What is an ACORD 140 form?

Starting a career in insurance means getting comfortable with applications used in an Agency Management System (AMS). This includes developing familiarity with various forms such as the commercial property ACORD 140 form.

ACORD forms are universally recognized documents that contain information which most, if not all, insurance carriers require be completed in order to provide a quote back to the agency. There are several ACORD forms and each serves a purpose specific to the type of coverage that it represents.

The ACORD 140 form, also referred to as the property ACORD form, is often called the Property Section. It captures details about the insured’s business locations/buildings, property values, and other vital property information. This form cannot be submitted on its own; it’s always used with the ACORD 125 and sometimes alongside the ACORD 101 for additional remarks.

Let’s explore several key areas of the form. These ACORD 140 instructions will guide you through the process. You can find a copy at the bottom of the page or click here to download.

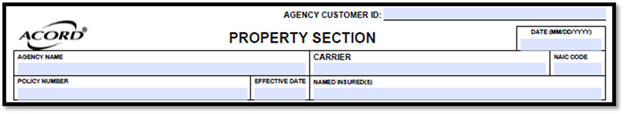

Agency and Insured Information - ACORD 140

On Page 1, enter the Agency and Insured Information, including the Agency Name, Named Insured, Effective date, and Agency Customer ID. These details are critical to the ACORD commercial insurance application workflow.

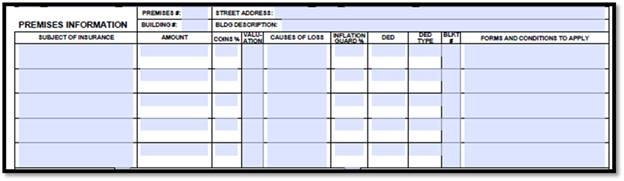

Premises Information

Next, fill out the Premises Information section on the ACORD 140:

- Premises and Building number

- Premises address (street, city, state, ZIP)

- Building description

In the following columns:

- Subject of Insurance: List coverages needed (e.g., Building, Business Personal Property, or Business Income). For detailed calculations, you might use the ACORD business income worksheet.

- Amount of Coverage: Enter the insurance limit for each subject. A statement of values ACORD form can help confirm replacement costs.

- Coinsurance: Common percentages are 80%, 90%, or 100%.

- Valuation: Mark “A” (Actual Cash Value) or “R” (Replacement Cost).

- Causes of Loss: Could be Basic, Broad, Special, Special including theft, or Special excluding theft.

- Deductible: Indicate the deductible that applies to that property

- Blanket #: If relevant, enter a number for blanket coverage.

Additional Information:

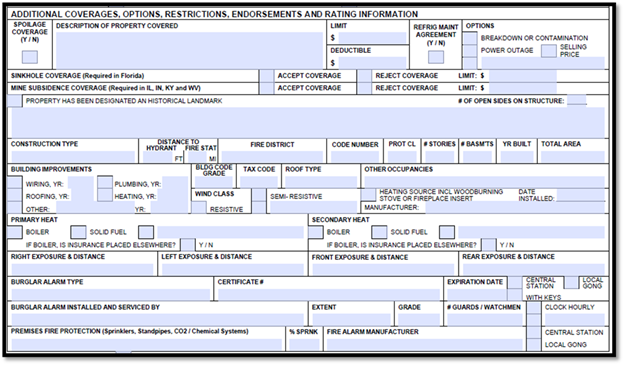

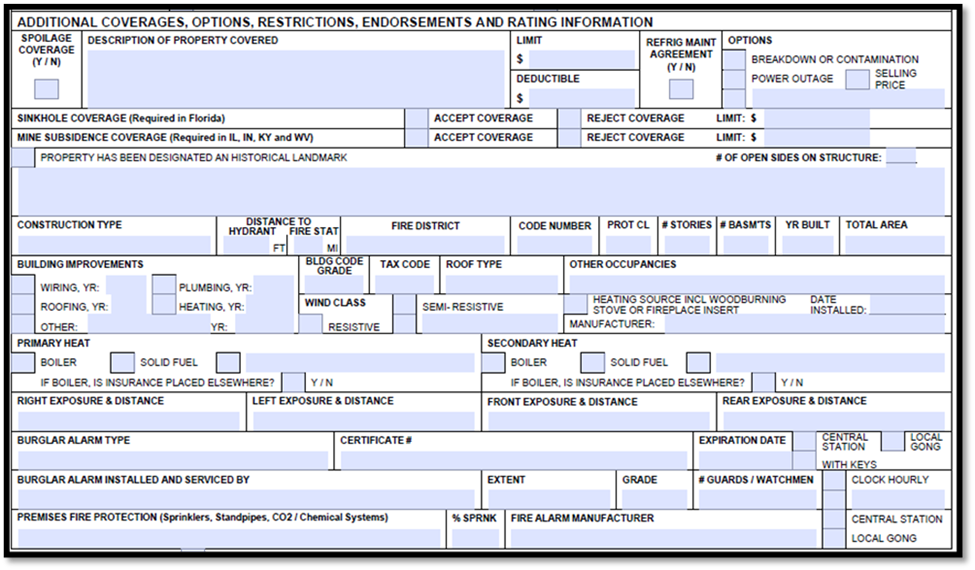

After Premises Information on the ACORD 140, you’ll move to Additional Coverages:

- Construction Type: Such as Frame, Joisted Masonry, Non-Combustible, Masonry Non-Combustible, Modified Fire Resistive, or Fire Resistive.

- Fire Protection: Enter Fire District and Protection class details.

- Building Details: Number of stories, basements, year built, total area, plus any applicable wind class.

- Building Improvements: Include years when wiring, roofing, plumbing, or heating were updated.

- Adjacent Properties: Describe surrounding structures or activities, which helps assess occupancies.

- Security Systems: Note any burglar alarm or sprinkler system.

Some buildings may also require extra documentation, for instance, if the property is a historical landmark, as this can affect valuation.

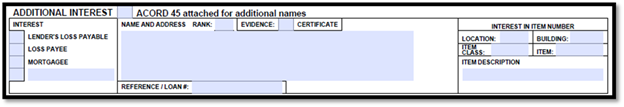

Additional Interests - ACORD 140

Towards the bottom of Page 1 of the ACORD 140 is the Additional Interests section. Here, list any entity with a stake in the insured property, such as a loss payee. Check the corresponding box, provide names and addresses, and list the location, building, or item in the “Interest in Item Number” field.

Additional Premises Information - ACORD 140

Page 2 of the ACORD 140 offers extra space for more premises Information if you have additional properties. You can also note specialized coverages such as mine subsidence or sinkhole coverage, depending on the property’s location.

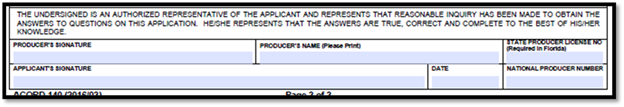

Signatures

At the bottom of Page 3 on the ACORD 140, you’ll find signature lines for both producer and insured. While these aren’t required for quoting, they may be necessary to bind coverage.

Other Important Notes:

An ACORD 140 (like the ACORD 28) is typically available in your AMS. Once completed, you can email an ACORD 140 PDF to the client for review and signature. Many fields will auto-populate from your system, saving time when you fill out the ACORD 140 form.

Remember to include details about extra expense coverage, spoilage coverage, or any other additional coverages your client may require, and be sure you have the correct policy number. You might also see other ACORD forms in commercial insurance, like the ACORD 45 for construction and occupancy details.