Introduction

Policy cancellations stand among the most misunderstood—and financially significant—aspects of insurance administration. For brokers, agents, underwriters, and risk managers, properly distinguishing between pro-rata cancellation and flat rate cancellation methods directly impacts client relationships, agency revenue, and carrier obligations. The terminology itself creates confusion: while “flat rate” appears in pricing discussions, in cancellation contexts, professionals typically reference “flat cancellation” as a distinct category separate from pro rata and short-rate cancellation methodologies.

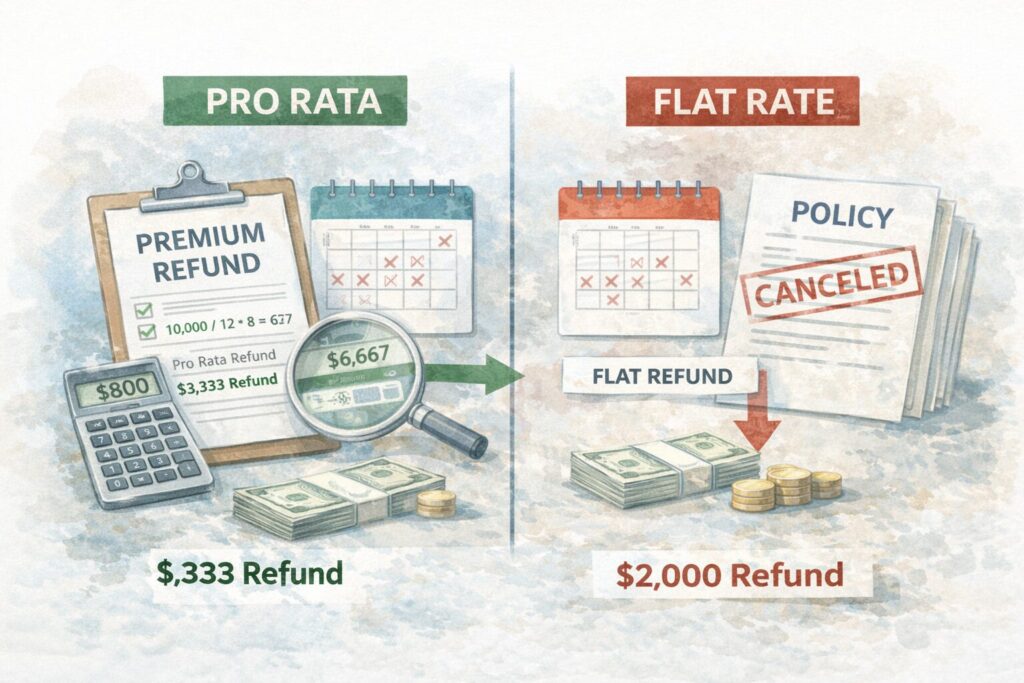

Grasping what is the difference between pro-rata cancellation and flat rate cancellation goes beyond simple definitions. These cancellation methods determine premium allocation, refund calculations, and the financial consequences borne by both insureds and insurers when coverage ends before the policy period expires. Mastering these concepts equips insurance professionals to advise clients competently, process endorsements accurately, and recognize when carrier practices align with policy provisions and regulatory requirements.

This comprehensive analysis clarifies the operational mechanics, financial implications, and strategic applications of both cancellation approaches, providing actionable guidance for daily professional practice.

Understanding Pro Rata Cancellation

Definition of Pro Rata

Pro-rata cancellation represents the most equitable method of policy termination, returning unearned premium to the policyholder based precisely on the unused coverage period. Under this cancellation method, the insurer retains only the premium corresponding to the actual days coverage remained in force, calculating the refund proportionally without applying penalties or retention charges.

Key characteristics of pro-rata cancellation:

- Premium gets earned on a daily basis throughout the policy term

- Refunds reflect the exact unused portion of the policy period

- No cancellation fee gets assessed

- Carriers typically use this method when they initiate cancellation

- Considered the fairest approach for policyholders facing mid-term cancellation

When carriers cancel policies for reasons such as underwriting reassessment, non-renewal decisions, or business exits from specific markets, pro-rata calculations protect policyholders from financial penalties for circumstances beyond their control. Many state insurance regulations mandate pro-rata refunds when insurers initiate cancellations, recognizing the imbalance of power between institutional carriers and individual insureds.

Pro-rata cancellation also applies when policyholders cancel under specific circumstances defined in policy contracts—particularly in commercial lines where negotiated terms may guarantee penalty-free cancellation rights. Agency management systems automate these calculations, but understanding the underlying methodology prevents processing errors that erode client trust.

Calculation of Pro Rata Share

The pro-rata refund calculation follows a straightforward formula:

Pro Rata Refund = Total Policy Premium × (Unused Days ÷ Total Policy Days)

Practical Example:

A commercial general liability policy with an annual premium of $12,000 gets cancelled after 146 days (approximately 5 months) into a 365-day term.

- Total premium: $12,000

- Days coverage was in force: 146

- Unused days: 219 (365 – 146)

- Pro rata refund: $12,000 × (219 ÷ 365) = $7,200

The earned premium retained by the carrier equals $4,800 ($12,000 × 146 ÷ 365), representing compensation for exactly 146 days of risk transfer.

Advanced Considerations:

When processing pro-rata cancellations, insurance professionals must account for:

- Minimum earned premium provisions: Some policies stipulate minimum retained amounts regardless of cancellation timing

- Policy fees and taxes: These may be fully earned at inception and non-refundable

- Endorsement timing: Mid-term coverage changes affect premium calculations

- Leap years: 366-day calculations for policies spanning February 29

- Premium finance agreements: Outstanding balances may reduce net refunds to insureds

Most agency management systems (AMS) include cancellation calculators, but manual verification catches system configuration errors. A working knowledge of the cancellation formula enables agents to provide immediate estimates during client conversations, building confidence and transparency.

Examining Flat Rate Cancellation

Definition of Flat Rate

Flat cancellation—more precisely termed “flat” or “void ab initio” cancellation—treats the policy as if coverage never existed. This method returns 100% of premium to the policyholder and voids all coverage from the policy’s inception date. Unlike pro-rata or short rate methodologies that calculate partial premium retention, flat cancellation results in zero earned premium for the carrier.

Circumstances warranting flat cancellation:

- Material misrepresentation: Discovery that application information was fraudulent

- Non-payment before coverage attaches: Premium not received by effective date

- Mutual agreement: Both parties consent to void the contract from inception

- Regulatory violations: Coverage issued in violation of underwriting guidelines or law

- Death of the named insured: In some personal lines, when occurring before policy inception

- Duplicate coverage: Policy issued in error when existing coverage already applies

Flat cancellation carries serious implications beyond refund mechanics. Because coverage gets deemed never to have existed, any claims submitted during the policy period become void. This retrospective elimination of coverage creates significant liability exposure if losses occurred before cancellation processing, making flat cancellation appropriate only in limited scenarios.

Insurance professionals must exercise caution when processing flat cancellations. Documentation requirements intensify because carriers must justify treating a binding contract as void. Many jurisdictions require specific evidence of material misrepresentation or fraud before permitting retroactive coverage elimination.

How Flat Rate Pricing Works

In cancellation contexts, “flat rate” describes the all-or-nothing nature of the refund: 100% return of premium with 0% retention. The calculation requires no formula:

Flat Cancellation Refund = Total Premium Paid

Practical Example:

A business auto policy with an annual premium of $8,400 gets cancelled flat after 73 days when underwriting discovers the applicant misrepresented vehicle usage as personal rather than commercial delivery.

- Total premium paid: $8,400

- Flat cancellation refund: $8,400

- Earned premium: $0

- Coverage provided: None (retroactively voided)

This differs fundamentally from pro-rata treatment of the same scenario, where the carrier would retain $1,677.37 for the 73 days of coverage ($8,400 × 73 ÷ 365).

Critical Distinctions:

While “flat rate” in pricing discussions typically refers to fixed-price service models (mechanics charging $150 for oil changes regardless of time spent), insurance cancellation uses “flat” to denote complete premium return with retroactive contract voidance. This semantic difference creates confusion among new industry professionals and requires clear communication when discussing cancellation options with clients.

The complete premium return under flat cancellation may appear beneficial to policyholders, but the simultaneous elimination of coverage creates dangerous gaps. Any claims filed during the voided period become denied, potentially leaving insureds personally liable for covered losses. This risk explains why responsible agents document client understanding when processing flat cancellations, protecting both the agency and the insured from future disputes.

Key Differences Between Pro Rata and Flat Rate

Pricing Strategies Overview

The fundamental distinction between pro-rata cancellation and flat cancellation lies in how each method treats the coverage period and premium allocation:

Factor | Pro Rata Cancellation | Flat Cancellation |

Coverage Status | Coverage valid for period before cancellation date | Coverage void from policy inception |

Premium Earned | Proportional to days in force | Zero premium retained |

Refund Calculation | Based on unused coverage period formula | 100% of premium returned |

Penalty Applied | No cancellation fee assessed | N/A—not a penalty but voidance |

Typical Initiator | Insurer-initiated or negotiated policyholder request | Mutual agreement or carrier-discovered fraud |

Claims Coverage | Claims during in-force period remain covered | All claims denied—no coverage existed |

Common Applications | Standard mid-term cancellations | Material misrepresentation, non-payment |

Real-World Scenario Comparison:

Scenario: A workers’ compensation policy with $15,000 annual premium gets cancelled 100 days into the policy term.

Pro-Rata Cancellation:

- Days in force: 100

- Earned premium: $15,000 × (100 ÷ 365) = $4,109.59

- Refund: $15,000 – $4,109.59 = $10,890.41

- Coverage status: Valid for first 100 days; claims during that period remain covered

Flat Cancellation:

- Days in force: 0 (retroactively voided)

- Earned premium: $0

- Refund: $15,000

- Coverage status: No coverage ever existed; any claims submitted for incidents during those 100 days get denied

This comparison illustrates why flat cancellation, despite its larger refund, poses greater risk. Insurance professionals must clearly communicate these trade-offs when clients request cancellation, documenting conversations to prevent future liability claims against the agency.

Flat Rate vs Hourly Rate Comparisons

The fundamental distinction between pro-rata cancellation and flat cancellation lies in how each method treats the coverage period and premium allocation:

Factor | Pro Rata Cancellation | Flat Cancellation |

Coverage Status | Coverage valid for period before cancellation date | Coverage void from policy inception |

Premium Earned | Proportional to days in force | Zero premium retained |

Refund Calculation | Based on unused coverage period formula | 100% of premium returned |

Penalty Applied | No cancellation fee assessed | N/A—not a penalty but voidance |

Typical Initiator | Insurer-initiated or negotiated policyholder request | Mutual agreement or carrier-discovered fraud |

Claims Coverage | Claims during in-force period remain covered | All claims denied—no coverage existed |

Common Applications | Standard mid-term cancellations | Material misrepresentation, non-payment |

Real-World Scenario Comparison:

Scenario: A workers’ compensation policy with $15,000 annual premium gets cancelled 100 days into the policy term.

Pro-Rata Cancellation:

- Days in force: 100

- Earned premium: $15,000 × (100 ÷ 365) = $4,109.59

- Refund: $15,000 – $4,109.59 = $10,890.41

- Coverage status: Valid for first 100 days; claims during that period remain covered

Flat Cancellation:

- Days in force: 0 (retroactively voided)

- Earned premium: $0

- Refund: $15,000

- Coverage status: No coverage ever existed; any claims submitted for incidents during those 100 days get denied

This comparison illustrates why flat cancellation, despite its larger refund, poses greater risk. Insurance professionals must clearly communicate these trade-offs when clients request cancellation, documenting conversations to prevent future liability claims against the agency.

Pros and Cons

Advantages of Pro Rata Cancellation

For Policyholders:

- Fair premium allocation: Insureds pay only for actual coverage provided

- Claim coverage maintained: Protection remains valid during the in-force period

- No cancellation fee: Full credit for unused coverage time

- Predictable calculations: Straightforward formula produces transparent refunds

- Regulatory protections: Many states mandate pro-rata treatment for carrier-initiated cancellations

For Insurance Carriers:

- Reasonable compensation: Premium retention reflects actual risk transfer period

- Reduced disputes: Transparent calculations minimize policyholder complaints

- Regulatory compliance: Meets statutory requirements for carrier-initiated cancellations

- Claims legitimacy: Coverage during in-force period protects against bad-faith allegations

- Relationship preservation: Fair treatment supports potential policy reinstatement

For Agents and Brokers:

- Client trust building: Equitable treatment strengthens long-term relationships

- Simplified explanations: Clear methodology requires minimal justification

- Reduced errors and omissions exposure: Transparent processes minimize agency liability

- Efficient processing: Automated calculations reduce administrative burden

Administrative costs often exceed the benefits when dealing with very short-term policies, creating operational challenges that carriers must consider in their cancellation procedures.

Disadvantages of Pro Rata Cancellation

For Policyholders:

- No financial benefit from early cancellation: Unlike short rate cancellation, pro-rata offers no incentive beyond proportional treatment

- Premium finance complications: Outstanding finance agreements may result in additional charges that offset refunds

- Timing precision required: Effective cancellation dates significantly impact refund amounts

- Minimum earned premium exposure: Some policies retain baseline charges regardless of pro-rata calculations

For Insurance Carriers:

- Administrative costs exceed retention: Processing expenses may surpass earned premium on very short policy periods

- Loss ratio implications: Claims occurring just before cancellation affect profitability despite limited premium retention

- Acquisition cost recovery: Marketing and underwriting expenses may not get recouped on short-term policies

- System processing burden: Each cancellation requires calculation, documentation, and refund processing

For Agents and Brokers:

- Commission reversals: Pro-rata cancellations typically trigger proportional commission chargebacks

- Revenue unpredictability: High cancellation rates create income volatility

- Client service time: Cancellation processing consumes resources without generating new revenue

- Replacement policy pressure: Clients expecting immediate replacement coverage require expedited placement efforts

Advantages of Flat Rate Cancellation

For Policyholders:

- Complete premium recovery: 100% refund returns all paid premium

- Error correction: Resolves misunderstandings or inappropriate coverage placements

- Financial relief: Full refund provides maximum cash return

For Insurance Carriers:

- Risk elimination: Retroactive voidance removes all claims exposure from voided period

- Fraud deterrence: Consequences of material misrepresentation discourage application dishonesty

- Underwriting integrity: Ability to void coverage protects classification accuracy

- Regulatory compliance: Addresses violations requiring contract voidance

For Agents and Brokers:

- Error correction mechanism: Provides remedy for placement mistakes

- Client relationship repair: Demonstrates responsiveness when coverage proves inappropriate

- Clean record maintenance: Removes erroneously issued policies from producer records

Disadvantages of Flat Rate Cancellation

For Policyholders:

- Complete loss of coverage: Retroactive voidance eliminates all protection during the policy period

- Claims denial exposure: Any losses during the voided period become uncovered, creating personal liability

- Coverage gap creation: Time between flat cancellation and replacement policy leaves dangerous exposure

- Regulatory reporting: Some flat cancellations appear on loss history reports, affecting future insurability

- Legal vulnerability: Retroactive coverage elimination may violate contractual obligations to third parties (lenders, landlords, contract counterparties)

For Insurance Carriers:

- Documentation burden: Justifying flat cancellation requires extensive evidence of grounds for voidance

- Litigation risk: Policyholders may challenge retroactive coverage elimination, especially if claims occurred

- Regulatory scrutiny: Insurance departments examine flat cancellations for appropriateness and pattern abuse

- Bad faith exposure: Improper flat cancellation may trigger extracontractual liability

- Reputation damage: Perceived unfairness harms carrier market perception

For Agents and Brokers:

- Errors and omissions liability: Flat cancellations creating coverage gaps may trigger professional liability claims

- Client relationship damage: Coverage elimination often destroys trust and terminates client relationships

- Commission clawback: Full premium return eliminates all producer compensation

- Regulatory reporting: Some flat cancellations require explanation in agency licensing renewals

- Replacement urgency: Clients require immediate coverage placement, creating operational stress

Application in Fixed Price Contracts

Role of Pro Rata in Fixed Price Contracts

Fixed-price insurance contracts—policies with guaranteed annual premiums regardless of exposure fluctuations—commonly incorporate pro-rata cancellation provisions. This combination balances pricing predictability during the policy term with equitable treatment upon early termination.

Commercial Applications:

Workers’ Compensation Guaranteed Cost Policies: When payroll projections determine the premium at inception, mid-term cancellations require pro-rata refunds based on the unused coverage period. The final audit adjusts for actual payroll exposure during the in-force period, but the cancellation refund calculation follows pro-rata methodology for the time-based component.

Commercial Package Policies: Bundled coverage with annual premium commitments typically cancel pro rata, with each coverage component receiving proportional treatment. This approach maintains consistency across property, liability, and inland marine sections.

Professional Liability Policies: Claims-made professional liability coverage frequently includes pro-rata cancellation rights for policyholder-initiated terminations, recognizing that insureds may change carriers or retire from practice. The pro-rata calculation applies to the policy premium, while extended reporting period (tail coverage) purchases follow separate pricing.

Business Auto Policies: Fleet coverage agreements benefit from pro-rata treatment when businesses reduce vehicle counts or change operations mid-term. This method ensures fair premium adjustment while maintaining coverage integrity.

Conclusion

Understanding the difference between pro rata and flat rate cancellation is essential for accurate premium handling, regulatory compliance, and effective client guidance. Pro rata cancellation treats coverage as valid up to the cancellation date, earning premium proportionally and preserving claim protection during the in-force period. Flat cancellation, by contrast, voids the policy from inception, returns all premium, and eliminates all coverage—making it appropriate only in limited, well-documented situations such as material misrepresentation or coverage issued in error.

Frequently Asked Questions

A pro rata refund returns the unused portion of premium by multiplying the total policy premium by the percentage of time remaining in the term (unearned period ÷ full term), with no penalty.

With pro rata, premium is earned only for the days the policy was in force and the rest is unearned and refunded, while a flat cancellation treats the policy as if it never started so no premium is earned and all paid premium is unearned and returned.

Pro rata refunds unused premium exactly based on time on risk, flat cancellation voids coverage from inception and refunds 100% of premium, and short-rate cancellation refunds unused premium minus a penalty so the insurer keeps more than the pure time-on-risk amount.

Under pro rata, your down payment is applied to the earned premium and any excess may be refunded, whereas under flat cancellation your full down payment is typically returned because no premium is considered earned.