Getting Started in a Career as a Health Insurance Specialist

Achieving your health insurance certificate is an essential foundation for a career as a health insurance specialist within an agency. However, genuine growth and professional success depend on continued learning, hands-on experience, and specialized training. This comprehensive guide will explore how to become a health insurance specialist and how certified professionals can leverage targeted strategies and resources to excel as agency-based health insurance specialists, including pursuing medical insurance specialist certification and other valuable health insurance certifications.

Defining the Agency-Based Health Insurance Specialist Role

Within an insurance agency, health insurance specialists focus primarily on building client relationships, advising on policy options, and effectively managing coverage strategies. Unlike roles centered around medical billing or coding, agency specialists concentrate on guiding businesses and individuals through selecting optimal medical insurance solutions, handling group and individual policy submissions, ensuring compliance with Medicare and Medicaid regulations, and providing ongoing client support.

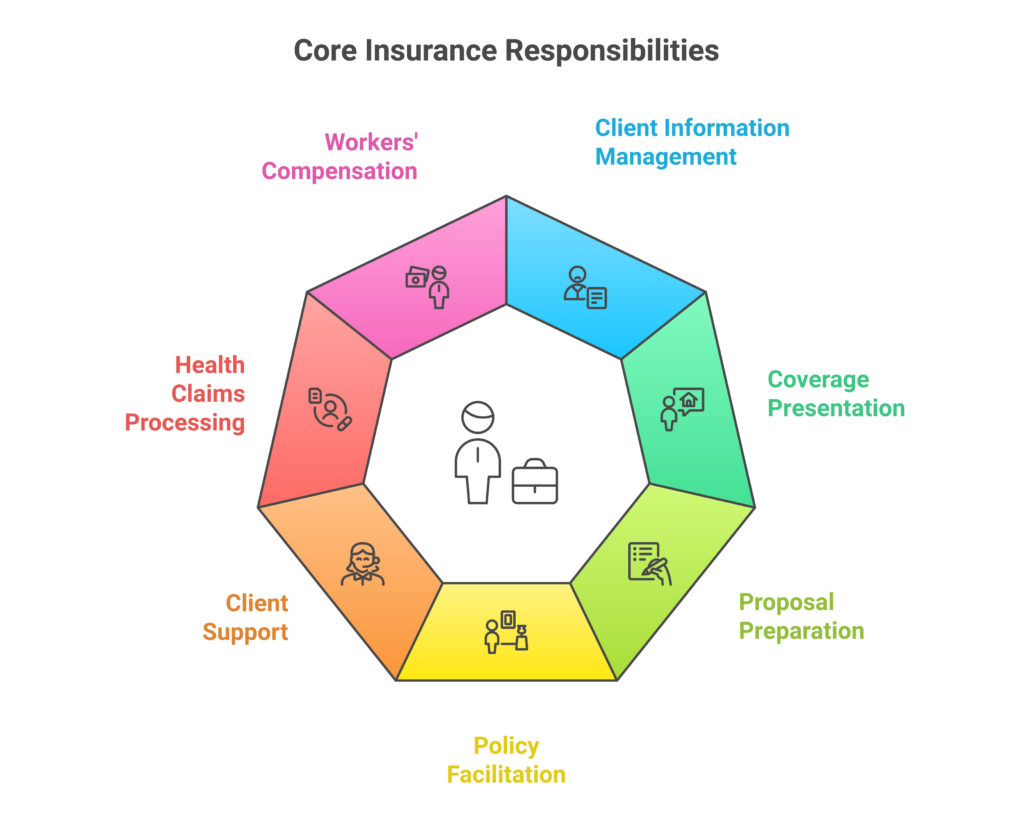

Key responsibilities include:

- Collecting and analyzing client information and data

- Clearly presenting coverage options tailored to client needs

- Preparing comprehensive and understandable insurance proposals

- Facilitating seamless policy enrollments and renewals

- Providing consistent client support and expert policy management

- Health care claims processing, including outpatient claims

- Assisting with workers’ compensation claims

Why Health Insurance Certification is Crucial

Certification differentiates specialists, positioning them as experts capable of delivering significant value. Certification brings:

- Greater Client Trust: Certified specialists demonstrate verified expertise, boosting client confidence.

- Expanded Career Opportunities: Credentials facilitate access to advanced positions and greater responsibilities.

- Improved Earnings: Professionals with certifications typically receive higher salaries and benefits.

Strategic Steps to Career Development

Step 1: Comprehensive Industry Training

To excel within an agency, specialists must possess thorough knowledge of various medical insurance coverages and regulatory requirements. Total CSR provides detailed health insurance training specifically tailored for agency-based professionals:

- Health Insurance Fundamentals: Deep knowledge of Medical, Dental, and Vision insurance is crucial. Specialists need to effectively advise clients, clarify benefits, and manage coverage expectations accurately.

- Regulatory Compliance: Mastery of ACA, HIPAA, ERISA, COBRA, Medicare, and Medicaid is mandatory. Thorough knowledge ensures agency professionals can mitigate compliance risks, prevent fraud and abuse, and guide clients effectively.

- Specialized Benefits Knowledge: Expertise in voluntary benefits, disability insurance, life insurance, and tax-advantaged accounts broadens your advisory capabilities, enabling more comprehensive client service.

Step 2: Advanced Practical Skill Development

Specialists must convert their extensive theoretical knowledge into actionable agency practices. Total CSR’s targeted skill development training helps refine crucial practical abilities:

- Submission Preparation and Management: Developing an efficient and accurate process for collecting necessary client information streamlines small and large group submissions, including proper use of CMS-1500 forms.

- Comparing and Analyzing Insurance Proposals: Proficiency in effectively comparing quotes ensures clients receive tailored, cost-effective coverage recommendations.

- Policy Implementation and Ongoing Management: Training in enrollment processes and meticulous policy checking ensures smooth transitions and ongoing management of client policies.

- Medical Insurance Verification Training: Learning proper techniques for verifying insurance coverage and benefits is essential for accurate claims processing.

Step 3: Pursuing Relevant Professional Certifications

Agency professionals greatly benefit from advanced certifications that underscore specialized skills. Total CSR offers the Qualified Employee Benefits Specialist (QEBS) designation, tailored specifically for agency professionals focused on employee benefits. Achieving the QEBS designation signals in-depth knowledge of employee benefits solutions and compliance strategies, equipping specialists to expertly manage group insurance needs.

Other relevant certifications include:

- Certified Employee Benefits Specialist (CEBS): Broadens understanding of benefits strategy and administration.

- Qualified Professional in Life and Health Insurance (QPLHI): Highlights comprehensive expertise in advising clients on both life and health insurance solutions.

Preparation for these best certifications for health insurance professionals includes:

- Taking specialized agency-focused courses and health insurance certification programs

- Actively engaging in professional seminars

- Regularly participating in industry-specific webinars and workshops

- Attending medical insurance classes to stay updated on industry trends

Real-World Agency Application for Health Insurance Specialist

Example: Improving Group Submission Efficiency

A health insurance specialist in a growing agency recognized significant inefficiencies in handling large group submissions. By applying Total CSR’s targeted training, the specialist successfully developed and implemented a streamlined system to manage client submissions. The result was reduced administrative errors, increased client satisfaction, and improved operational productivity within the agency.

Enhancing Agency Compliance Practices

Navigating compliance can be particularly challenging. Specialists who undergo rigorous compliance training provided by Total CSR can efficiently handle complex scenarios related to ACA, ERISA, COBRA, HIPAA, Medicare, and Medicaid, thus minimizing the risk of costly regulatory breaches for their agency and clients.

Continuous Learning for Long-Term Success

To sustain career growth, agency-based specialists must actively engage in ongoing professional education:

- Regular attendance at industry-specific conferences and seminars

- Enrollment in advanced courses for continuous skills enhancement

- Frequent review of industry publications and resources to remain updated on trends, best practices, and regulatory changes

Total CSR’s robust and continuously updated training modules provide agency professionals with essential resources for ongoing professional growth, including medical insurance training and certification exam preparation.

Gaining Expertise through QEBS Designation

Example: Improving Group Submission Efficiency

A health insurance specialist in a growing agency recognized significant inefficiencies in handling large group submissions. By applying Total CSR’s targeted training, the specialist successfully developed and implemented a streamlined system to manage client submissions. The result was reduced administrative errors, increased client satisfaction, and improved operational productivity within the agency.

Enhancing Agency Compliance Practices

Navigating compliance can be particularly challenging. Specialists who undergo rigorous compliance training provided by Total CSR can efficiently handle complex scenarios related to ACA, ERISA, COBRA, HIPAA, Medicare, and Medicaid, thus minimizing the risk of costly regulatory breaches for their agency and clients.

Continuous Learning for Long-Term Success

To sustain career growth, agency-based specialists must actively engage in ongoing professional education:

- Regular attendance at industry-specific conferences and seminars

- Enrollment in advanced courses for continuous skills enhancement

- Frequent review of industry publications and resources to remain updated on trends, best practices, and regulatory changes

Total CSR’s robust and continuously updated training modules provide agency professionals with essential resources for ongoing professional growth, including medical insurance training and certification exam preparation.

Total CSR equips agency professionals with comprehensive training resources designed to address specific agency needs:

- Compliance and Regulatory Mastery: Detailed instruction in ACA, ERISA, COBRA, HIPAA, Medicare, and Medicaid ensures thorough knowledge and confident handling of compliance matters.

- Advanced Proposal Preparation Techniques: Learn precise methods for creating persuasive and customized client proposals.

- Client Management Expertise: Specialized courses in effectively managing client relationships and ensuring sustained client retention and satisfaction.

- Coding and Documentation: Training on CPT, ICD-10-CM, and HCPCS coding systems, as well as proper medical documentation practices. This includes procedural coding essential for accurate claims submission.

Gaining Expertise through QEBS Designation

Total CSR’s QEBS designation specifically addresses the needs of agency-based health insurance professionals by providing focused training on employee benefits management. The QEBS training includes:

- Comprehensive understanding of benefit plan structures

- Advanced insights into employee benefit compliance and regulatory frameworks

- Strategic skills for effectively managing group benefits

- Knowledge of reimbursement processes and third-party payers

Acquiring the QEBS designation signifies your advanced capability in handling complex employee benefits situations, setting you apart in your agency and enhancing your professional standing.

Additional Resources for Health Insurance Specialists

To further enhance your expertise, consider exploring resources from reputable organizations such as the Practice Management Institute. These institutions offer valuable insights into:

- Electronic data interchange in healthcare

- Managed care plans and their impact on insurance

- Medical ethics and fraud prevention

- Collection strategies for insurance claims

- Computerized medical billing systems

Acquiring the QEBS designation signifies your advanced capability in handling complex employee benefits situations, setting you apart in your agency and enhancing your professional standing.

Wrapping up Starting your Career as a Health Insurance Specialist

Building a successful career as a health insurance specialist within an agency requires strategic focus on continued education, practical experience, and professional certifications. Leveraging targeted training opportunities like those offered by Total CSR, including the QEBS designation and other medical insurance certification courses, will position certified professionals to thrive, elevate client satisfaction, and significantly contribute to their agency’s success. By mastering both the intricacies of medical insurance and the nuances of agency operations, specialists can become invaluable assets in the ever-evolving health insurance landscape.

For medical office professionals looking to specialize in health insurance, this career path offers numerous opportunities for growth and development. With a strong foundation in insurance and medical knowledge, combined with excellent insurance problem-solving skills, health insurance specialists can navigate the complex world of healthcare coverage with confidence and expertise.