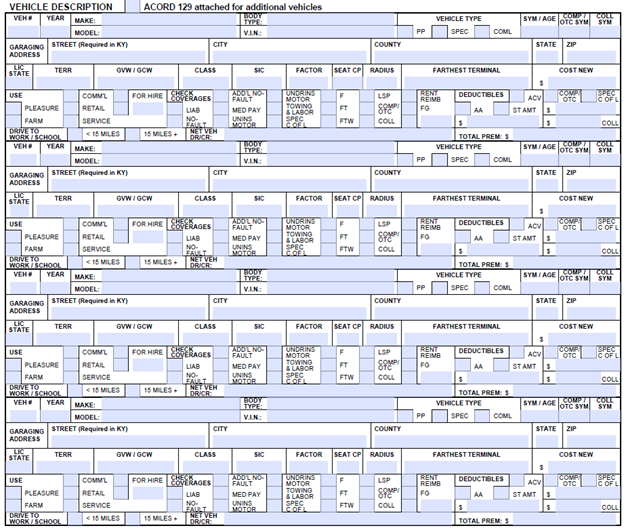

Vehicle Description - ACORD 127

Still on Page 3, you’ll see the vehicle description section, functioning as an ACORD vehicle schedule form. Number each vehicle in order and include:

- Year, Make, Model

- vehicle identification number (VIN)

- vehicle type (e.g., private passenger or commercial)

- garaging address

- Registration state

- Gross vehicle weight

- Vehicle classification

- vehicle use

- Coverage details (e.g., liability coverage, comprehensive coverage, uninsured motorist coverage, medical payments coverage, rental reimbursement coverage, towing and labor coverage, and deductibles for damage)

- Any vehicle maintenance program

There’s space for four vehicles. If you need more, use an ACORD form 129.

Signature

Other Important Notes

An ACORD 127 form (and other ACORD forms) should be available in your AMS. After filling it out, you can send an ACORD 127 PDF to the client. Always include the ACORD 125 and ACORD 137 fillable forms:

- The ACORD 125 fillable covers insured details not requested elsewhere.

- The ACORD 137 fillable clarifies Commercial Auto Coverage limits and Covered Auto Symbols.

Sometimes, you’ll also need the ACORD 101 for extra notes or the ACORD 50 for state-specific details. Much of the data can auto-populate in your AMS, saving you time when preparing the ACORD 127 for ACORD commercial insurance applications, including ACORD business insurance and ACORD commercial truck insurance.

By mastering the ACORD commercial auto application process, you’ll help ensure clients get comprehensive coverage for their commercial vehicles.

Frequently Asked Questions

Are additional forms required with the ACORD 127?

What if there are more than 13 drivers to list?

If the insured has more than 13 drivers, an ACORD 163 form must be used to record the additional driver information

Vehicle information includes year, make, model, body type, and usage (commercial, retail, service, for hire). Each vehicle should be numbered sequentially, starting with 1

The ACORD 127 requires comprehensive driver information, including name, date of birth, year licensed, driver’s license number, state of issue, marital status, sex, social security number, and percentage of vehicle use

The ACORD 127 includes a section for hired and non-owned auto exposures. This part asks for details such as the cost of hire, whether employees rent vehicles in their own names, and if non-owned autos are used in the business. Accurate completion of this section is vital for ensuring proper coverage for these often-overlooked exposures.

The ACORD 127 includes sections for various coverage types such as liability, no-fault, medical payments, uninsured/underinsured motorist, and physical damage coverages. Each coverage type has fields for limits and deductibles, allowing for detailed specification of the desired insurance protection.