Understanding Duty to Defend Insurance

Duty to defend insurance serves as a critical shield for policyholders facing potential legal battles. At its core, this protection addresses an insurer’s responsibility to handle legal defense when claims emerge under a covered policy. Many individuals and businesses with liability insurance count on this safeguard when confronting expensive litigation. For both parties involved, grasping the subtleties of legal defense insurance coverage matters tremendously.

The concept of duty to defend insurance covers both paying for defense costs and making strategic choices throughout legal proceedings. You’ll find it as a fundamental element in many coverage structures, particularly within commercial general liability and professional liability policies. Insurance professionals who understand what duty to defend insurance means can provide better guidance to clients seeking reliable defense coverage. This concept also relates to broader insurance principles like risk transfer and risk pooling, which underpin how insurance typically works.

What is the Duty to Defend

Duty to defend insurance requires an insurer to organize and pay for an insured party’s legal defense whenever a policy applies. This obligation may exist even when allegations appear baseless, as long as they fall within policy parameters. An insurer typically must appoint legal counsel, cover defense expenses, and guide settlement discussions. You’ll find the duty to defend clause in an insurance policy outlining these responsibilities.

Most policies clearly state when this duty activates. Often, insurers defend the insured from a claim’s beginning, assuming potential coverage. Even a slight connection to covered events can trigger the duty, ensuring the policyholder isn’t immediately burdened by growing legal costs. The coverage in force at the time of the incident generally determines the insurer’s duty to defend.

Since legal fees can quickly grow overwhelming, an insurer’s involvement preserves the insured’s capacity to respond effectively to lawsuits. Plaintiffs frequently name multiple parties in litigation, and the duty to defend helps address potentially far-reaching allegations. Remember that the duty to defend vs duty to indemnify differ – the latter concerns the insurer’s obligation to pay damages or settlements for a claim.

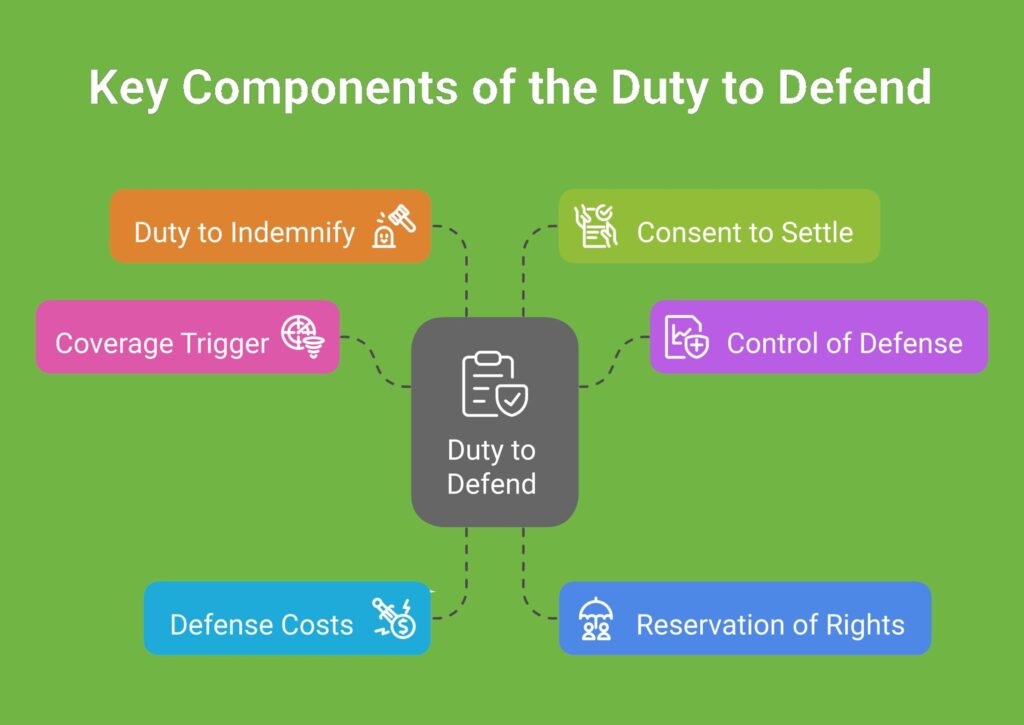

Key Components of the Duty to Defend

Coverage Trigger

The duty to defend begins when a claim or lawsuit indicates a scenario covered by the policy. Insurers typically review allegations in the underlying complaint to determine if they fall within coverage scope. Even if a lawsuit includes non-covered elements, the presence of at least one covered claim usually requires the insurer to act. Pre-suit demand letters can also activate the duty to defend if they suggest potential coverage. Understanding the defense of a claim definition proves essential for all parties involved.

Control of Defense

Once the duty attaches, the insurer typically gains control over the defense process. This might include selecting defense attorneys, guiding litigation strategy, or supervising settlement talks. Policy language usually addresses how much control the insurer exercises. In some cases, the insurer might designate panel counsel or choose independent counsel if conflicts of interest exist. Many insurers follow litigation management guidelines to promote efficient defense approaches and control litigation costs.

Defense Costs

All expenses related to investigating, defending, or settling a covered lawsuit generally become the insurer’s responsibility, subject to policy limits or conditions. These defense costs may include attorney fees, expert witness fees, and other legal expenditures. Some policies cover these expenses without reducing policy limits, while others decrease available coverage as costs accumulate. Typically, insurers pay reasonable and necessary fees connected to the defense. Allocating defense costs becomes complicated when a single lawsuit involves both covered and non-covered claims. Policyholders should understand any deductibles that might apply to these expenses.

Reservation of Rights

In situations where some claims appear covered while others don’t, insurers may issue a reservation of rights letter. This allows the insurer to later deny coverage for specific allegations shown to be excluded under the policy. This approach helps insurers manage their obligations while still providing a defense.

Duty to Indemnify

Though closely related, the duty to defend and the duty to indemnify serve different purposes. The duty to indemnify focuses on paying judgments or settlements for covered claims, while the duty to defend concentrates on managing the defense. Both obligations may stem from the same policy language but function distinctly.

Consent to Settle

Many policies include provisions regarding the insurer’s right to settle claims. Some require the insured’s agreement before settlement, while others give the insurer broader authority. These provisions can significantly affect how litigation unfolds under duty to defend insurance and may impact the insurer’s obligation to pay.

Duty to Defend vs Duty to Reimburse

Comparing duty to defend insurance with a “duty to reimburse” arrangement, which appears in certain coverage types, reveals important differences. The table below highlights key distinctions between duty to defend vs reimbursement:

| Aspect | Duty to Defend Insurance | Duty to Reimburse |

|---|---|---|

| Primary Obligation | Insurer hires and pays for legal defense | Insured arranges defense, then seeks repayment |

| Control of Defense | Insurer often controls legal strategy | Insured directs key defense decisions |

| Payment Timeline | Insurer directly covers defense costs | Insured pays first, then requests reimbursement |

| Policy Language | Usually stated as an obligation to defend | May be stated as liability for incurred expenses |

Some policies blend these models or include endorsements specifying how they’ll handle defense costs. Insurance professionals often rely on policy interpretation to confirm which approach applies. It’s worth noting that some policies feature a non-duty to defend provision, where the insurer agrees to pay for defense costs but doesn’t manage the defense itself. A reimbursement insurance policy typically requires the insured to cover out-of-pocket costs initially.

Duty to Defend: Practical Applications and Real-World Examples

What is the Duty to Defend

In a CGL policy, duty to defend insurance commonly appears as a standard feature. Consider a retail store facing a slip-and-fall lawsuit from a customer. If the policy identifies bodily injury as a covered event, the insurer steps in. They might hire defense counsel, gather evidence, and manage discussions with the injured party. Sometimes, the insurer might seek judgment on the pleadings if facts suggest the lawsuit lacks merit or constitutes a frivolous suit.

Professional Liability or Errors & Omissions (E&O)

Professionals like architects, attorneys, or healthcare providers typically carry E&O coverage. If a client alleges negligence and the policy includes duty to defend insurance, the insurer handles all legal matters. This arrangement allows the professional to maintain focus on daily activities while defense lawyers address the lawsuit. The insurer’s duty to defend typically continues until the case concludes or reaches the policy limit.

Directors & Officers (D&O) Coverage

Corporate leaders can face lawsuits alleging mismanagement or breach of fiduciary duties. D&O policies with duty to defend provisions protect board members and executives by appointing specialized counsel for complex corporate cases. This support helps prevent financial strain on both the business and individuals, covering legal expenses that might otherwise prove prohibitive.

Pollution or Environmental Claims

Some environmental liability policies include duty to defend provisions. If a company faces accusations of contaminating a water source and the policy covers that environmental damage type, the insurer conducts the legal defense. Because defense costs in environmental suits can escalate rapidly, prompt insurer action often proves crucial. The duty to defend in these scenarios may involve complex scientific evidence and expert testimony.

In each example, insurers protect their clients from bearing enormous legal bills. Though details vary among policies, the scope of the duty to defend is frequently expansive. Understanding when the insurer duty to defend end is important, as it typically concludes when the policy limit is exhausted or the case resolves.

Best Practices for Insurance Professionals

Review Policy Language Thoroughly

Each policy contains unique terms. Reading them carefully helps understand how the duty to defend will function. Look for endorsements or provisions that might affect coverage—proper policy interpretation determines the extent of the insurer’s obligation. Pay particular attention to any liberalization endorsement that might expand coverage.

Clarify Defense Arrangements Early

Policyholders benefit from knowing beforehand how the insurer will handle their defense. Agents and brokers should explain whether the insurer appoints the attorney or if the policyholder may select counsel. Establishing these details early prevents confusion when claims arise and helps avoid coverage disputes.

Maintain Clear Documentation

Keep thorough records of discussions, emails, and claim details. Good documentation helps resolve any coverage disputes that might develop. It also helps both insurer and insured verify compliance with defense conditions and proves crucial if questions arise about pre-tender defense costs.

Assess Reservation of Rights Letters Carefully

When an insurer issues a reservation of rights letter, it signals that certain claims might not receive coverage. Monitor the case’s progress in case developments alter the insurer’s coverage position. Policyholders should consider legal counsel if coverage disputes emerge, especially regarding covered allegations.

Encourage Early Communication with Insurers

Prompt claim notification simplifies the defense process. Failing to report quickly can jeopardize the insurer’s duty to defend, especially if delayed notice hinders the insurer’s ability to investigate or respond. Early communication also helps clarify the insurer’s obligation to pay for various defense aspects.

Address Common Misconceptions

Some policyholders assume the insurer automatically covers all lawsuit aspects. In reality, an insurer may defend certain claim portions but not others. Agents and brokers should clarify these nuances so policyholders aren’t surprised if parts of a defense later prove uncovered. This includes explaining differences between duty to defend and duty to indemnify.

Understand Attorney-Client Privilege

In duty to defend scenarios, appointed attorneys often represent both insurer and insured. Policyholders should learn how attorney-client privilege applies to ensure sensitive information remains protected. This understanding builds trust between all parties involved in the defense.

Your Responsibility as an Insurance Agent

Duty to defend insurance provides essential protection during legal disputes by substantially reducing financial impact on insured parties. Insurers fulfilling this responsibility manage defense costs, coordinate legal strategies, and help clients approach lawsuits more confidently. These points establish a solid foundation for understanding how duty to defend provisions work across various policies and industries.

A breach of duty to defend by an insurer can lead to serious consequences, including potential damages exceeding the policy’s limit. This highlights why insurers and insureds must fully understand their rights and duties outlined in the policy. Insurance agents play a vital role in educating clients about these coverage aspects.

Frequently Asked Questions

? Yes, the duty to defend is broader than the duty to indemnify because it applies to potential coverage, not just actual coverage.

The duty to defend is triggered when the insurer receives notice of a lawsuit that might potentially result in covered liability.

Yes, an insurer must defend against any lawsuit that might potentially result in a covered judgment, even if the claim is groundless, false, or fraudulent.

If an insurer breaches its duty to defend, it may face a breach of contract or bad faith complaint from the policyholder.

The duty to defend can vary between policies, with some giving the insurer control over the defense and others allowing the insured to manage their own defense.