Introduction to Aleatory Insurance

Most of us will sign insurance agreements several times throughout our lives. Yet beneath what seems like a simple exchange of premium payments for protection lies a complex legal framework built on a fundamental concept: the aleatory contract. The aleatory contract insurance definition refers to a specific type of legal agreement where performance depends on uncertain future events, creating an imbalanced exchange that forms the basis of how insurance works. Understanding this principle provides key insights into what is aleatory, how insurance operates, why it functions differently from typical contracts, and what rights this creates for both insurers and policyholders.

Definition and Overview of Aleatory Contracts in Insurance

An aleatory contract is a legal agreement where the obligations of the parties depend on the occurrence of a fortuitous event outside their control. The term “aleatory” comes from the Latin word “alea,” meaning dice—aptly referencing the element of chance central to these agreements. This concept has roots in Roman law, which recognized the unique nature of such contracts. But what does aleatory mean in insurance specifically?

In insurance, an aleatory contract establishes a framework where:

- The insurer’s obligation to perform (pay a claim) only activates upon the occurrence of a specified fortuitous event.

- The policyholder pays premiums regardless of whether the triggering event ever occurs.

- The potential payout to the insured party may significantly exceed the sum of premiums paid.

This structure distinguishes insurance from most commercial contracts where parties exchange roughly equivalent value with certainty. Instead, insurance creates a mechanism for transferring financial risk from individuals to institutions better positioned to absorb it. The aleatory insurance meaning is fundamental to understanding how these agreements function.

Key Components of Aleatory Insurance Contracts

Aleatory insurance agreements contain several distinctive elements that separate them from standard contracts:

Fortuitous Triggering Event

- Must be a future occurrence with genuine uncertainty

- Typically involves natural disasters, accidents, death, property damage, or other perils

- Event must be beyond the control of either contracting party

- The timing and whether the event will occur remain unknown when forming the contract

Conditional Performance Obligation

- Insurer’s duty to pay only activates upon the specified event.

- No performance required if the event never occurs.

- Contingent nature fundamentally shapes the entire agreement.

Risk Transfer Mechanism

- Policyholder transfers potential financial burden to insurer.

- Insurer assumes risk exposure in exchange for premium payments.

- Creates stability for the insured through predictable costs.

Unequal Transfer of Value

- Premiums paid may never result in any return benefit.

- Alternatively, payouts may far exceed premiums collected.

- This imbalance is accepted and expected by both parties.

Legal Enforceability Components

- Includes standard contract requirements (offer, acceptance, consideration).

- Contains additional protections given the specialized nature.

- Subject to specific regulatory requirements for validity.

Insurance policies are aleatory contracts because they embody these key components, particularly the unequal exchange in value and dependence on fortuitous events. This aleatory definition in insurance sets the foundation for understanding which kind of contract includes an unequal exchange in value.

Aleatory Contracts vs. Other Insurance Principles

| Principle | Definition | Relationship to Aleatory Contracts | Key Difference |

|---|---|---|---|

| Indemnity | Restoration to pre-loss position | Complements aleatory nature of an insurance contract | Limits recovery to actual loss amount |

| Insurable Interest | Financial stake in subject matter | Prerequisite for aleatory contract | Prevents gambling on others' misfortune |

| Utmost Good Faith | Full disclosure of material facts | Essential given aleatory uncertainty | Addresses information imbalance |

| Subrogation | Insurer assumes rights to pursue third parties | Extends from aleatory relationship | Prevents double recovery |

| Contribution | Proportional sharing among multiple insurers | Administrative principle | Manages overlapping coverage |

The aleatory nature of insurance serves as the foundation upon which these other principles operate. Without the fundamental aleatory structure, these secondary principles would have no context to function within.

Practical Applications of Aleatory Principles in Insurance

The aleatory insurance definition manifests throughout the insurance industry in various practical ways:

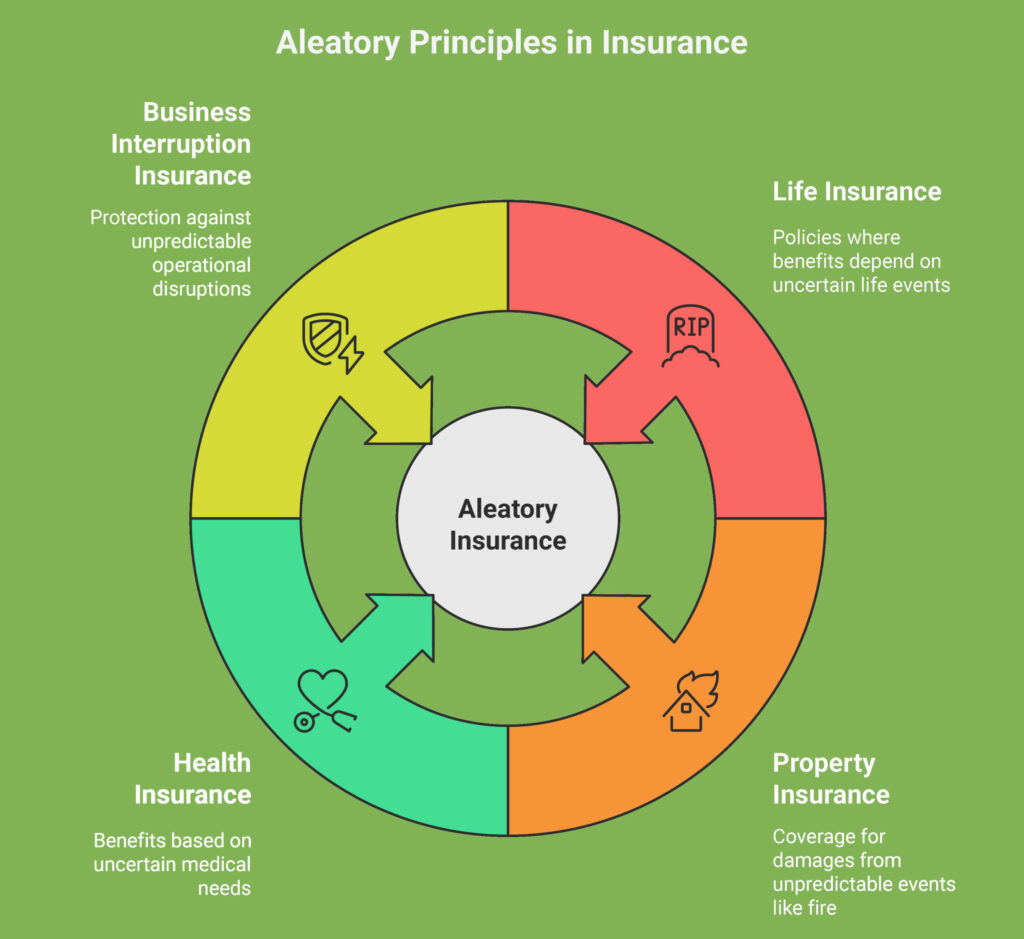

Life Insurance Applications

Life insurance represents perhaps the purest form of aleatory contracting. The policyholder may pay premiums for decades without any benefit being paid, or a single premium payment could result in a substantial death benefit if the insured passes away shortly after policy issuance. This dramatic imbalance is accepted precisely because of the aleatory nature of the agreement. The aleatory contract life insurance underscores the uncertainty inherent in these policies.

Property Insurance Applications

When homeowners maintain coverage year after year without filing claims, they receive no direct financial return on their premiums. However, should a catastrophic event like a fire or accident damage their property, the insurer must pay potentially hundreds of thousands of dollars in claims—far exceeding collected premiums. This arrangement works specifically because of the aleatory principle that conditions payout on fortuitous events. Fire insurance is a prime example of how aleatory contracts function in property protection.

Health Insurance Applications

Health insurance operates on aleatory principles when healthy policyholders pay regular premiums without receiving benefits, while those experiencing medical emergencies may receive care costing far more than their premium contributions. The uncertainty of who will need extensive medical care and when makes this system function.

Business Interruption Insurance

Organizations purchase business interruption coverage without knowing if operational disruptions will ever occur. The aleatory nature allows businesses to transform unpredictable catastrophic risks into manageable premium expenses, providing financial stability regardless of future events.

Best Practices for Understanding Aleatory Insurance Contracts

Insurance professionals and policyholders can benefit from these recommendations when dealing with aleatory contracts:

- Clear Event Definition: Ensure policy language precisely defines covered events that trigger insurer performance obligations

- Exclusion Transparency: Maintain clarity about circumstances where the aleatory condition will not trigger insurer obligations

- Premium-Risk Alignment: Structure premiums to appropriately reflect the probability and severity of the fortuitous events

- Documentation Protocols: Maintain comprehensive records of all communications related to the contract formation

- Consistent Claim Standards: Apply consistent standards when determining if a triggering event has occurred

- Regular Policy Reviews: Periodically review policy terms to confirm ongoing suitability for current risk exposures

- Regulatory Compliance: Stay current with evolving regulations governing aleatory contracts in applicable jurisdictions

For insurance professionals specifically, understanding what is an aleatory contract in insurance provides the conceptual foundation for properly structuring coverage, explaining policy limitations, and managing client expectations about when benefits will and won’t be paid. Effective risk management in insurance relies heavily on a thorough grasp of aleatory principles.

Conclusion

The aleatory nature of an insurance contract represents the essential legal framework that enables the entire insurance system to function. By conditioning performance on fortuitous events, these agreements create a mechanism for efficiently transferring and distributing risk across society. Understanding that insurance operates as an aleatory contract helps explain why premiums must be paid regardless of claims, why exclusions exist, and why policies must carefully define covered events.

Insurance contracts are known as aleatory contracts. This means that the exchange of value between the insurer and the insured is unequal and dependent on chance events. In what way are insurance policies said to be aleatory? They promise performance based on the occurrence of fortuitous events, creating a unique legal relationship between the insured party and the insurance provider.

For insurance professionals, this knowledge provides the theoretical foundation upon which practical insurance operations rest. For policyholders, it clarifies expectations about how and when insurance benefits become available. As insurance policies continue evolving to address emerging risks, the aleatory principle remains the constant that makes financial protection against uncertainty possible.