The Real Impact of Apparent Authority on Insurance Agents and Clients

The concept of apparent authority in insurance, also known as ostensible authority, stands as one of the most critical yet frequently misunderstood principles governing the relationship between insurance companies, agents, and clients. This legal doctrine can make or break coverage disputes, determine liability outcomes, and significantly impact both professional relationships and financial outcomes. For insurance professionals operating in today’s complex regulatory environment, mastering the nuances of apparent authority represents far more than academic knowledge—it’s a practical necessity that directly affects daily operations, risk exposure, and client satisfaction.

Unlike other industries where agent-principal relationships may be straightforward, insurance presents unique challenges. Clients often interact primarily with agents rather than insurance companies directly, creating scenarios where the boundaries of authority become blurred. When disputes arise over coverage, claims, or policy modifications, courts frequently turn to apparent authority principles to resolve conflicts. Understanding these dynamics allows insurance professionals to navigate potential pitfalls while building stronger, more transparent relationships with clients.

Definition of Apparent Authority

Apparent authority in insurance refers to the authority that a reasonable third party would believe an insurance agent possesses based on the actions, communications, or representations of the insurance company (the principal). This authority exists independently of any actual authority granted by the insurer and stems from the reasonable reliance of clients on the apparent scope of an agent’s powers.

The legal foundation rests on three key elements: First, the principal (insurance company) must engage in conduct that would lead a reasonable person to believe the agent has authority. Second, the third party (client) must reasonably rely on this apparent authority. Third, the reliance must result in a change of position or detriment to the third party.

What is apparent authority in practical terms? Consider an agent who regularly handles policy endorsements without requiring company approval. Suppose the insurance company has knowledge of this practice and fails to correct it. In that case, apparent authority may exist for future endorsements, even if the agent lacks express authority for a specific transaction. This scenario illustrates how apparent authority fills gaps between formal authorization and business realities.

Importance in Insurance Transactions

The significance of apparent authority in insurance transactions cannot be overstated. Insurance companies often operate through extensive agent networks, making direct supervision of every interaction impossible. Clients reasonably expect agents to possess certain powers based on their position, industry customs, and past experiences.

Consider the following practical implications:

- Policy Modifications: When agents regularly process certain types of changes without company approval, clients develop reasonable expectations about the agent’s capabilities

- Premium Collection: Agents who consistently collect premiums may create apparent authority for future collections, even during periods when it is suspended

- Coverage Representations: Statements made by agents regarding coverage scope can bind insurers under apparent authority principles, regardless of policy language

This doctrine protects clients from the often invisible limitations of agent authority while holding insurance companies accountable for the reasonable expectations they create through their agents’ conduct.

The Role of Agents in Apparent Authority

Responsibilities of Insurance Agents

Insurance agents bear significant responsibility in managing apparent authority situations. Their primary obligation involves understanding and clearly communicating the scope of their actual authority to clients. This responsibility extends beyond mere compliance—it requires proactive management of client expectations and careful attention to how their actions may create apparent authority.

Key agent responsibilities include:

Documentation and Communication: Agents must document their authority limitations and communicate these boundaries to clients. When agents lack authority for specific transactions, they should explicitly state this limitation and explain the approval process required.

Consistency in Practice: Agents should maintain consistency between their actual authority and their conduct. Regularly performing actions outside their actual authority, even with subsequent company approval, can create apparent authority for similar future actions.

Professional Boundaries: Agents must understand that their position inherently carries certain apparent authority based on industry customs and client expectations. Professional licensing, company affiliation, and marketing materials all contribute to apparent authority creation.

How Agents Establish Apparent Authority

Agents establish apparent authority through various mechanisms, often without realizing the legal implications of their actions. Understanding these mechanisms allows agents to control apparent authority creation better while serving clients effectively.

-

-

Company-Sanctioned Conduct: When insurance companies provide agents with specific tools, systems, or processes, they create apparent authority for the reasonable use of these resources. For example, providing agents with policy modification software suggests authority to make such modifications.

Previous Course of Dealing: Repeated patterns of conduct, particularly when known to and accepted by the insurance company, establish apparent authority. If an agent regularly binds certain types of coverage and the company consistently honors these commitments, apparent authority exists for similar future transactions.

Industry Custom and Practice: Apparent authority also derives from standard industry practices. Clients reasonably expect agents to possess authority consistent with industry norms, regardless of specific company limitations. This can sometimes lead to implied authority, where the agent’s power is inferred from the nature of their position and industry standards.

-

Binding Authority vs. Apparent Authority

Understanding Binding Authority

Authority to bind represents the actual, documented power granted by an insurance company to an agent. This express authority is typically outlined in agency agreements, underwriting guidelines, and specific authorization documents. Binding authority creates immediate coverage obligations for the insurance company, regardless of subsequent underwriting review.

Express authority is clearly defined and limited, also known as expressed authority. Common examples include authority to bind specific coverage types up to certain limits, express authority to collect premiums, or express authority to cancel policies under defined circumstances. This authority is contractual and creates direct obligations between the insurance company and the agent.

The relationship between binding authority and actual authority is direct and documented. When agents operate within their binding authority, they act as direct representatives of the insurance company, and their actions create immediate legal obligations.

Key Differences Between the Two

The distinction between binding authority and apparent authority creates significant practical implications for insurance professionals. Understanding these differences prevents common misunderstandings and reduces liability exposure.

Source of Authority: Binding authority derives from explicit grants of power documented in agency agreements or specific authorizations. Apparent authority stems from reasonable third-party perceptions based on the insurance company’s conduct and representations.

Company Knowledge: Binding authority requires active company participation and agreement. Apparent authority can exist even when the company is unaware of the specific circumstances creating the authority, provided its general conduct would lead to reasonable reliance.

Scope and Limitations: Binding authority has clearly defined parameters and limitations. Apparent authority’s scope depends on what a reasonable person in the client’s position would believe, based on all relevant circumstances.

Example of apparent authority versus binding authority: An agent has binding authority to write auto coverage up to $50,000 per claim. However, the agent regularly writes higher limits with subsequent company approval. A client requesting $75,000 coverage may rely on apparent authority based on the agent’s past practice, even though the request exceeds actual authority.

Risk Management and Apparent Authority

Managing Risks Related to Apparent Authority

Effective risk management regarding apparent authority requires proactive strategies that address both legal obligations and business relationships. Insurance professionals must balance client service excellence with clear authority boundaries.

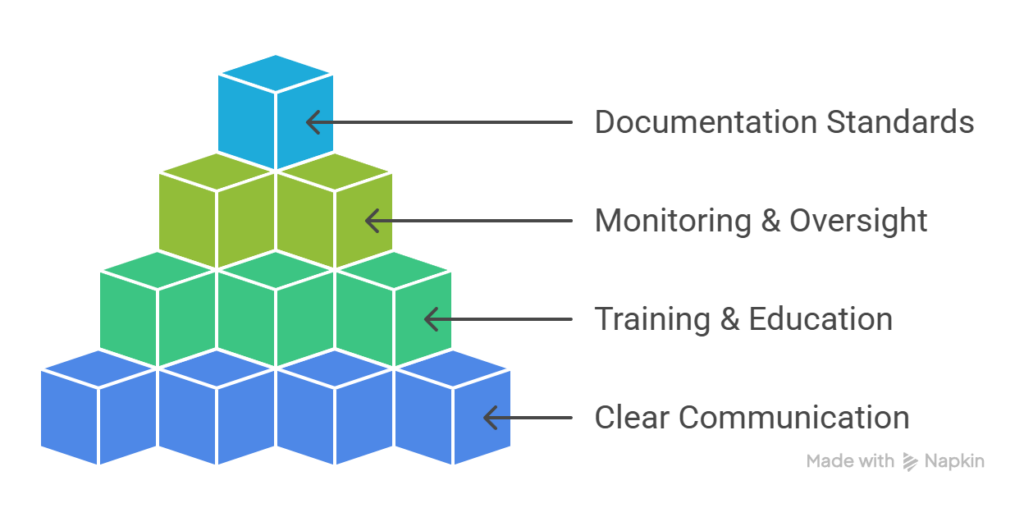

Clear Communication Protocols: Establish standardized language for communicating authority limitations to clients. This includes written disclaimers, verbal confirmations, and follow-up documentation when agents exceed their actual authority.

Training and Education: Regular training programs should address apparent authority concepts, current case law developments, and practical scenarios. Agents need real-world examples to understand how their daily actions create apparent authority.

Monitoring and Oversight: Insurance companies should implement systems to monitor agent conduct and identify patterns that might create unintended apparent authority. Regular audits of agent-client communications, transaction patterns, and exception approvals help identify potential issues.

Documentation Standards: Comprehensive documentation of agent authority, client communications, and transaction approvals creates clear records for potential disputes. This documentation should include both granted authority and explicitly withheld powers.

Case Studies in Risk Management Authority

Real-world applications of apparent authority principles provide valuable insights for risk management strategies. These examples illustrate common scenarios and their resolution through apparent authority analysis.

Case Study 1: Premium Collection Authority An insurance agent consistently collected premiums for multiple clients over five years. The insurance company processed these payments without objection. When the agent’s actual authority was revoked due to licensing issues, a client paid a premium to the agent, believing coverage would continue. The court found apparent authority existed based on the established pattern of conduct, and the insurance company was bound to accept the premium payment.

Case Study 2: Coverage Modification An agent regularly processed policy endorsements through an online company portal. The company approved these modifications routinely. When a client requested a specific endorsement that the agent processed outside their actual authority, the insurance company attempted to void the coverage. The court ruled that apparent authority existed based on the company’s provision of modification tools and historical approval patterns.

These cases demonstrate how agency law principles apply in insurance contexts and why proactive risk management proves valuable for all parties.

Implications for Clients

How Clients Are Affected by Apparent Authority

Clients benefit significantly from apparent authority protections, but they also bear certain responsibilities in these relationships. Understanding these dynamics helps clients make informed decisions while protecting their interests.

Protection from Hidden Limitations: Apparent authority protects clients from undisclosed limitations on agent authority. When insurance companies create reasonable expectations through their agents’ conduct, clients can rely on these expectations even if the agent lacks actual authority.

Reasonable Reliance Standards: Clients must demonstrate reasonable reliance on apparent authority. This means clients cannot ignore clear indications of authority limitations or rely on obviously excessive claims of agent power.

Due Diligence Expectations: While apparent authority provides significant protection, clients retain responsibility for reasonable due diligence. This includes reviewing policy documents, understanding coverage limitations, and asking appropriate questions about agent authority.

Building Trust and Expectations in Insurance Relationships

Trust formation in insurance relationships depends heavily on clear understanding of apparent authority principles. Both agents and clients must navigate these relationships with transparency and mutual understanding of authority boundaries.

Establishing Clear Expectations: Successful insurance relationships begin with clear communication about agent authority, company processes, and client rights. This foundation prevents most apparent authority disputes while building stronger professional relationships.

Regular Communication: Ongoing communication about changes in agent authority, company policies, or client needs maintains relationship clarity. This includes proactive notification of authority changes and clear explanation of any limitations.

Mutual Responsibilities: Both agents and clients share responsibility for relationship success. Agents must clearly communicate their authority limitations and company procedures. Clients must engage in reasonable due diligence and communicate their needs clearly.

The interplay between contractual rights, fiduciary duty, and apparent authority creates complex obligations that require ongoing attention from insurance professionals. These relationships extend beyond simple business law or employment law concepts, requiring specialized knowledge of insurance industry practices and legal principles.

What is an example of apparent authority in building client relationships? Consider an agent who consistently provides immediate coverage confirmations for standard risks. Over time, clients reasonably expect immediate confirmation for similar risks. If the agent’s authority changes but the company fails to notify clients, apparent authority may still exist for confirmation practices, protecting clients who reasonably relied on established patterns.

Understanding apparent authority represents both a legal necessity and a business opportunity. Insurance professionals who master these concepts provide better client service while managing risk exposure effectively. The doctrine serves as a bridge between formal authority structures and practical business relationships, ensuring that reasonable client expectations receive appropriate legal protection while maintaining necessary boundaries for insurance company operations.

Success in managing apparent authority requires ongoing attention, clear communication, and comprehensive understanding of legal principles. As insurance markets continue to evolve, these fundamental concepts remain constant, providing stability and predictability for professional relationships built on trust, expertise, and mutual understanding.

Frequently Asked Questions

Apparent authority can extend an insurance company’s legal liability by binding the insurer to actions taken by an agent that third parties reasonably believe the agent was authorized to perform.

Implied authority arises from actions or duties implicitly authorized by the insurer, while apparent authority stems from the insurer’s actions that lead third parties to reasonably believe the agent has specific authority.

Third parties can determine an agent’s apparent authority by assessing representations made by the insurance company or observing the agent’s customary practices that the insurer has not objected to.

An example of apparent authority causing legal issues in insurance occurs when an agent verbally assures coverage outside policy terms, and the insurer becomes legally obligated to uphold those assurances.

Perceived authority directly influences customer trust, as customers typically place greater confidence in agents they believe have clear authorization and credibility backed by the insurer.