What is an ACORD 27 Form?

When you start working in insurance, it’s vital to get familiar with the forms and applications used in your Agency Management System (AMS). You’ll use these documents daily to manage client information and provide proof of insurance. Read on to learn more about the forms like an ACORD 27 and applications you’ll rely on every day.

ACORD forms are well-recognized documents that contain details most insurance carriers need in order to issue a quote to the agency. There are multiple ACORD forms, each serving a specific type of coverage. Among them, a common one you’ll see is the ACORD 27.

The ACORD 27 form is often referred to as the Certificate of Insurance or insurance certificate. This single-page document offers proof of insurance for property coverage to another party that has an interest in a residential property, commercial property or the property’s contents. Mortgagees or loss payees typically request it when they are providing a mortgage or loan.

You might wonder if knowing how to fill out ACORD 27 is really that important. In short, yes! Clients often need to present proof of insurance for property coverage, so it’s essential to understand the parts of the form and how to complete the ACORD 27 for policy verification. Let’s break down the main sections of the ACORD 27 – Certificate of Insurance. You can scroll to the bottom of the page to find a copy or click here to download.

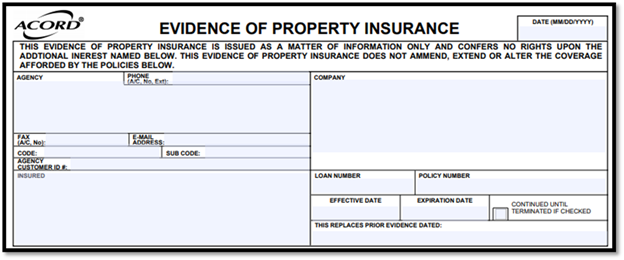

Agency and Insured Information:

On the first page of the Certificate of Insurance form, you’ll need to include Agency and Insured Information, plus details about the carrier and insurance policy. For the Producer, list the Agency name, complete address, and contact information (phone, fax, and email). For the Insured, be sure to provide the full named insured and a complete mailing address. To the right, you must include the carrier name, address, policy number, and the effective date and expiration date of the policy period. If you know the loan number for the property in question, enter it in the relevant box.

If the Certificate of Insurance form is issued on a continuous basis, check the “continued until terminated” box. This indicates that the policy remains active until a cancellation notice is sent. If this particular ACORD 27 replaces a previous certificate, enter the date of the earlier certificate.

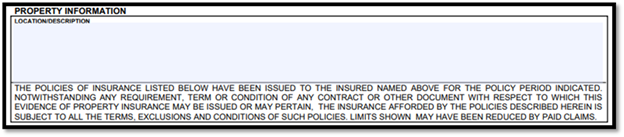

Property Information:

After filling in the Agency, Insured, and Carrier information, move on to the Property Information section. Here, provide the full address of the location and a short description of the building, noting occupancy and use. If the ACORD 27 is used to show proof of insurance for something other than a building, describe the contents. For instance, if it’s for a piece of equipment, include details like the year, make, model, and serial number.

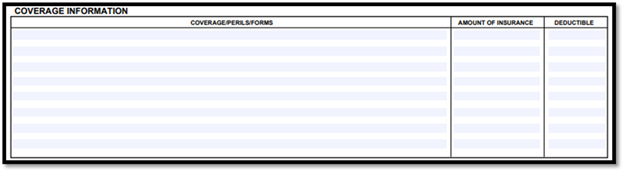

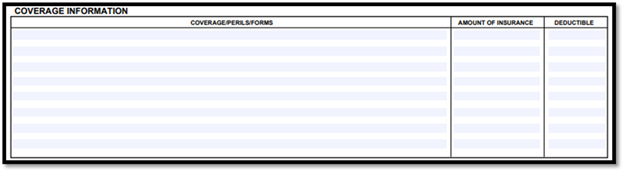

Coverage Information - ACORD 27

In the next part of the form, you’ll enter Coverage Information details. This includes a description of the insurance coverage provided and perils insured (for example, Special, Broad, or Basic), along with the corresponding form number. This section is crucial for both commercial property insurance and personal property insurance policies. In the two columns on the right, list the amount of insurance and the deductible.

Enter these details for each building or other property item shown on the ACORD 27 certificate of insurance.

Remarks:

Upon completing the Property Information section, you can move down the page to the Remarks area of the form. The Remarks section can be used to list any special conditions that may be part of the policy or for additional comments that may need to be presented to the Acord 27 recipient.

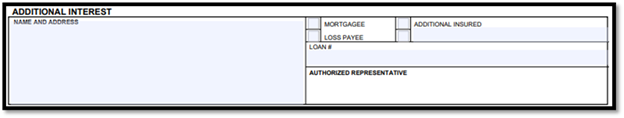

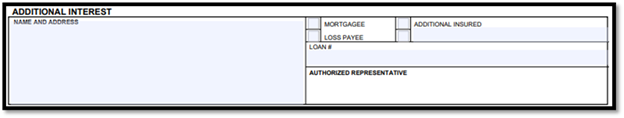

Additional Interest - ACORD 27

In the final section, identify the Additional Interest. Include the full name and address of the mortgagee or loss payee who needs proof of insurance. You also have to specify whether they are a mortgagee, loss payee, lender’s loss payable, or additional insured. Include the loan number if it’s available. The last box is for the signature of the authorized representative.

An ACORD 27 form (along with other ACORD forms like the ACORD 125, ACORD 28 for commercial property insurance, or ACORD 24 for personal property insurance) should be accessible in your Agency Management System. You can complete the form, then send an ACORD 27 via PDF to the client so they can review it and pass it on to the Certificate holder.

Most (if not all) of the details discussed will pre-fill in your AMS, saving you time when finalizing the ACORD 27 form for policy verification and proof of insurance purposes.

Conclusion for the ACORD 27

In conclusion, understanding the ACORD 27 Certificate of Insurance is essential for insurance professionals managing property coverage. By getting familiar with each part of the form—from agency and insured information to specific coverage details and additional interests—you’ll be able to fill it out quickly and confidently. Using your Agency Management System (AMS) will simplify the process even more, helping you stay accurate and save time. This way, you can consistently provide clients and stakeholders with trustworthy proof of insurance, building confidence and ensuring compliance in every transaction.

Frequently Asked Questions

The ACORD 27 form, also known as the Certificate of Insurance, provides proof of property insurance coverage to third parties, such as mortgagees or loss payees. It ensures that interested parties are aware of an active insurance policy covering a specific property.

Mortgage lenders, loss payees, and financial institutions commonly request an ACORD 27 to confirm that a property or its contents are insured before approving loans or other financial agreements.

While both forms serve as proof of insurance, ACORD 27 is used primarily for property insurance and personal property coverage, whereas ACORD 28 is designed for commercial property insurance and includes additional lender protections.

No. The ACORD 27 certificate only serves as proof of insurance. It does not extend or modify coverage terms or guarantee payment for claims.

Yes. If the insurance coverage applies to equipment, machinery, or other personal property, you should describe these items in the property section, including relevant details like the year, make, model, and serial number.