How to Explain an Experience Modification Rate to a Client

Insurance professionals often meet clients who struggle to understand their experience modification rate and its significant impact on their workers’ compensation premiums. This detailed guide offers practical methods for clarifying this challenging topic while strengthening client relationships through proper education.

What is an Experience Modification Rate?

The experience modification rating, sometimes called EMR or ERA (Experience Rating Adjustment), serves as a multiplier that adjusts a company’s workers’ compensation premium based on its past loss performance compared to similar businesses. The National Council on Compensation Insurance develops this system to benefit companies with excellent safety records while charging more for those with poor claim histories.

Essentially, the experience rating compares a company’s real losses to projected losses for their industry type. A rate of 1.00 represents the industry standard, while rates below 1.00 indicate better-than-average performance, and rates above 1.00 reflect worse-than-average results.

Introduction to Experience Modification Rate

When presenting the experience rating modification idea to clients, begin with a fundamental principle: insurance companies want to price coverage based on risk. Companies with fewer safety problems and smaller losses create less risk, earning them premium reductions through favorable experience rating.

The experience rating system uses a three-year lookback period, reviewing loss data from years two through four before the current policy term. This delay provides sufficient time for claims to mature, making the rating calculation more stable. For example, a 2024 policy would review experience periods from 2020, 2021, and 2022.

The NCCI handles experience rating in most states, though some monopolistic states run their own systems. The rating affects employers with sufficient premium volume – typically those exceeding certain thresholds that vary by state, but usually range from $5,000 to $10,000 in annual premium.

Common Terms Related to EMR

Knowing important terminology helps clients understand the experience modification process:

- EMR rate: The final modification number applied to premiums

- EMR rating: The complete evaluation system for experience modifications

- EMR scores: Number results from the rating calculation

- Experience rating: The wider system of changing premiums based on loss history

- Experience mod: A shorter reference to the modification rate

- Experience modifier: The calculated number that changes premium

- Mod rate: Another shortened term for the modification rate

- Mod factor: The multiplier applied to base premiums

- X-mod or E-mod: Industry shorthand for experience modification

The Importance of Understanding EMR

Clients who grasp their experience modification gain valuable insights into premium management and workplace safety investment returns. This knowledge transforms abstract insurance ideas into tangible business decisions.

Benefits of Knowing Your EMR

Companies that actively track their experience rating achieve several benefits:

- Premium Control: Understanding how the mod calculation works allows proactive premium determination. Clients can forecast future rate effects and budget accordingly, avoiding unexpected premium increases.

- Safety Investment Justification: The experience rating system measures safety programs returns. When clients see how claim reductions convert to premium savings, they make smart decisions about safety spending and may consider hiring a certified safety professional.

- Competitive advantage: In industries where EMR directly impacts contract eligibility, understanding and improving the modification rate becomes a business development tool. Many construction industry contracts require specific EMR thresholds.

- Risk Management Enhancement: Experience rating encourages complete risk management beyond basic compliance. Companies develop strong safety management systems when they understand the financial effects, often leading to reduced insurance costs.

Common Misconceptions About EMR

Several wrong ideas about experience rating create confusion among clients:

- Misconception: “Small claims don’t affect my mod.”

Reality: The experience rating formula places a strong emphasis on accident frequency. Multiple small claims can impact the mod more severely than single large losses due to the formula’s structure.

- Misconception: “Open claims don’t count toward my experience modification.”

Reality: Open claims are valued at their current reserves. Outstanding medical payments and estimated future losses contribute to the loss experience immediately.

- Misconception: “Changing insurance companies resets my EMR.”

Reality: The experience modification rate follows the employer, not the insurance policy. Insurance companies cannot change or reset experience ratings.

Calculating the Experience Modification Rate

The experience rating formula compares actual losses to expected losses, but the calculation involves complex statistical adjustments that account for credibility and claim predictability.

Key Factors in EMR Calculation

Several important elements determine the final modification rate:

- Expected Losses: The NCCI calculates anticipated losses for each classification code based on industry experience. These expected losses reflect the theoretical losses a perfectly average company in that classification should experience.

- Actual Losses: Historical losses include both paid amounts and outstanding reserves. Medical costs, indemnity payments, and expense components all contribute to actual loss calculations.

- Ballast Factor: This statistical element stabilizes the calculation by adding credibility to expected losses. The ballast factor prevents extreme modifications for companies with limited loss data.

- Primary and Excess Splits: The experience rating formula divides losses into primary (frequency-related) and excess (severity-related) parts. This split recognizes that employers have greater control over claim frequency than accident severity.

The Formula for EMR

While the complete experience rating formula looks complex, breaking it into parts clarifies the calculation:

Experience modification Rate = (Actual Primary Losses + Ballast) / (Expected Primary Losses + Ballast) × Weight Factor + (Actual Excess Losses / Expected Excess Losses) × (1 – Weight Factor)

The Weight Factor determines the formula’s emphasis on primary versus excess losses. Companies with larger expected losses receive higher weight factors, meaning claim severity has greater impact on their modifications.

The experience rating worksheet provided by the NCCI details these calculations, showing clients exactly how their losses translate to modification rates. This statistical plan forms the basis for manual rating and cost prediction in workers compensation insurance.

How EMR Affects Workers' Compensation Costs

The experience modification rate directly multiplies the manual premium calculated from payroll and classification rates, making it one of the most significant cost factors in workers compensation coverage.

The Role of Loss Experience

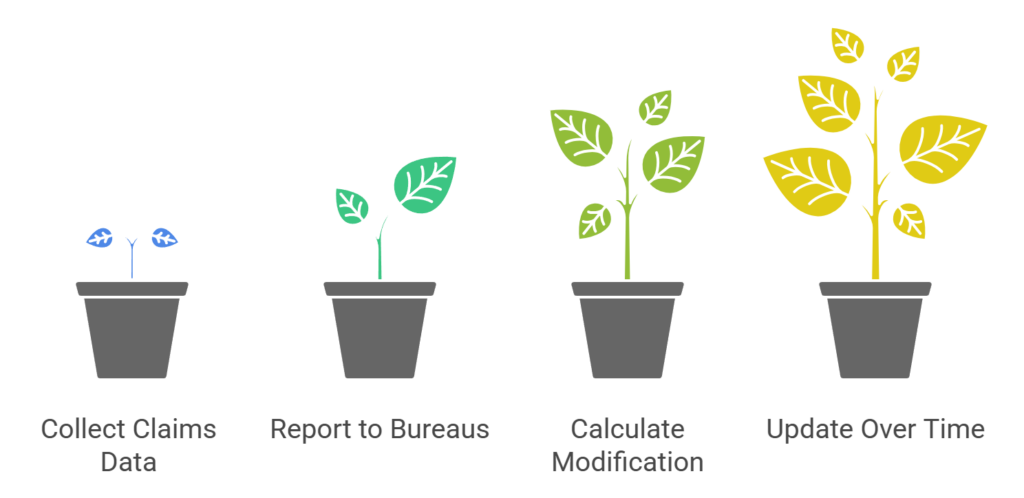

Loss history drives experience rating through three years of claims data. The experience period captures enough information to establish patterns while staying current enough to reflect recent safety improvements.

Insurance companies report unit statistical reports to rating bureaus, documenting losses by policy period. These reports form the foundation for mod calculation, making accurate loss reporting critical for proper experience rating.

Claims evolving over time affect multiple experience periods. A single accident might impact three consecutive modifications as medical costs develop and reserves adjust.

Premium Adjustments Based on EMR

The modification calculation creates direct premium impacts:

- Credits: Companies with modifications below 1.00 receive premium discounts. A 0.85 mod reduces premiums by 15% compared to manual rates.

- Debits: Modifications above 1.00 increase premiums. A debit mod of 1.25 raises costs by 25% over standard rates.

- Cumulative Effects: Companies maintaining consistent workplace safety performance see compounding benefits as favorable modifications continue across multiple policy periods.

Implications of a High or Low EMR

- Low EMR Benefits: Companies achieving good EMR rating status gain significant advantages beyond premium savings. Contract opportunities expand, particularly in EMR rating construction projects. Insurance carriers offer broader coverage terms and increased capacity. The favorable rating demonstrates a strong safety culture to stakeholders and employees.

- High EMR Consequences: Poor modifications create multiple challenges. Premium costs increase substantially, often pushing companies toward assigned risk markets. Contract eligibility narrows as many projects specify maximum EMR thresholds. Insurance providers may impose coverage restrictions or require additional safety measures, such as hiring a safety officer or conducting more frequent safety inspections.

Tips for Explaining EMR to Clients

Effective EMR communication requires converting technical concepts into business language that connects with client priorities.

Using Simple Language

Replace insurance jargon with familiar business terms. Instead of “loss development,” discuss “claim costs over time.” Rather than “statistical credibility,” explain “reliability of the data.”

Present the experience modification rate as a “safety report card” that measures performance against industry peers. This comparison helps clients understand the competitive nature of experience rating without getting lost in the complexities of statistical methodology.

Connect modifications to budget line items clients recognize. Show how premium changes from EMR adjustments compare to other business expenses, providing context for safety investment decisions and potential impact on overhead costs.

Anticipating Client Questions

What is experience modification rate impact on my business?” Quantify the financial effects using specific dollar amounts rather than percentages. Show annual premium differences and project three-year impacts to demonstrate significance.

“How is emr calculated for my industry?” Use industry-specific examples that reflect the client’s actual classification codes and expected losses. Construction clients benefit from understanding EMR ratings in construction-specific contexts, while manufacturers require different contexts.

“What is the best emr rating in construction or my industry?” Explain theoretical minimums while setting realistic expectations. Discuss top-performing companies in their respective classifications without setting unrealistic goals.

“What is the highest experience modification rate possible?” Address maximum modifications while focusing on prevention strategies rather than worst-case scenarios.

“How is the experience modification rate calculated differently in various states?” Clarify interstate mod applications for multi-state operations and explain the variations in monopolistic states.

Providing Visual Aids

Create simple charts showing EMR trends over time. Visual representations of mod calculation components help clients understand the relationship between claims and premiums.

Develop comparison matrices showing industry benchmarks and safety benchmarks. Clients respond well to competitive positioning information that shows their performance relative to peers.

Use flowcharts to illustrate how safety programs connect to injury rates, which affect claim history, which influences the experience rating adjustment, which determines premium costs.

Sharing Real-Life Examples

Present case studies from similar businesses showing successful EMR improvement strategies. Anonymized examples illustrate the practical applications of safety programs and the implementation of return-to-work programs.

Discuss specific scenarios: “A manufacturing company with your classification reduced its mod from 1.15 to 0.92 over three years by implementing hazard assessments and improving its occupational safety management systems.”

Show premium calculation examples using actual numbers: “With $100,000 in annual premium, improving your mod from 1.10 to 0.95 saves $15,000 yearly – enough to fund a comprehensive safety program and hire a certified safety professional.”

Conclusion - Waiver of Subrogation

Explaining experience modification concepts effectively requires converting complex insurance mathematics into actionable business intelligence. Insurance professionals who master this communication skill build stronger client relationships while helping businesses make informed decisions about risk management.

The key lies in connecting EMR calculations to business outcomes clients value: cost control, competitive positioning, and operational efficiency. By focusing on practical applications rather than technical details, agents and brokers transform experience rating from an abstract insurance concept into a powerful business management tool.

Success in EMR education comes from consistent reinforcement, regular monitoring, and celebrating improvements. When clients understand how their daily safety decisions directly impact their experience modification rate, they become active partners in risk management rather than passive insurance purchasers.

Remember that experience rating serves as a foundation for broader risk management conversations. Utilize EMR discussions to introduce comprehensive safety culture development, loss prevention strategies, and proactive claims management, creating value that extends far beyond premium calculations. This approach can lead to improved risk scoring and more accurate cost prediction for future losses.

By integrating concepts such as employers’ liability insurance, premium audits, and the impact of ownership changes on EMR, insurance professionals can provide a comprehensive view of workers’ compensation insurance. This comprehensive approach helps clients understand how various factors, including accident history and safety incidents, contribute to their overall insurance costs and premium determination.

Frequently Asked Questions

A waiver of subrogation prevents my client’s insurer from recovering claim costs from responsible third parties, potentially impacting future premiums or claim history.

My client should specify a waiver of subrogation in contracts involving partnerships, leasing arrangements, or business collaborations where mutual protection against recovery actions is desired.

Waiving subrogation rights can increase claim costs, limit recovery options, and potentially raise future insurance premiums for my client.

My client can confirm by reviewing their policy documents, endorsements, or consulting directly with their insurance broker or agent.

A specific waiver applies to clearly defined parties and situations, whereas a blanket waiver covers all contractual partners automatically without naming each individually.