What is the ACORD 126 Form?

As you embark on your insurance career, it’s important to get comfortable with the applications found in your Agency Management System (AMS). Below, you’ll learn more about the ACORD application you’ll use regularly to manage client data, including the essential ACORD 126 form.

ACORD forms are widely accepted documents that include the information insurance carriers typically need to provide a quote back to the agency. There are many ACORD forms, each one designed for a specific type of coverage. Among them, you’ll frequently use the ACORD 126 form, or simply the ACORD 126. You can download a copy at the bottom of the page or by clicking here.

About the ACORD 126 form?

The ACORD 126 form, often called the Commercial General Liability Section, is a key part of ACORD business insurance. It gathers details about the insured’s exposure, loss history, and other relevant business operations. When you prepare a submission for a carrier, the ACORD 126 is always paired with the ACORD 125.

This application form appears in almost every commercial insurance policy, providing vital information about a business’s liability exposure. Knowing how to complete an ACORD 126 is essential for the underwriting process and evaluating the insurance risk.

Let’s look at the major points to focus on when you’re working with the ACORD 126 example:

ACORD forms are widely accepted documents that include the information insurance carriers typically need to provide a quote back to the agency. There are many ACORD forms, each one designed for a specific type of coverage. Among them, you’ll frequently use the ACORD 126 form, or simply the ACORD126.

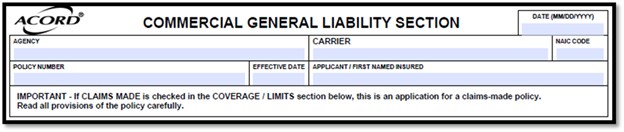

Agency and Insured Details - ACORD 126

Page 1 begins with a section for Agency and Insured details. In this space, you’ll provide the Agency name, Effective Date, and the First Named Insured.

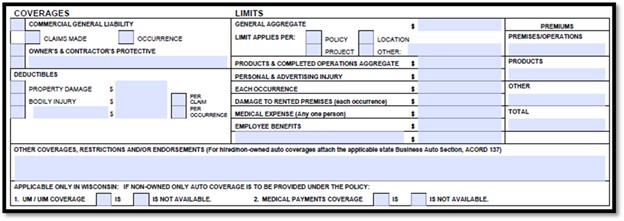

Coverages and Limits for the ACORD 126 Form

Here’s what you need to do for the ACORD 126 form:

- Check the box next to Commercial General Liability.

- Select “Occurrence” rather than “Claims Made,” unless directed otherwise.

- Indicate how the aggregate should apply (commonly “per policy”).

- Enter General Liability limits. Common figures include:

- GENERAL AGGREGATE – $2,000,000

- PRODUCT & COMPLETED OPERATIONS AGGREGATE – $2,000,000

- PERSONAL & ADVERTISING INJURY – $1,000,000

- EACH OCCURRENCE – $1,000,000

- DAMAGE TO RENTED PREMISES – $50,000

- MEDICAL EXPENSE – $5,000

- EMPLOYEE BENEFITS – $1,000,000

After entering limits, you’ll want to take a moment to note Other Coverages, Restrictions and/or Endorsements. This area is used to stipulate one or two more restrictions and/or endorsements for the policy. If many endorsements are required for the policy, complete and attach ACORD 829 to ACORD 126 and enter “See attached Forms & Endorsements Schedule.“

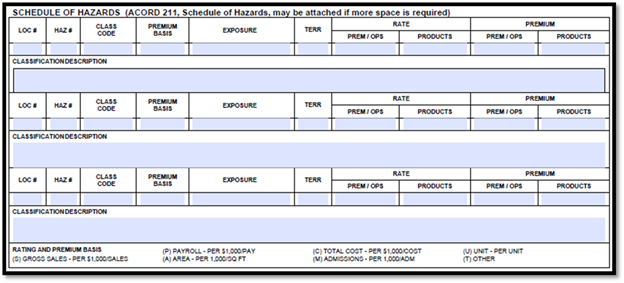

Schedule of Hazards:

- Enter the location number that matches the one listed on the ACORD 125 fillable form.

- Specify the Hazard, beginning at #1 for each location and increasing sequentially.

- Include the classification code for the location and hazard.

- Show the premium basis and use the correct abbreviation.

- Provide the exposure (your estimated annual figure).

- Add the Classification Description from the ISO Classification Table.

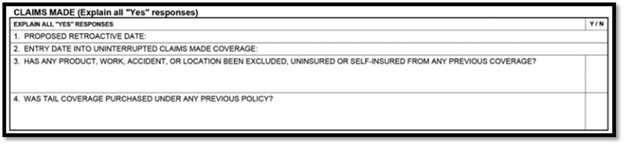

Claims Made - ACORD 126

After the schedule of hazards, you’ll see a Claims Made section, which you only complete if the policy is on a claims-made basis.

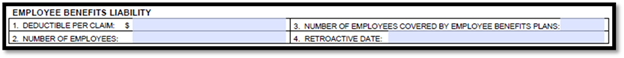

Employee Benefits Liability on the ACORD 126 Form

At the bottom of Page 1 on the ACORD 126, fill in the Employee Benefits Liability details:

- Deductible per Claim (often $1,000)

- Number of Employees

- Number of Employees covered under the benefits plan

- Retroactive date

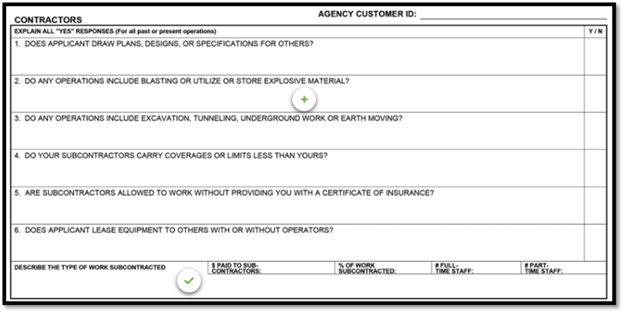

Contractors Questions on the ACORD 126 Form

Page 2 opens with a section about Contractors on the ACORD 126. Answer the six questions and provide explanations for any “yes” answers. If subcontractors are involved, describe the work they handle.

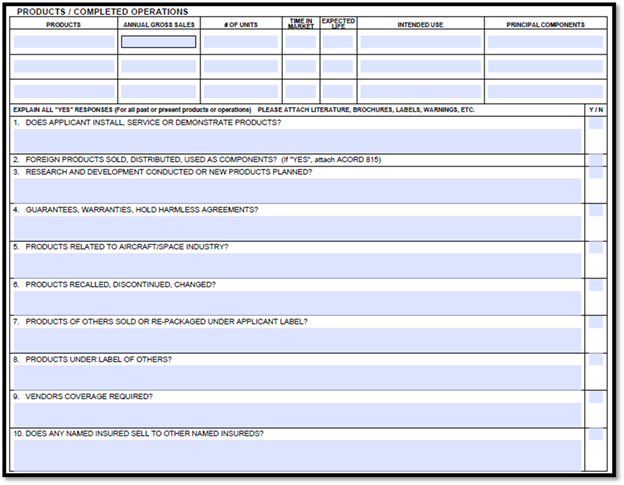

Products and Completed Operations - ACORD 126

Next, you’ll complete the Products/Completed Operations section for the ACORD 126, which asks for:

- The name of any product(s) manufactured or sold, or service(s) provided

- Annual gross sales for each product

- The number of units manufactured or sold each year

- How long the product or service has been on the market

- The useful life of the product or service

- Product use

Answer ten questions here and give explanations for any “yes” responses for ACORD 126.

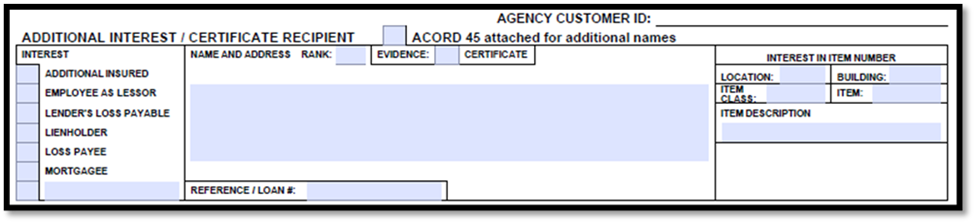

Additional Interest/Certificate Recipient - ACORD 126

Page 3 starts with a section for Additional Interest or Certificate Recipient. Provide the name and address of the Additional Interest, and note their Interest type.

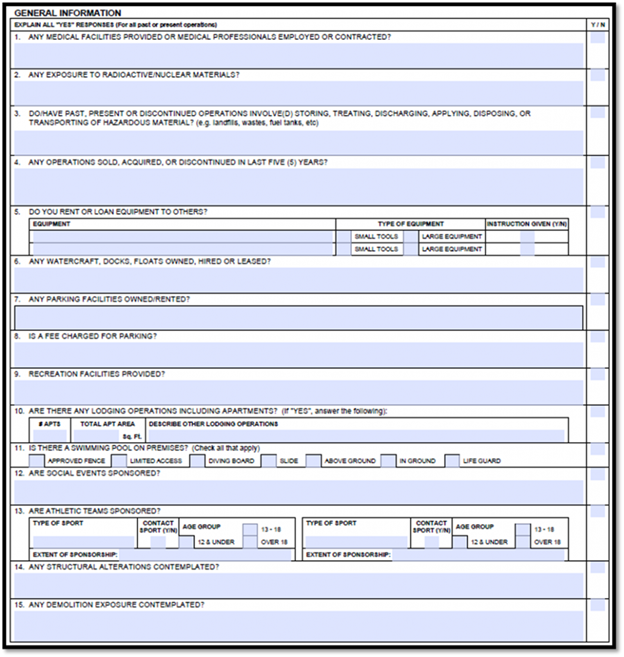

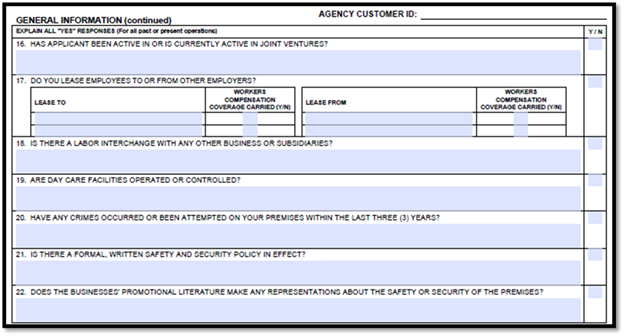

General Information - ACORD 126

The rest of Page 3 and most of Page 4 focus on General Information for ACORD 126. You’ll see 22 questions that require answers, and you must explain any “yes” responses. This area can cover details about filing claims and other vital insurance policy information.

You’ll find Producer and Applicant signature lines at the end of the form, which will be needed when binding coverage.

Other Important Notes:

An ACORD 126 fillable form should be available in your Agency Management System. Once it’s complete, you can send an ACORD 126 PDF to your client for review and signature. This process supports paperless processing and allows for efficient data extraction using intelligent OCR technology.

Some fields may pre-fill in your AMS, saving you time when you work on the ACCORD form 126. This data validation feature helps streamline the process and reduces errors. Many AMS platforms also incorporate automation and machine learning algorithms to optimize the rating process and boost accuracy.

By mastering the ACORD 126 form, you’ll be well-prepared to manage ACORD general liability insurance applications and help your agency provide comprehensive liability coverage for clients. Keep in mind that this form is a vital component of the ACORD application process, playing a major role in identifying and handling a business’s legal liability.

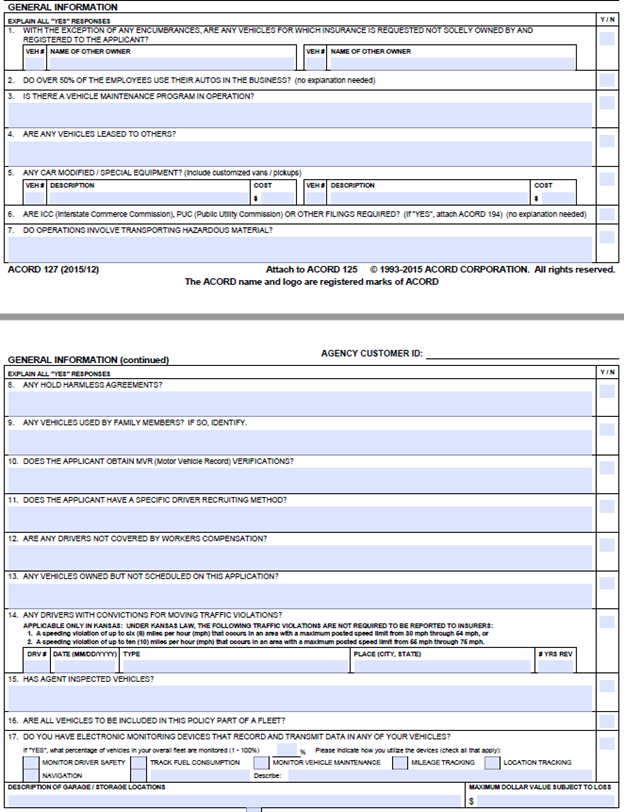

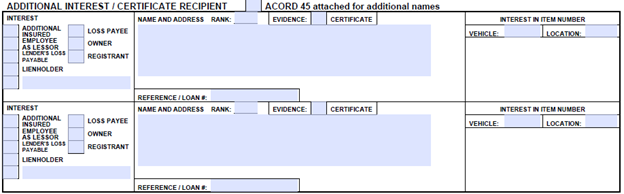

Additional Interest/Certificate Recipient

After you finish the General Information questions for the ACORD 126, you’ll move on to the Additional Interest/Certificate Recipient section. This part of the application documents any parties who have an additional interest in the vehicles. For example, if an insured has a commercial auto loan from a bank to purchase a vehicle, you would check the “LIENHOLDER” box. Make sure to include the name and address for the additional interest and specify which vehicle the party has an interest in. (ACORD 127 Additional Interest)

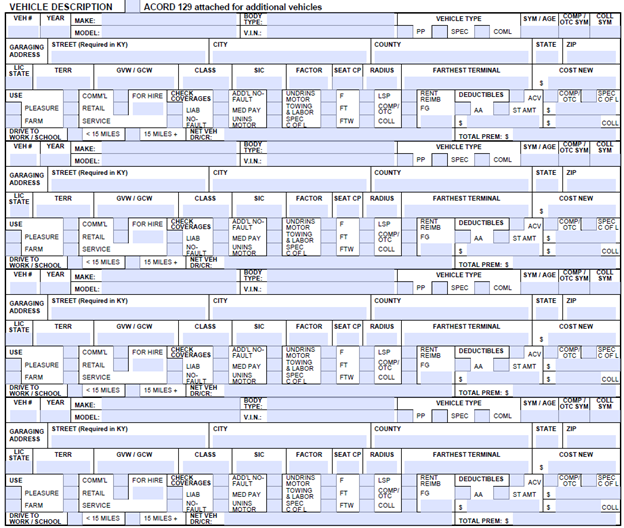

Vehicle Description:

Once you’ve entered all the Additional Interest information, proceed to Page 3 of the application. This page is dedicated to Vehicle Description details for autos that require coverage. Vehicles should be numbered in sequence starting with #1. Be prepared to provide as much information as possible, including:

- Year, Make, Model, VIN # (Vehicle Identification Number)

- Vehicle Type (Private Passenger, Special, or Commercial)

- Garaging Address

- Registration State

- Gross Vehicle Weight

- Vehicle Classification

- Vehicle Use

- Coverage Needed

- Cost New

- Deductibles for Comprehensive and Collision (if the insured elects them)

You’ll see space for four vehicles on this page. If more vehicles need to be listed, use the ACORD 129. At the end of Page 4, there is a spot for Producer and Insured signatures, which aren’t required during the quoting process but must be obtained once the policy is bound.

Other Important Notes:

An ACORD 127 fillable form (as well as other ACORD forms) should be available in your Agency Management System. You can complete the form and then send an ACORD 127 PDF to the client for review and signature.

Keep in mind that the ACORD 127 should always be accompanied by the ACORD 125 and ACORD 137. The ACORD 125 captures details about the insured that aren’t requested elsewhere, while the ACORD 137 specifies Commercial Auto Coverage limits and Covered Auto Symbols.

Finally, some details may pre-fill in your AMS, which helps save time and reduces errors when you’re completing the ACORD 127 form.