Why Operational Efficiency Is the Hidden Driver of Your Insurance Agency’s True Value

Getting an accurate insurance agency valuation isn’t just about crunching numbers—it’s about understanding what makes your business truly valuable to potential buyers. Whether you’re thinking about retirement, considering a sale, or want to know where you stand, knowing your agency’s worth requires looking beyond basic financial metrics.

Too many agency owners focus solely on revenue figures, missing the operational elements that can make or break a deal. Here’s the thing: buyers today are savvy. They want agencies that can run smoothly without the original owner micromanaging every detail. They’re looking for businesses with solid systems, predictable income, and teams that don’t need constant hand-holding.

This is where smart operational decisions—especially those related to hiring and training—can have a dramatic impact on your bottom-line valuation. When your agency runs like a well-oiled machine, buyers take notice. And they’re willing to pay premium prices for that kind of operational efficiency.

What Goes Into an Insurance Agency Valuation?

Valuing an insurance agency goes way beyond simple math. Sure, revenue matters, but professional appraisers delve into multiple factors that determine whether your business can maintain its value over time. They’re examining the consistency of your income, the profitability of your operations, and whether clients remain loyal year after year.

The Financial Foundation:

- How stable are your commission rates and annual revenue streams?

- What do your EBITDA margins tell us about operational efficiency?

- Can you predict cash flow patterns, and how well do you manage working capital?

- Are your net profit trends heading in the right direction?

- How tightly do you control operating expenses?

What Really Drives Value:

- Do your producers consistently meet their targets, and what is your overall staff experience level?

- How well do you retain clients, and what does customer loyalty look like?

- Can your training systems scale up when you need them to?

- Does your geographic location give you any competitive advantages?

The agencies that command the highest prices have something special: they’ve built systems that work without constant oversight. When your training processes, onboarding procedures, and performance tracking operate smoothly, buyers see reduced risk and increased potential for growth.

Your financial statements might get you in the door, but it’s operational excellence that determines the multiple applied to your earnings. Agencies with streamlined training, documented processes, and consistent performance metrics earn premium valuations because they represent safer investments with more predictable growth.

Professional buyers understand that agencies requiring heavy owner involvement or lacking systematic approaches to training carry operational risks that directly impact what they’re willing to pay. On the flip side, agencies with proven systems for developing talent quickly and maintaining consistent performance attract competitive offers and achieve higher multiples.

What Makes an Agency Appealing to Buyers?

Savvy buyers evaluate agencies based on growth potential under new ownership. They want systematic approaches that ensure consistent performance, regardless of who is running the show.

- Predictable Revenue: Buyers gravitate toward agencies with diverse income streams, reliable commission multiplier performance, and clear organic growth patterns. When your annual commissions grow through systematic expansion rather than market luck, you’ll see premium valuations. Understanding buyer motivation helps position your agency appropriately, whether they’re seeking geographic expansion, product diversification, or operational expertise.

- Independence from Owners: The most attractive agencies operate with minimal daily involvement from owners. Buyers want businesses that have systematic training programs, standard procedures, and documented processes, which enable teams to maintain their performance independently.

- Training Systems That Scale: Agencies that can rapidly onboard and develop new talent demonstrate the kind of scalability buyers value highly. When you can cut training time from months to weeks, the growth potential becomes obvious.

- Low Turnover Risk: Consistent staff experience and high retention rates signal operational stability. Buyers recognize that agencies with effective development systems maintain team stability, thereby reducing the risk of client defection during ownership transitions.

Insurance Agency Valuation Rule of Thumb (And Its Limitations)

Industry professionals commonly use several rule-of-thumb methods for initial estimates, though these provide starting points rather than definitive answers.

- Revenue Multiple Approach: Most independent agencies trade between 1.5 and 2.5 times their annual revenue, with variations based on profitability, growth trajectory, and operational efficiency. Commercial-focused agencies typically command higher multiples due to larger account sizes and longer client relationships.

- EBITDA Multiple Method: Agencies typically sell for 4 to 13 times EBITDA, with higher multiples reserved for businesses demonstrating consistent growth, operational excellence, and market leadership. This approach better reflects actual profitability and efficiency. When compared to industry benchmarks, agencies with superior training systems and operational standardization consistently hit the higher end of these ranges.

- Book of Business Percentage: Some use a percentage of 15% to 25% of the total book value, although this method often undervalues agencies with strong growth potential or exceptional operational systems. The revenue multiplier approach offers an alternative perspective, typically ranging from 1.5 to 2.5 times annual revenue, depending on profitability and operational sophistication.

These quick calculations miss crucial operational context that influences real-world insurance agency valuations. Two agencies with identical revenue can achieve vastly different sale prices based on operational maturity, training systems, and scalability potential.

The limitation becomes clear when comparing agencies with similar financial metrics but different operational approaches. An agency with systematic training processes, documented procedures, and proven scalability will significantly outperform a peer with comparable revenue but operational dependencies.

How to Value an Insurance Agency

Professional valuation necessitates a comprehensive approach that combines financial analysis with operational assessment, employing multiple methods to establish accurate market value ranges.

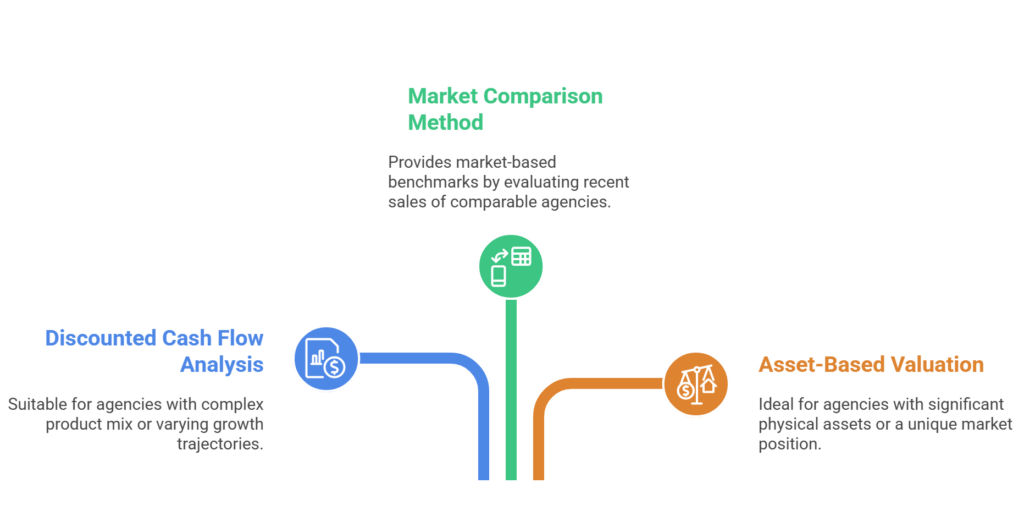

- Discounted Cash Flow Analysis: This method projects future cash flows and discounts them to present value using appropriate risk-adjusted rates. The approach accounts for growth potential, market conditions, and operational efficiency when establishing long-term projections. Financial modeling becomes critical for accurate projections, particularly when assessing agencies with complex product mix or varying growth trajectories.

- Market Comparison Method: Evaluating recent sales of comparable agencies provides market-based benchmarks. Factors include geographic location, product mix, client base characteristics, and operational sophistication levels.

- Asset-Based Valuation: This approach values tangible assets while also assessing intangible factors, such as brand recognition, client relationships, and operational systems. The method works particularly well for agencies with significant physical assets or a unique market position.

Agency TypeRevenue MultipleEBITDA MultipleKey Factors

Personal Lines 1.5x – 2.0x 4x – 8x Client volume, retention rates

Commercial Lines 2.0x – 2.5x 8x – 13x Account size, expertise depth

Mixed Portfolio 1.75x – 2.25x 6x – 10x Diversification, growth trajectory

- Operational Efficiency Premium: Agencies with documented training systems, standardized processes, and proven scalability receive premiums of 10% to 25% above industry averages. This premium reflects reduced operational risk and enhanced growth potential.

The process should account for personal expenses that may be embedded in operating costs, ensuring adjusted EBITDA calculations accurately reflect transferable earnings. Professional valuators also consider the impacts of the regulatory environment, competitive landscape positioning, and industry trends on long-term prospects. Agencies with premium finance capabilities often command higher valuations due to enhanced service offerings and additional revenue streams.

Working with an experienced M&A advisor provides access to current market data, buyer preferences, and methodology expertise that individual insurance agency owners may lack. These professionals understand how operational factors influence purchase price negotiations and can position agencies for maximum value realization. A comprehensive valuation report from qualified professionals provides the necessary documentation for serious acquisition discussions, while identifying specific areas for value improvement.

Strategies to Quickly Increase Your Insurance Agency Valuation

Agency owners have significant control over their business value through strategic operational improvements that enhance both financial performance and buyer appeal. Rather than waiting for market conditions to improve, proactive owners can implement systematic changes that drive immediate value increases.

The most impactful improvements focus on operational efficiency, scalability, and reduced owner dependency. These changes not only improve current profitability but also demonstrate to potential buyers that the agency can sustain growth under new ownership. Every agency owner should recognize that operational sophistication directly correlates with market valuation premiums.

Reduce Training Time and Ramp Speed

Training bottlenecks represent one of the most significant barriers to agency growth, directly impacting both current profitability and future potential. When new employees require extensive training periods before making meaningful contributions to revenue generation, the agency’s scalability is limited.

Traditional training approaches often require 6-12 months before new producers reach acceptable performance levels. This extended ramp time creates cash flow challenges, limits growth potential, and increases the risk of early turnover. The cumulative effect reduces agency profitability and demonstrates operational inefficiency to potential buyers.

Immediate Financial Impact:

- Reduced training costs and improved cash flow management

- Faster revenue generation from new team members

- Decreased turnover risk during critical early employment periods

- Improved profit margins through enhanced operational efficiency

Enhancement Benefits:

- Demonstrated scalability through rapid team expansion capability

- Reduced operational risk and dependency on lengthy training processes

- Improved expense control through systematized development approaches

- Enhanced buyer appeal through proven talent development systems

Standardize Onboarding and Operations

Creating repeatable, scalable systems reduces manual processes, allowing teams to focus on revenue-generating activities rather than administrative tasks. Standardization becomes particularly critical in training functions, where team members often must assist with employee development instead of serving clients.

Systematic Process Development:

- Documented procedures for all critical functions

- Standardized training protocols and assessment methods

- Automated administrative processes, where possible

- Clear performance metrics and accountability structures

Operational Benefits:

- Reduced dependency on individual team members

- Consistent service delivery regardless of staff changes

- Improved efficiency through streamlined processes

- Enhanced customer experience through standardized approaches

Standardized operations also simplify the integration of acquisitions for potential buyers. When agencies operate through documented systems rather than institutional knowledge, the transition process becomes significantly more manageable and less risky.

Buyers value agencies with proven systems because they understand the reduced integration challenges and enhanced scalability potential. The time and cost savings associated with acquiring a systematized agency often justify premium purchase prices.

Strengthen Staff Retention and Engagement

Trained teams remain longer and contribute more significantly to agency growth, representing a factor that many owners overlook. High retention rates indicate operational stability and reduce the ongoing costs associated with recruitment and training.

Retention Impact:

- Reduced recruitment and training costs

- Maintained client relationships during staff transitions

- Consistent service delivery and customer experience

- Demonstrated operational stability for potential buyers

Ongoing Development Value:

- Continuous skill enhancement improves team productivity

- Addressing knowledge gaps prevents performance plateaus

- Enhanced expertise levels support premium pricing strategies

- Improved customer satisfaction and retention rates

Long-term Strategic Value:

- Reduced operational risk through stable team performance

- Enhanced reputation and brand recognition through consistent service

- Improved referral opportunities through satisfied clients

Stronger competitive landscape positioning

Start Growing Your Agency's Value Today

Insurance agency valuation isn’t a fixed number—it’s a dynamic reflection of your business’s operational effectiveness, financial performance, and growth potential. The most successful agency owners recognize that value creation requires systematic approaches to training, operations, and team development.

Among the various strategies available for increasing agency worth, improving training efficiency represents one of the most leverageable and frequently overlooked opportunities. When agencies can rapidly develop talent, maintain consistent performance standards, and scale operations effectively, they create the foundation for sustained value growth.

The distinction between agencies that achieve premium valuations and those that struggle to meet market expectations often comes down to operational sophistication. Agencies with proven systems for talent development, consistent performance management, and scalable operations consistently outperform peers with similar financial metrics but less systematic approaches.

Your agency’s potential extends far beyond current revenue levels. By implementing systematic training processes, standardizing operations, and building scalable team development approaches, you create the operational foundation that drives both immediate profitability and long-term value growth.

Ready to Transform Your Agency’s Value?

Discover how streamlined training, improved retention, and scalable systems can enhance your agency’s market value. Book a personalized demo to see how the right platform can accelerate your agency’s growth while building the operational foundation that buyers value most.

Take the first step toward maximizing your agency’s potential—your future self will thank you for it.

Frequently Asked Questions

The value of an insurance agency is typically calculated using multiples of revenue, EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), or commissions. Factors influencing value include revenue stability, client retention, growth potential, and profitability.

Valuation of an insurance company often involves analyzing financial metrics such as book value, earnings, loss ratios, profitability, market conditions, and regulatory capital requirements. Methods like discounted cash flow (DCF), price-to-book ratios, and comparable company analysis are frequently used.

- Insurance valuation refers to the process of determining the fair market value of an insurance business, its policies, or its book of business, considering financial performance, future earning potential, risk factors, and market conditions.

- Valuation of an insurance agency is the determination of its worth based on financial performance indicators like annual revenue, commissions, profit margins, client retention rates, growth prospects, and prevailing market multiples.

- Insurance agencies typically sell for multiples between 1.5 to 3 times annual commission revenue or 5 to 10 times EBITDA, depending on factors such as agency size, product lines, client base quality, retention rates, geographic location, and growth potential.