What is an ACORD 25 form?

Starting a career in the insurance industry means getting to know the forms and applications you’ll use daily in your Agency Management System (AMS). Read on for details about the documents, such as the Acord 25 form, you’ll rely on each day to manage client information and insurance policies.

Each misstep in liability coverage details or policy numbers can cause massive headaches for your agency, damaging client trust and creating extra work. No one wants to deal with needless follow-up calls or policy claims confusion.

Fortunately, mastering the ACORD 25 is easier than you think once you know the essentials. In this comprehensive guide, we’ll show you step-by-step instructions on filling out the form correctly, plus tips to simplify the onboarding process for new hires looking to learn about the ACORD 25 form. Let’s make sure you—and your team—feel confident from day one.

Background on the ACORD 25 Form

The Acord 25 is commonly known as the Certificate of Liability Insurance. This ACORD form is often required in business contracts when a party must hold a specific amount of insurance. A certificate of insurance liability form serves as proof of coverage for the third-party (often called the “certificate holder”).

If you’re wondering whether you need to know how to fill out an Acord 25, the answer is absolutely yes. Below, we’ll explore the sections of the Acord 25 – Certificate of Liability Insurance and walk you through how to complete it, section by section. Scroll to the bottom of this page to see a live version or find the downloadable Acord 25 form here.

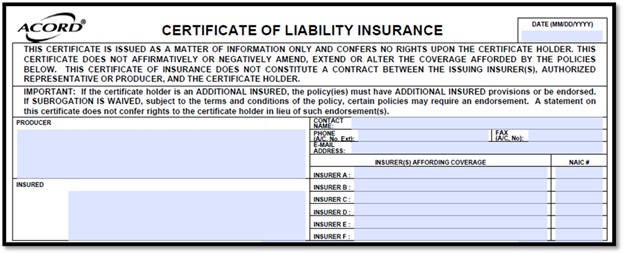

Section: Agency and Insured Information - ACORD 25

At the top of the Certificate of Liability Insurance form, you’ll enter Agency and Insured Information, along with carrier/insurance provider details.

- Producer Information: Under Producer, include the Agency name and full address, plus a contact name, phone number, fax number, and email.

- Insured Information: For the Insured, provide the complete named insured and mailing address.

- Insurance Companies: In the lower right-hand section, list the carrier name for each insurance company that is granting coverage on the certificate.

Be sure to include the proper NAIC (National Association of Insurance Commissioners) number for each carrier. These identification numbers help verify that you’re working with legitimate, authorized insurers.

Each certificate should also have a unique certificate number that identifies the specific document and helps with tracking and recordkeeping. Your Agency Management System typically generates this number automatically.

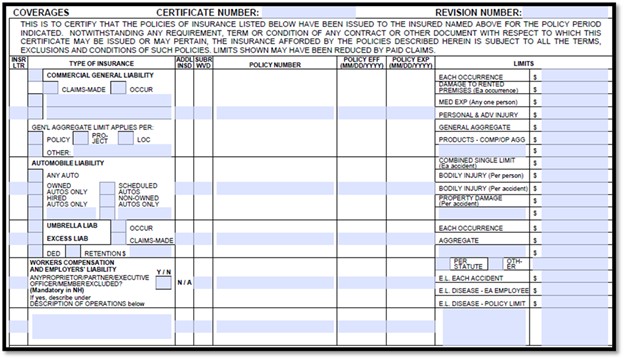

Section: Coverages - ACORD 25

Next, you’ll move on to the Coverages area. You’ll need to supply information for each applicable line of coverage: Commercial General Liability, Automobile Liability, Umbrella or Excess Liability, and Workers Compensation.

- Commercial General Liability: Include the carrier, specify Claims-Made or Occurrence, note the General Aggregate (per policy, project, or location), and list coverage limits for each occurrence, property damage, bodily injury, and personal & adv injury.

- Automobile Liability: Mark all relevant auto coverages.

- Umbrella Liability: Indicate whether the policy is on a claims-made or occurrence basis.

- Workers Compensation: Specify “yes” or “no” if proprietors, partners, officers, or members are excluded from workers compensation and employers liability.

For each line of liability coverage, you’ll also indicate “yes” or “no” for Additional Insured and whether subrogation is waived, as well as the policy number, policy period, and policy limits.

Common Mistakes: Certificate Holder vs. Additional Insured

One of the most common points of confusion for new insurance professionals is understanding the difference between a certificate holder and an additional insured form. This distinction is crucial when completing the ACORD 25 form.

Clarifying Roles & Responsibilities

The Certificate Holder is simply the entity receiving the certificate as proof that insurance exists. They have no rights under the policy itself. By contrast, an Additional Insured is actually given some protection under the insured’s policy. When an entity is added as an additional insured, they receive defense and indemnity coverage under the named insured’s policy for claims resulting from the named insured’s activities or operations.

Missing just one detail when adding a certificate holder can lead to frustrating claims disputes later. Don’t risk the headache or your agency’s reputation—follow these quick tips to ensure accuracy every time:

- Verify the certificate holder’s legal name and complete mailing address

- Confirm whether they should be listed as an additional insured

- Document which policy (or policies) they need to be added to

- Note any specific endorsement numbers that apply

Clarifying Roles & Responsibilities

Example scenario: A property manager requires proof of insurance from a contractor working on their property. The property manager would be the certificate holder. If the contract requires the property manager to be protected under the contractor’s insurance, they would also need to be added as an additional insured.

- Listing someone as a certificate holder when they should be an additional insured

- Failing to document the specific additional insured endorsement

- Not specifying which policies include the additional insured

- Incorrectly indicating that a waiver of subrogation applies

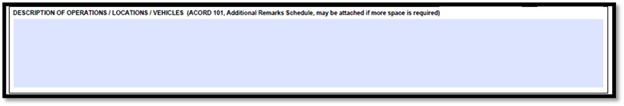

Section: Description of Operations - ACORD 25

In the Description of Operations section, detail the operations, locations, vehicles, exclusions by endorsement, and any special provisions for which the certificate was issued.

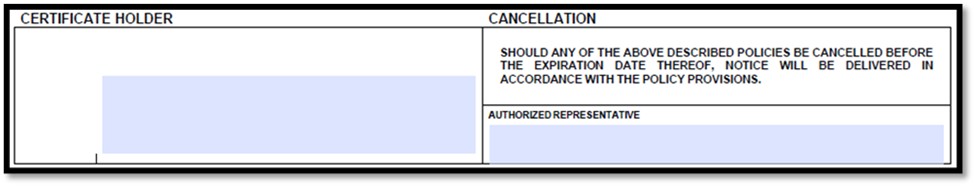

Section: Certificate Holder and Cancellation - ACORD 25

The final part of the Certificate of Liability Insurance provides space for the certificate holder’s name and mailing address. You’ll also see a standard cancellation notice and a spot for the signature of an authorized representative from the agency.

Accessing and Completing Acord 25 Forms

A blank certificate of insurance (Acord 25) is generally available in your AMS. Complete it and then send the ACORD certificate of insurance to the client for review and forward to the certificate holder. Much of the key data—such as the NAIC number, products-comp/ops aggregate, and whether subrogation is waived—will often auto-populate from your agency management system, saving you time when you fill out the Acord 25 form.

Frequently Asked Questions

The ACORD 25 form, also known as the Certificate of Liability Insurance, consists of several key sections: Insured and Insurer or Insurance Company information, Coverages Section, Description of Operations/Locations/Vehicles, Certificate Holder, Cancellation Notice

Wrong Policy Numbers: Pair each insurance type with its correct policy number.

Mismatched Dates: Verify that effective and expiration dates are correct for each policy.

Inaccurate Coverage Details: Ensure all essential coverage information is accurately reported.

Omitted Exclusions: Include any exclusionary endorsements to avoid misrepresentation.

Incorrect Information for Insured: Use the business name and proper address, not an individual’s name.

Listing Nonexistent Coverage: Only list coverage that is actually provided.

Missing or Wrong NAIC Numbers: Check that each insurer’s NAIC number is correct.

The insured is the individual or entity that owns the insurance policy and has paid for the coverage.

The certificate holder is the party that receives the documentation confirming that the insurance is in place—this is often a client, contractor, or another interested party.

The ACORD 25 is used to show evidence of liability insurance coverage, demonstrating that the insured has protection against liability claims.

The ACORD 28 is the form provided to confirm commercial property insurance coverage, verifying protection for property-related risks.

The insured is the policyholder who has purchased the insurance coverage. The certificate holder is the party requesting proof of insurance, often a client or contractor

An ACORD 25 should be signed by an authorized representative of the agency, typically a licensed agent or CSR. Electronic signatures are commonly used in most agency management systems. Make sure your staff understands that signing represents a professional certification of the information’s accuracy.