What Is an ACORD 130 Form?

If you’re beginning a career in insurance, it’s important to learn about the applications like the ACORD 130 used in the Agency Management System (AMS).

ACORD forms, created by the ACORD Corporation, are standardized documents recognized across the insurance industry. They include all the details insurers require to issue quotes. Different ACORD forms exist for specific coverage types, and a common one you’ll encounter is the ACORD 130

The ACORD 130 form, more widely known as the Workers Compensation Application, is used to gather policy data needed to rate workers compensation. This workers compensation insurance application includes critical information like remuneration (payroll), loss history, and other operational details.

You might wonder how to fill out ACORD 130. In short, it’s essential, because this workers comp application is needed for every workers compensation policy. Some insurance professionals refer to it as the ACORD application for brevity. Accuracy on this form determines not only the efficiency of processing but also the eligibility for workers compensation insurance.

Let’s explore the main areas to focus on when completing an ACORD 130.

How to Complete the ACORD 130 Form Step-by-Step

Page 1: Core Details - ACORD 130

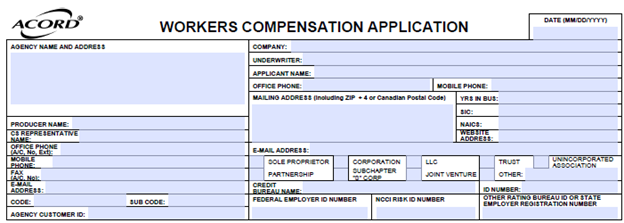

Agency and Applicant Information

Start by entering your agency information. If you’re using an AMS, it may auto-populate. Otherwise, input the required data manually. Next, fill in the Applicant Information on the right side of the page:

- Applicant name

- Phone number(s)

- Years in Business

- Mailing address

- Applicant Entity Type

- ID Number (if applicable)

- Federal Employer ID Number (EIN)

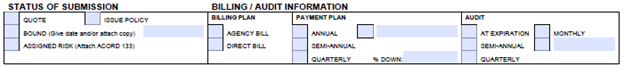

Submission and Billing Details - ACORD 130

Below that, choose the Status of Submission—for new quotes, select “quote.” Under Billing/Audit Information, note who gets billed (the insured or the agency) and identify the chosen premium payment plan. There’s also a space to indicate the policy’s audit frequency.

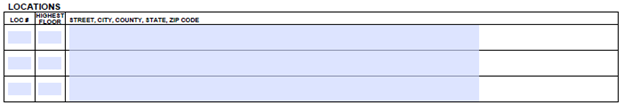

The next area you will find in the ACORD 130 is the Locations section. Here you will need to enter the location number and full address for the insured. Use additional lines as needed to record all of the insured’s locations, including any work from home arrangements.

Locations Section

List each insured location, including any work from home setups. If there are multiple sites, add them on additional lines.

Policy Information - ACORD 130

Use this section to record:

- Effective and expiration dates

- State(s) where the insured operates (including any ACORD 130 FL specific information for Florida)

- Employer’s liability limits

- Other states the insured might need coverage in

Contact Information - ACORD 130

If you’ve completed the ACORD 125 for the same client, you can skip this area. If not, enter the applicant’s contact details, ensuring all information is accurate.

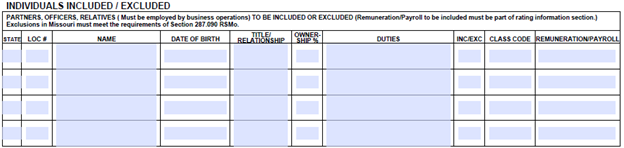

Individuals Included/Excluded

Here, identify owners, partners, officers, or relatives and indicate whether they’re included or excluded from workers compensation benefits. Supply details such as state, location number, title, ownership percentage, and remuneration.

State Rating Worksheet & Premium Information - ACORD 130

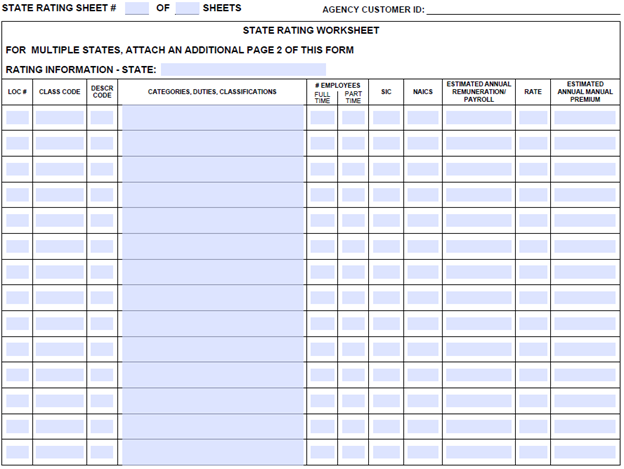

On Page 2, you’ll find the State Rating Worksheet, where you detail each location’s specific job duties. Include:

- Class code

- Categories

- Duties and classifications

- Number of full-time and part-time employees

If payroll is broken down by various tasks, list each task separately with the appropriate class codes. This can lower the minimum premium if done correctly.

Premium Section - ACORD 130

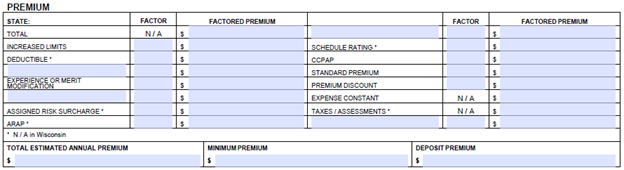

Focus on the Experience Mod, assigned by NCCI (National Council on Compensation Insurance) based on loss history. An insured with three years of workers’ comp experience and a premium over $3,000 might have an experience modification. A modifier under 1.0 lowers costs; one above 1.0 raises premiums.

Other items here include:

- Premium discount

- Deposit premium

- Any consideration for assigned risk

- Rating information

Policy History & Business Operations - ACORD 130

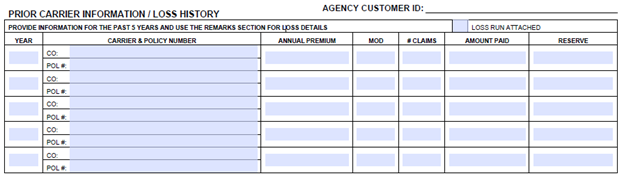

Prior Carrier & Loss History

Document the last five years of coverage, including prior carrier information:

- Policy year

- Carrier name

- Policy number

- Premium

- Experience Mod (if any)

- Claim counts and claim amounts (paid or reserved)

This is key for NCCI when calculating the experience modification factor.

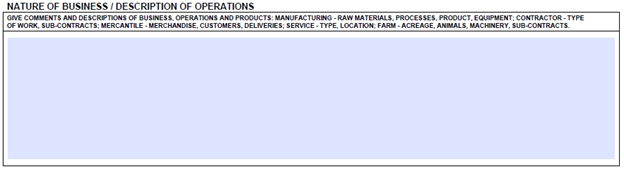

Nature of Business

Use this area to describe the insured’s operations, including any subcontractors or leased employees. If you’re not submitting ACORD 125, you must fill this out.

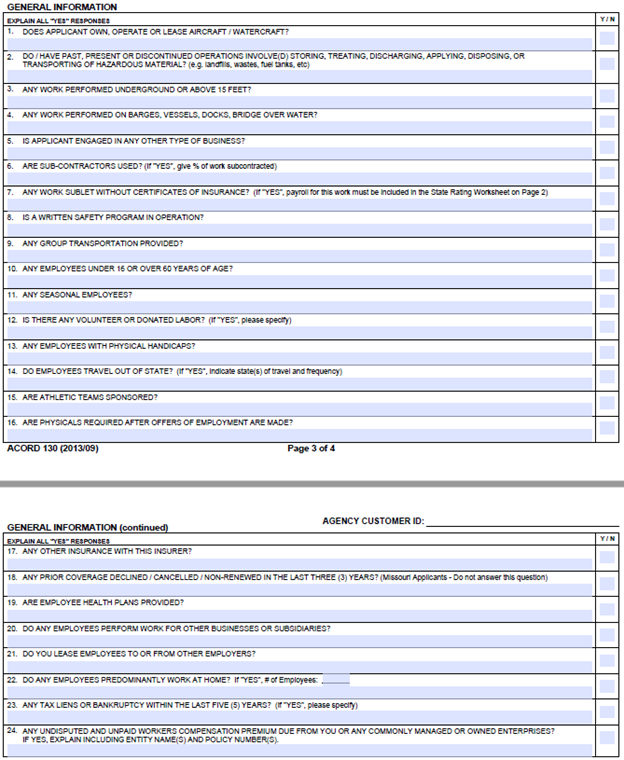

General Information Section

Spread across Page 3 and Page 4, this part has 24 yes/no questions covering:

- Safety programs

- Seasonal employees

- Physical handicaps of employees

- Whether coverage declined in the past

- Bankruptcy and tax liens

Any “yes” requires an explanation. Pay special attention to questions about safety program implementation, as this can affect premiums.

Finalizing the Form

Additional Notes

- A fillable ACORD 130 form is generally found in your AMS.

- You can send an ACORD form PDF to the client for review and signature.

- Some data auto-fills in the AMS, saving time.

The ACORD 130 is critical for issuing workers compensation insurance. It allows carriers to review policy information, loss history, and other risk factors to price coverage appropriately. By filling it out accurately, you ensure clients get the coverage they need.

Remember to consider the NCCI risk ID for experience rating when working with ACORD 130.

Within the form, you’ll see sections for rating information and schedule rating, both of which help determine the estimated annual premium. Accurately completing them ensures the premium is calculated properly.

Stay informed of updates to the ACORD 130 form, as industry requirements evolve. Always use the most recent version of the ACORD 130 to remain compliant.

Completing the ACORD 130 form is an essential task in insurance agencies, but it’s just one piece of a much larger puzzle of practical insurance skills. Whether you’re

- Onboarding a new hire

- Looking to improve your team’s training workflows

- Simply trying to minimize costly errors

Check out Total CSR’s insurance agency training platform, designed to prepare new hires with the practical skills they need.

Book a Customized Demo today to discover how Total CSR can help your agency thrive in the insurance industry.

Frequently Asked Questions

Yes, the duty to defend is broader than the duty to indemnify because it applies to potential coverage, not just actual coverage

The duty to defend is triggered when the insurer receives notice of a lawsuit that might potentially result in covered liability

Yes, an insurer must defend against any lawsuit that might potentially result in a covered judgment, even if the claim is groundless, false, or fraudulent

If an insurer breaches its duty to defend, it may face a breach of contract or bad faith complaint from the policyholder

The duty to defend can vary between policies, with some giving the insurer control over the defense and others allowing the insured to manage their own defense