Introduction to the Third Party Administrator's Role

The commercial insurance landscape continues to evolve in complexity, with businesses facing increasing pressure to control expenses while maintaining adequate coverage. Insurance professionals are increasingly relying on specialized service providers to manage administrative functions that exceed traditional carrier capabilities. Third-party administrators (TPAs) serve as essential intermediaries, filling the gaps between insurers, employers, and claimants, while providing specialized knowledge in claims management, regulatory compliance, and administrative services.

Grasping how TPAs operate within commercial insurance arrangements proves vital for brokers, agents, underwriters, and risk managers who must recommend optimal coverage solutions for their clients. This analysis explores the multifaceted role of third-party administrators in commercial insurance, their risk management capabilities, and practical considerations for insurance professionals evaluating TPA partnerships.

What is a Third Party Administrator?

Definition of a TPA

A third-party administrator represents an independent organization that delivers administrative services for insurance plans, employers, and insurance companies without assuming financial risk for claim payments. Unlike traditional insurers, TPAs don’t underwrite policies or hold reserves for claim payments. Instead, they operate as contracted service providers specializing in claims processing, member services, provider network management, and regulatory compliance across various commercial insurance lines.

The TPA model enables insurance companies to outsource complex administrative tasks while retaining control over underwriting decisions and risk assessment. For self-funded employers, TPAs provide a comprehensive administrative infrastructure without requiring internal claims management capabilities. This arrangement creates operational flexibility for both insurers seeking to expand their service capabilities and employers pursuing self-insurance strategies.

What is TPA in practical terms? TPAs operate as specialized service organizations that blend insurance expertise with operational efficiency. They maintain a dedicated staff, technological infrastructure, and regulatory licenses to handle administrative work that would otherwise require significant internal resources from insurance companies or corporate clients. TPA services encompass a broad range, from claim processing to managing employee benefit plans.

Importance of TPAs in Commercial Insurance

The TPA insurance industry has become indispensable within commercial insurance markets due to several convergent factors. Regulatory changes have increased compliance requirements, making specialized expertise more valuable than generalized administrative capabilities. Healthcare costs continue to rise, creating a demand for sophisticated claims adjudication and network management services. Additionally, multinational corporations require standardized administrative processes across multiple states and jurisdictions.

TPAs offer insurance companies scalable administrative capacity without fixed overhead costs associated with internal departments. This flexibility allows insurers to compete for large accounts while maintaining operational efficiency. For brokers and agents, TPA partnerships enable access to comprehensive administrative services that boost client satisfaction and retention.

The specialization offered by TPAs often surpasses what insurance companies can develop internally. Leading TPAs invest heavily in modern systems, data security protocols, and specialized staff training. This technological infrastructure and expertise create measurable value for insurance professionals seeking to differentiate their service offerings in competitive markets. Health plan TPAs have become essential partners for many health insurers looking to streamline their operations and improve their bottom line.

Third Party Risk Management

Understanding Third-Party Risk

Third-party risk encompasses potential exposures that emerge when organizations outsource critical functions to external service providers. In commercial insurance contexts, this includes risks related to data protection, regulatory compliance, financial stability, and operational continuity. Insurance professionals must evaluate these risks when recommending TPA partnerships to clients, taking into account the organization’s risk appetite and overall risk management strategy.

Data security represents a primary concern, as TPAs handle sensitive member information, claims data, and financial records. Regulatory compliance risks emerge when TPAs fail to maintain proper licensing or adhere to changing government regulations. Operational risks include service disruptions, inadequate staffing, or technology failures that impact claims processing and customer service delivery.

Financial risk assessment requires examining TPA financial stability, professional liability coverage, and contractual indemnification provisions. Insurance professionals should assess whether TPAs have sufficient resources to handle claim volumes and whether their financial condition supports long-term service commitments.

Experienced TPAs implement comprehensive risk management programs that protect both their operations and their clients’ interests. Leading TPAs maintain robust cybersecurity protocols, including data encryption, access controls, and incident response procedures, to protect their clients’ sensitive information. They invest in redundant technological infrastructure to prevent service interruptions and maintain business continuity plans for various operational scenarios.

Professional TPAs also maintain extensive professional liability coverage and errors and omissions insurance to protect against claims arising from administrative errors or regulatory compliance failures. Many TPAs provide detailed indemnification provisions in their service agreements, transferring certain risks back to the TPA rather than leaving clients exposed.

Quality control programs implemented by reputable TPAs include regular audits, performance monitoring, and corrective action procedures. These programs help prevent errors that could create liability exposures for insurance companies or employers. Comprehensive reporting capabilities allow insurance professionals to monitor TPA performance and identify potential issues before they impact client relationships.

Best Practices for Effective Risk Management

Insurance professionals should implement structured evaluation processes when assessing TPA vendors. This includes reviewing financial statements, insurance coverage, regulatory compliance records, and operational capabilities. Due diligence should extend beyond initial selection to include ongoing performance monitoring and periodic reevaluation of vendor relationships.

Contract negotiations should address specific risk allocation provisions, including data breach notification requirements, liability caps, and termination procedures. Insurance professionals should ensure that TPA agreements include adequate service level commitments and financial penalties for performance failures.

Regular communication with TPA partners creates opportunities to address emerging risks before they impact operations. This includes participation in quarterly business reviews, claims trending analysis, and strategic planning discussions. Insurance professionals who maintain active oversight of TPA relationships typically achieve better outcomes for their clients and can offer more innovative solutions to address evolving risk management needs.

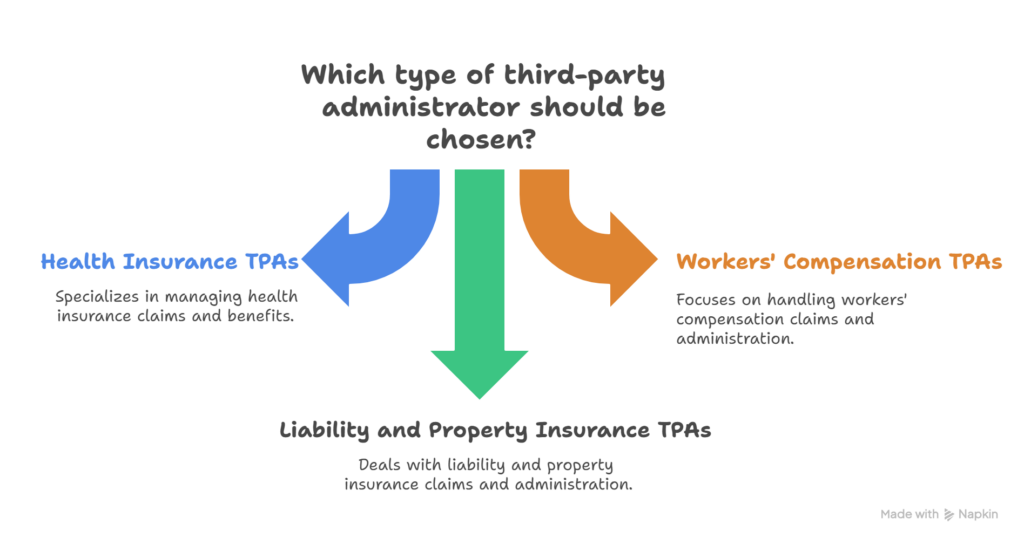

Types of Third-Party Administrators

Health Insurance TPAs

Health insurance TPAs represent the largest segment of the third-party administration market, serving both fully insured and self-funded health plans. These TPAs manage member enrollment, process medical and pharmacy claims, coordinate healthcare networks, and handle customer service inquiries. Major health plan TPAs often maintain extensive PPO networks and specialized disease management programs.

Self-funded health plans rely heavily on TPA services because employers often lack internal expertise in healthcare administration. TPAs offer comprehensive claims adjudication services, encompassing medical necessity reviews, network contract enforcement, and appeals processing. They also coordinate with stop-loss insurance carriers to manage catastrophic claims and financial risk exposure.

TPA health insurance services extend beyond basic claims processing to include wellness programs, health savings account administration, and regulatory compliance support. Many health TPAs offer integrated customer portals that allow plan members to access claims information, locate healthcare providers, and manage their benefit utilization.

What is TPA in health insurance from an operational perspective? Health TPAs serve as comprehensive service platforms that replicate the capabilities of insurance companies, allowing employers to maintain control over plan design and funding decisions. This arrangement provides cost transparency and customization options that traditional fully insured arrangements cannot match, often resulting in improved health coverage and a more competitive benefit package for employees.

Workers' Compensation TPAs

Workers’ compensation TPAs specialize in managing occupational injury claims, ensuring regulatory compliance, and facilitating return-to-work coordination. These TPAs maintain specialized expertise in medical case management, disability evaluation, and state-specific regulatory requirements. They work closely with employers, medical providers, and state agencies to manage complex workers’ compensation exposures.

The specialized nature of workers’ compensation administration makes TPA services particularly valuable for insurance companies and self-insured employers. Workers’ compensation TPAs maintain dedicated staff with relevant professional certifications and extensive experience in injury management protocols. They often provide superior outcomes compared to generalized claims departments.

Workers’ compensation TPAs also coordinate with defense counsel on disputed claims, manage provider networks specialized in occupational medicine, and implement fraud detection programs. These capabilities require significant investment in specialized systems and staff training that many insurance companies find more cost-effective to outsource. The expertise of claims adjusters in this field proves crucial for managing claim costs effectively.

Liability and Property Insurance TPAs

Commercial general liability and property insurance TPAs handle complex claims that require specialized investigation capabilities and legal expertise. These TPAs coordinate with defense counsel, manage litigation expenses, and implement settlement strategies that protect insurer interests while resolving claims efficiently.

Property insurance TPAs often maintain networks of contractors, adjusters, and restoration specialists who can respond quickly to large losses. They coordinate emergency services, estimate repair costs, and manage vendor partners throughout the restoration process. This specialization generates significant value for insurance companies that handle commercial property exposures.

Liability TPAs provide specialized expertise in areas such as product liability, professional liability, and environmental exposures. They maintain relationships with expert witnesses, specialized defense counsel, and technical consultants who support complex liability claims. This network of specialists enables more effective claims resolution than generalized claims departments typically achieve.

Benefits of Engaging Third-Party Administrators

Streamlined Claims Processing

Professional TPAs implement standardized claims processing procedures that improve efficiency and reduce administrative costs. Their specialized focus on claims management typically results in faster claim resolution times compared to generalized insurance company departments. TPAs invest in advanced claims management systems that automate routine tasks and flag complex claims for specialized attention.

Insurance claims processing through experienced TPAs often demonstrates superior accuracy rates due to specialized staff training and quality control procedures. TPAs handle high volumes of similar claims, creating operational efficiency that benefits both insurance companies and policyholders. This specialization translates into measurable cost savings through reduced administrative expenses and improved claim outcomes.

The technological infrastructure maintained by leading TPAs includes automated data entry systems, electronic document management, and integrated communication platforms. These capabilities reduce manual administrative tasks while improving accuracy and processing speed. Insurance professionals can leverage these efficiencies to enhance client satisfaction and improve their competitive positioning.

Enhanced Compliance and Reporting

Regulatory compliance represents a significant challenge for insurance companies operating across multiple states with varying requirements. TPAs maintain specialized compliance expertise and monitoring systems that track regulatory changes and implement necessary procedural updates. This specialization reduces compliance risks for insurance companies while improving operational efficiency.

Government regulations affecting employee benefit plans, workers’ compensation, and commercial insurance continue increasing in complexity. TPAs invest in compliance monitoring systems and specialized staff training that many insurance companies cannot justify maintaining internally. This expertise becomes particularly valuable for insurance companies serving corporate clients with operations in multiple jurisdictions.

Comprehensive reporting capabilities offered by experienced TPAs include detailed claims analytics, regulatory compliance reports, and performance dashboards. These reports enable insurance professionals to monitor account performance, identify cost-saving opportunities, and demonstrate value to their clients. Advanced reporting capabilities also support regulatory filings and audit requirements, including those related to mandated benefits and aggregate stop-loss coverage.

Cost Efficiency in Insurance Administration

The TPA model creates operational efficiencies that reduce overall insurance administration costs. TPAs achieve economies of scale by serving multiple clients with shared infrastructure and specialized staff. This shared cost structure typically delivers lower per-claim administrative costs compared to internal insurance company departments.

Administrative burden reduction represents a significant benefit for both insurance companies and employers utilizing TPA services. TPAs handle routine administrative tasks, including premium collection, member communications, and vendor management. This enables insurance company staff to concentrate on underwriting, sales, and relationship management activities that yield higher returns.

Finance teams at both insurance companies and client organizations benefit from detailed cost reporting and predictable administrative expense structures provided by TPA partnerships. Many TPAs offer guaranteed administrative fee arrangements that create budget predictability and eliminate surprises from fluctuating internal departmental costs. This approach can have a significant impact on the bottom line for both insurers and employers.

Choosing the Right Third Party Administrator

Key Considerations

Selecting an appropriate TPA requires careful evaluation of operational capabilities, financial stability, and service quality metrics. Insurance professionals should assess TPA experience with similar client types, claim volumes, and coverage lines. The evaluation process should include reference checks with existing clients and a review of performance metrics across key operational areas.

Technological infrastructure represents a critical evaluation criterion, as modern claims management requires sophisticated systems integration and data security protocols. Prospective TPAs should demonstrate compatibility with existing insurance company systems and provide detailed information about their cybersecurity measures and business continuity plans.

Geographic coverage capabilities become important considerations for insurance companies serving corporate clients with operations in multiple states. TPAs should maintain proper licensing and regulatory compliance across all relevant jurisdictions. They should also demonstrate familiarity with state-specific requirements and maintain relationships with local service providers, ensuring comprehensive network access for plan members.

Evaluating TPA Performance

Ongoing performance monitoring requires establishing clear service level agreements and key performance indicators during contract negotiations. Critical metrics include claim processing timeframes, accuracy rates, customer satisfaction scores, and regulatory compliance records. Regular performance reviews should address both quantitative metrics and qualitative service factors.

Claims management effectiveness can be measured through average resolution times, settlement ratios, legal expense management, and client satisfaction surveys. Leading TPAs provide detailed performance reporting that allows insurance professionals to identify trends and address potential issues proactively.

Network management capabilities should be evaluated through provider satisfaction surveys, network adequacy assessments, and contract negotiation outcomes. Effective TPAs maintain strong relationships with provider networks and demonstrate ability to control healthcare costs while maintaining quality care standards. This proves particularly important for health plan TPAs managing comprehensive healthcare networks.

Questions to Ask Potential TPAs

Insurance professionals should prepare comprehensive questionnaires that address operational capabilities, financial stability, and service quality factors. Critical questions should cover claims processing procedures, quality control measures, technology platforms, and staff qualifications. Prospective TPAs should provide detailed responses supported by performance data and client references.

Financial stability assessment requires reviewing audited financial statements, professional liability coverage, and bonding arrangements. TPAs should demonstrate adequate capitalization to handle anticipated claim volumes and maintain operations during economic downturns. Questions should address cash flow management, collection procedures, and funds distribution protocols.

Regulatory compliance capabilities should be thoroughly evaluated through questions about licensing status, complaint history, and audit results. TPAs should provide evidence of ongoing compliance monitoring and demonstrate familiarity with applicable regulations across their service territories. They should also explain their procedures for adapting to regulatory changes and maintaining compliance standards.

Technology and data security questions should address system architecture, integration capabilities, and cybersecurity measures. TPAs should provide detailed information about their data protection protocols, disaster recovery procedures, and system upgrade schedules. The attachment point between TPA systems and insurance company platforms requires careful technical evaluation to ensure seamless integration and optimal customer experience.

Conclusion

The role of a third-party administrator in commercial insurance continues to expand as market complexity creates a demand for specialized administrative expertise. TPAs deliver measurable value through streamlined operations, regulatory compliance support, and cost efficiency improvements, benefiting insurance companies, employers, and plan members. Success in TPA partnerships depends on careful selection, comprehensive contract negotiations, and ongoing performance monitoring.

Insurance professionals who understand TPA capabilities and limitations can leverage these partnerships to improve client service while controlling operational costs. The continued growth of self-funded health plans, complex regulatory requirements, and demand for administrative efficiency position TPAs as increasingly important partners within commercial insurance markets. Effective TPA relationships require ongoing attention and active management but typically deliver significant value for properly structured arrangements.

The future of third-party administration will likely include continued technological advancements, expanded service capabilities, and greater specialization across specific insurance lines. This evolution may encompass innovative solutions for managing retirement plans, integrating human resources functions, and enhancing employee education initiatives. Insurance professionals who develop expertise in TPA evaluation and account management will be well-positioned to serve their clients effectively in increasingly complex commercial insurance markets, offering personalized service and comprehensive benefit solutions that address the evolving needs of employers and employees alike.

Frequently Asked Questions

A third-party administrator (TPA) manages claims processing and administrative tasks for insurance policies but does not underwrite or provide insurance coverage. An insurance company underwrites, assumes risk, and issues policies directly to insureds.

A TPA manages administrative tasks like claims processing, policy management, and customer service for insurers or self-insured companies. An adjuster specifically investigates, evaluates, and negotiates claims settlements directly with insured parties.

Examples of TPAs include companies like Sedgwick, ESIS (a division of Chubb), and Gallagher Bassett, all of which manage claims and administrative functions without underwriting risk.

Disadvantages of a TPA may include reduced control over customer service quality, potential misalignment with the company’s culture or goals, communication delays, and reliance on external vendors for critical claims handling.

A third-party administrator handles administrative tasks including claims management, enrollment, billing, reporting, and regulatory compliance on behalf of insurance companies, self-insured organizations, or employee benefit programs.