When insuring rental properties or vacant homes, understanding the differences between various dwelling fire policies is essential. Two popular options are DP1 and DP3 policies, also known as Dwelling Fire Form 1 and Dwelling Fire Form 3. Both dwelling fire policies serve non-owner-occupied properties, yet they provide significantly different coverage levels. This guide will clarify the differences between dp1 insurance and dp3 insurance, empowering property owners and insurance professionals to choose the ideal policy.

What Are DP1 and DP3 Policies?

DP1 and DP3 are dwelling fire policies primarily aimed at rental properties, vacant homes, or seasonal residences. They differ notably in coverage scope, claim payouts, and overall costs. So, what is dp1, and what is a dp3 policy exactly?

DP1 Policy Overview

DP1, or dp1 insurance, provides the most basic dwelling coverage, typically utilized for vacant or lower-value properties. It offers limited protection against specific named perils. Dp-1 policy coverage appeals to property owners seeking minimal, affordable coverage and is considered a named peril policy.

DP3 Policy Overview

In contrast, dp3 insurance delivers broader coverage, recommended for landlords or owners of higher-value properties. The dp3 coverage provides an open peril policy, protecting against most risks except explicitly excluded perils. For instance, dp3 insurance Florida is particularly favored due to unique local weather threats.

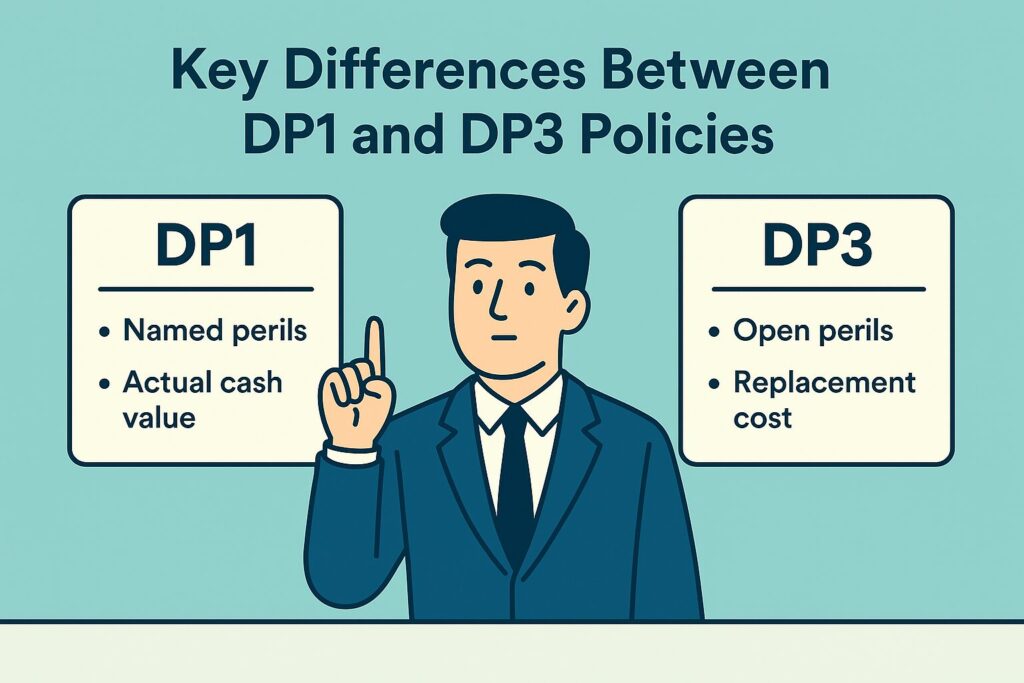

Key Differences Between DP1 and DP3 Policies

Understanding the dwelling 1 vs dwelling 3 distinctions is crucial. Let’s review these differences clearly:

Coverage Scope DP1 Policy:

- Named perils only

- Covers nine basic DP1 covered perils:

- Fire and lightning

- Internal explosion

- External explosion

- Windstorm and hail

- Riot or civil commotion

- Smoke

- Aircraft damage

- Vehicular damage

- Volcanic eruption

Coverage Scope DP3 Policy:

- Open perils coverage for the dwelling

- Covers all risks unless explicitly excluded

- Common exclusions include:

- Flood

- Earthquake

- War

- Nuclear hazards

- Intentional damage

Claim Payout Method

- Actual Cash Value (ACV) payout

- Factors depreciation into claim settlements

- Often results in lower payouts, especially for older properties

- Replacement Cost Value (RCV) payout for dwelling structures

- Funds repairs or rebuilding without depreciation considerations

Additional Coverages

- Minimal additional coverages

- Generally excludes loss of rental income

- Personal property and liability coverages are optional

- Typically includes loss of rental income coverage (fair rental value)

- Often provides personal property coverage for landlord belongings

- Liability coverage frequently included or offered as an add-on

- Coverage for other structures usually standard

Cost Comparison

- Lower cost due to limited coverage

- Suitable for budget-conscious owners or lower-value properties

- Higher premiums reflecting broader protection

- Provides greater value for landlords with substantial property investments

Comparative Analysis: DP1 vs DP3

To further highlight the differences, consider this dp1 dp3 comparison chart:

| Feature | DP1 Policy | DP3 Policy |

|---|---|---|

| Peril Coverage | Named perils only | Open perils (all risks) |

| Claim Payout | Actual Cash Value | Replacement Cost Value |

| Water Damage | Not typically covered | Often covered (excluding flood) |

| Theft Coverage | Not covered | Usually covered |

| Vandalism Coverage | Not typically covered | Typically covered |

| Falling Objects | Not covered | Covered |

| Freezing Pipes | Not covered | Typically covered |

| Loss of Rent | Not included | Often included |

When to Choose DP1 vs DP3 Policy

- Vacant properties

- Older or low-value homes

- Lower-risk areas

- Property owners wanting basic, affordable coverage

- Occupied rental properties

- Higher-value homes

- Higher-risk areas

- Landlords desiring comprehensive protection

Best Practices for Choosing Between DP1 and DP3

- Assess property value and condition

- Consider occupancy status

- Evaluate location-specific risks

- Align with budget and long-term goals

- Consult an insurance professional for policy specifics

- Compare multiple insurance quotes

- Understand policy exclusions

- Evaluate additional endorsements if necessary

Conclusion

Choosing between DP1 insurance and DP3 insurance hinges on factors such as property value, occupancy, and risk tolerance. DP1 offers basic, cost-effective coverage suitable for vacant or lower-value homes. In contrast, DP3 insurance provides comprehensive protection ideal for landlords and property owners.

DP3 policy coverage generally offers more perils covered, superior structure protection, and customizable coverage options. Meanwhile, DP-1 policy coverage provides limited protection but suits certain scenarios effectively.

By clearly understanding these dwelling fire policies’ key differences, property owners can select the coverage aligning best with their investment needs. For further comparisons, explore DP1 vs DP3 or consult an Ho3 vs DP3 comparison chart to contrast these options against homeowners insurance. Consulting a licensed insurance agent can further assist in identifying the ideal coverage tailored to your rental property insurance requirements.