Advancing Risk Evaluation Through Composite Risk Assessment

Composite risk assessment represents a paradigm shift in how insurance professionals evaluate and quantify complex risk exposures. Unlike traditional single-factor risk analysis, this methodology synthesizes multiple risk variables into a unified assessment framework, providing a more accurate representation of actual exposure levels across diverse portfolios. This approach is a crucial component of an effective composite risk management strategy.

Introduction to Composite Risk Assessment

Modern insurance operations demand sophisticated risk evaluation techniques that account for the interconnected nature of contemporary risk landscapes. Composite risk assessment addresses this need by integrating multiple risk dimensions into a coherent analytical framework, forming a comprehensive risk assessment process.

Definition of Composite Risk Assessment

omposite risk assessment is a systematic methodology that combines individual risk factors—including frequency, severity, correlation effects, and temporal variations—into a single, comprehensive risk metric. This approach moves beyond isolated risk evaluations to capture the cumulative impact of multiple exposures operating simultaneously within an insurance portfolio.

The methodology recognizes that risks rarely exist in isolation. A manufacturing client may face product liability exposure that correlates with regulatory compliance risks, which in turn connects to operational disruption potential. Traditional assessment methods evaluate these separately, missing critical interaction effects that can amplify or mitigate overall exposure. Composite risk assessment considers both probability and severity of potential risks, providing a more nuanced understanding of the risk landscape.

Key characteristics of composite risk assessment include:

- Multi-dimensional analysis: Incorporates frequency, severity, correlation, and temporal factors

- Dynamic weighting: Adjusts factor importance based on portfolio characteristics and market conditions

- Predictive modeling: Uses historical data patterns to project future risk scenarios

- Integration capability: Seamlessly connects with existing underwriting and claims management systems

Importance in Operational Risk Management

Operational risk management within insurance organizations benefits significantly from composite risk assessment implementation. This methodology provides risk managers with a more nuanced understanding of how individual risks interact to create portfolio-level exposures.

Consider a regional property insurer operating across multiple catastrophe-prone territories. Traditional assessment might evaluate hurricane risk in Florida separately from wildfire exposure in California. Composite risk assessment recognizes that these seemingly independent risks share common factors—reinsurance market conditions, catastrophe bond pricing, and regulatory response patterns—that create portfolio-level correlations requiring integrated management approaches.

The operational advantages include:

- Risk Aggregation Accuracy: Composite methodologies account for correlation effects that traditional models often underestimate or ignore completely. This prevents the dangerous assumption that diversification automatically reduces aggregate exposure.

- Capital Allocation Optimization: By understanding true risk interactions, insurers can allocate capital more effectively across business lines and geographic regions, improving return on equity while maintaining appropriate safety margins.

- Pricing Precision: Composite assessment enables more accurate premium calculations by capturing the full spectrum of risk interactions affecting loss potential.

- Regulatory Compliance: Modern solvency requirements increasingly demand sophisticated risk modeling approaches that composite assessment methodologies readily support.

Key Elements of a Risk Management Framework

Effective composite risk assessment requires a robust underlying framework that supports comprehensive data collection, analysis, and decision-making processes. This framework forms the backbone of the overall risk management process.

Components of a Risk Management Framework

A comprehensive risk management framework supporting composite assessment includes five critical components:

- Data Architecture: Robust data collection and storage systems capable of handling diverse risk inputs from multiple sources. This includes internal loss data, external industry benchmarks, economic indicators, and regulatory trend information. The architecture must support real-time data feeds and historical trend analysis across extended time horizons.

- Analytical Engine: Sophisticated modeling capabilities that can process complex risk interactions and generate meaningful insights. Modern analytical engines employ machine learning algorithms, Monte Carlo simulation techniques, and advanced statistical methods to identify patterns and correlations that traditional analysis might miss. This engine often incorporates a risk assessment matrix to visualize and quantify various risk factors.

- Risk Taxonomy: Standardized classification systems that ensure consistent risk identification and categorization across the organization. This taxonomy must be sufficiently detailed to capture meaningful risk distinctions while remaining practical for operational use. It also serves as a foundation for effective hazard identification within the composite risk management process.

- Governance Structure: Clear roles, responsibilities, and decision-making authority for risk management activities. This includes risk committee structures, escalation procedures, and approval authorities for various risk tolerance levels. The governance structure should clearly define the risk decision authority for different levels of risk exposure.

- Reporting and Communication Systems: Comprehensive reporting capabilities that translate complex analytical results into actionable intelligence for different stakeholder groups, from front-line underwriters to senior executive leadership.

Integrating Composite Risk Assessment

Integration of composite risk assessment into existing risk management frameworks requires careful consideration of both technical and organizational factors. The integration process typically follows a phased approach that allows for gradual implementation while maintaining operational continuity. This phased approach represents a strategic risk management approach that balances immediate needs with long-term objectives.

Phase 1: Foundation Building involves establishing the necessary data infrastructure and analytical capabilities. This phase focuses on data quality improvement, system integration, and staff training. Organizations often begin with pilot programs covering specific product lines or geographic regions to validate methodology effectiveness before broader implementation.

Phase 2: Methodology Development centers on creating the specific composite assessment models relevant to the organization’s risk profile. This includes defining risk factor weights, correlation parameters, and threshold levels that trigger management attention or action.

Phase 3: Operational Integration involves embedding composite assessment processes into daily underwriting, pricing, and portfolio management activities. This phase requires close collaboration between risk management, underwriting, actuarial, and IT departments to ensure seamless workflow integration.

The integration process must address several common challenges:

- Legacy System Compatibility: Many insurance organizations operate on legacy systems not designed for sophisticated risk analytics. Integration often requires middleware solutions or gradual system modernization programs.

- Cultural Adaptation: Staff accustomed to traditional risk assessment methods may resist new approaches. Comprehensive training programs and clear demonstration of methodology benefits help overcome resistance.

- Regulatory Alignment: Composite assessment results must align with regulatory reporting requirements and examination expectations. Early engagement with regulatory stakeholders helps ensure compliance throughout implementation.

Composite Risk Assessment Example

Practical application of composite risk assessment concepts becomes clearer through detailed examination of real-world implementation scenarios.

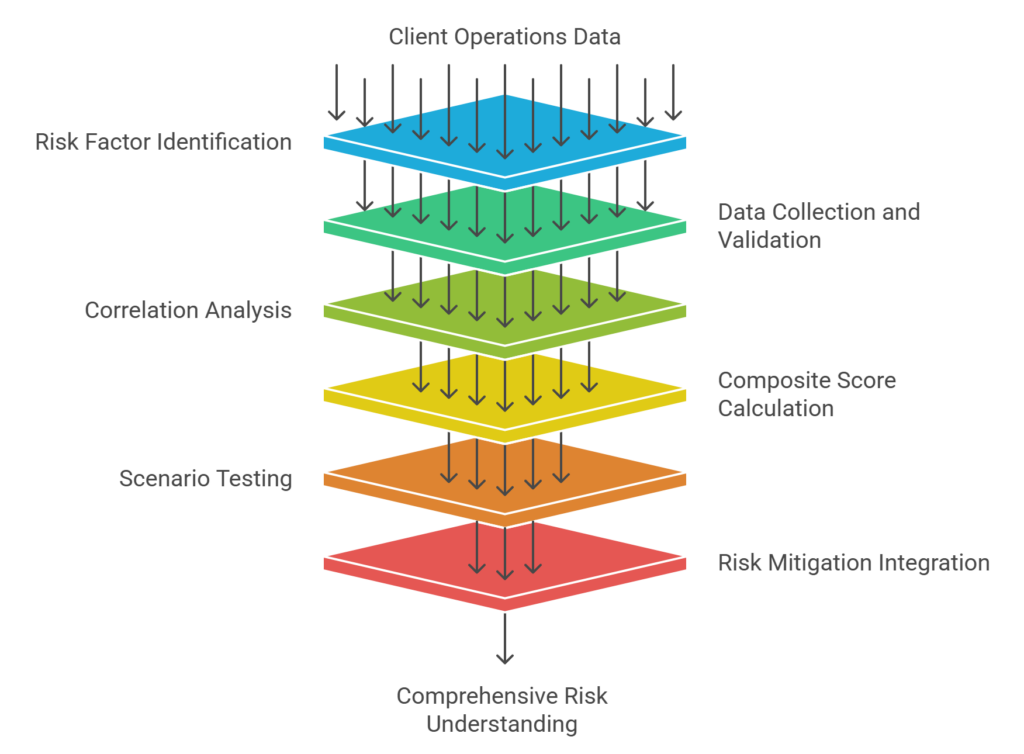

Step-by-Step Walkthrough of an Example

Consider a mid-size commercial lines insurer evaluating a manufacturing client with multiple locations across different states. Traditional assessment would evaluate each location independently, but composite risk assessment recognizes the interconnected nature of the client’s operations.

Step 1: Risk Factor Identification

The assessment begins by identifying all relevant risk factors affecting the client’s operations:

- Primary Operational Risks: Equipment breakdown, supply chain disruption, key person dependency

- External Environmental Risks: Natural catastrophes, regulatory changes, economic fluctuations

- Interconnection Risks: Business interruption cascades, common supplier dependencies, shared infrastructure vulnerabilities

Step 2: Data Collection and Validation

Comprehensive data gathering includes:

- Internal Loss History: Five years of claims data across all client locations

- Industry Benchmarking: Comparative loss experience for similar manufacturing operations

- External Risk Indicators: Catastrophe modeling results, economic forecasts, regulatory trend analysis

Step 3: Correlation Analysis

Advanced statistical analysis reveals risk correlations that traditional methods might miss:

- Hurricane exposure at the Florida facility correlates with supply chain disruption affecting all locations

- Regulatory compliance issues in California operations impact the entire organization’s reputation and regulatory standing

- Key personnel at the headquarters location influence operational effectiveness across all facilities

Step 4: Composite Score Calculation

The methodology combines individual risk scores using weighted correlation factors:

Composite Risk Score = Σ(Individual Risk Score × Correlation Weight × Temporal Factor)

Each component receives appropriate weighting based on historical data analysis and expert judgment

Step 5: Scenario Testing

The composite assessment undergoes stress testing using various scenario simulations:

- Major hurricane impacting Florida operations

- Regulatory investigation triggered by California compliance issues

- Economic recession affecting customer demand across all markets

Step 6: Risk Mitigation Integration

The assessment incorporates existing and proposed risk mitigation measures, adjusting the composite score to reflect their effectiveness. This step also considers the residual risk level after mitigation measures are applied, ensuring a comprehensive understanding of the organization’s risk position.

Tools Used in the Example

Successful composite risk assessment implementation requires sophisticated analytical tools and technologies:

- Catastrophe Modeling Platforms: Industry-standard models from vendors like RMS, AIR Worldwide, or EQE provide natural disaster risk quantification with correlation analysis capabilities.

- Statistical Analysis Software: Advanced platforms such as R, SAS, or specialized insurance analytics tools enable complex correlation analysis and predictive modeling.

- Business Intelligence Systems: Modern BI platforms consolidate diverse data sources and provide intuitive visualization of complex risk relationships.

- Monte Carlo Simulation Tools: These enable comprehensive scenario analysis and uncertainty quantification across multiple risk dimensions.

Risk Mitigation Strategies

Effective risk mitigation within a composite assessment framework requires strategies that address both individual risk factors and their interactions. These risk management strategies must be tailored to the specific risk profile identified through the composite assessment process.

Identifying Effective Risk Mitigation Strategies

Risk mitigation strategies in composite assessment environments must account for the interconnected nature of modern risk exposures. Traditional mitigation approaches that address individual risks may prove inadequate when risk correlations amplify overall exposure.

- Diversification Strategies remain important but require more sophisticated implementation. Geographic diversification, for instance, must account for correlation factors that may link seemingly independent territories. Climate change creates new correlation patterns between previously uncorrelated natural disaster risks.

- Risk Transfer Mechanisms benefit from composite assessment insights. Traditional insurance placement strategies may miss correlation effects that create aggregate exposure concentrations. Composite assessment helps identify these concentrations and develop appropriate risk transfer strategies.

- Operational Risk Controls gain increased importance in composite frameworks. Controls that address single risk factors may inadvertently increase other risk exposures. Composite assessment helps identify these trade-offs and optimize control strategies for overall risk reduction rather than single-factor improvement.

- Technology Solutions offer significant potential for risk mitigation across multiple dimensions simultaneously. Predictive analytics, IoT sensors, and artificial intelligence applications can address multiple risk factors while providing real-time monitoring capabilities.

Aligning Strategies with the Composite Risk Assessment

Mitigation strategy alignment requires understanding how individual controls affect the overall composite risk score. This alignment process involves several key considerations:

- Correlation Impact Analysis: Each mitigation strategy must be evaluated for its effect on risk correlations. Some strategies reduce individual risk factors while increasing correlations between remaining risks, potentially creating unexpected aggregate exposure increases.

- Cost-Benefit Optimization: Composite assessment enables more sophisticated cost-benefit analysis by accounting for mitigation effects across multiple risk dimensions. Strategies that appear expensive when evaluated against single risks may prove highly cost-effective when their composite benefits are properly quantified.

- Dynamic Adjustment Capabilities: Effective mitigation strategies in composite environments must adapt to changing risk correlations and external conditions. Static mitigation approaches may become ineffective as underlying risk relationships evolve.

Best Practices for Implementation

Successful composite risk assessment implementation requires adherence to proven best practices that address both technical and organizational challenges.

Utilizing Risk Assessment Tools

Modern risk assessment tools provide the analytical foundation for effective composite assessment implementation. Selection and deployment of these tools requires careful consideration of organizational needs and technical capabilities.

- Tool Selection Criteria should prioritize integration capabilities, scalability, and analytical sophistication. The selected platform must handle diverse data inputs while providing intuitive output for various stakeholder groups. Cloud-based solutions often provide better scalability and integration capabilities than traditional on-premise installations.

- Data Quality Management represents a critical success factor for tool effectiveness. Composite assessment results are only as reliable as the underlying data quality. Implementation best practices include comprehensive data validation procedures, regular quality audits, and continuous improvement processes.

- User Training and Support programs must address varying levels of technical sophistication across user groups. Front-line underwriters require different training approaches than actuarial analysts or senior executives. Effective programs provide role-specific training while maintaining consistency in methodology understanding.

- Model Validation and Testing procedures ensure ongoing accuracy and reliability of composite assessment results. Regular backtesting against actual loss experience helps identify model drift and calibration issues before they affect business decisions.

Continuous Monitoring and Feedback Loop

Composite risk assessment effectiveness depends on continuous monitoring and systematic feedback integration to maintain accuracy and relevance over time.

- Performance Monitoring Systems track assessment accuracy through comparison with actual loss experience. These systems must account for the probabilistic nature of risk assessment while identifying systematic biases or calibration issues that require model adjustment.

- Market Intelligence Integration ensures that composite assessments remain current with evolving risk landscapes. Regular integration of industry loss data, regulatory changes, and economic indicators maintains model relevance and predictive accuracy.

- Stakeholder Feedback Mechanisms provide valuable input for model refinement and enhancement. Regular feedback collection from underwriters, claims professionals, and risk managers helps identify practical implementation challenges and improvement opportunities.

- Model Enhancement Protocols establish systematic approaches for incorporating new risk factors, updating correlation parameters, and refining analytical methodologies. These protocols balance the need for continuous improvement with operational stability requirements.

The implementation of composite risk assessment represents a significant advancement in insurance risk management capabilities. By acknowledging the interconnected nature of modern risk exposures and providing analytical frameworks to quantify these relationships, composite assessment enables more informed decision-making across all aspects of insurance operations.

Success in composite risk assessment implementation requires commitment to analytical rigor, organizational change management, and continuous improvement. Organizations that invest in these capabilities position themselves for competitive advantage in increasingly complex risk environments while better serving their clients’ evolving risk management needs.

The methodology’s value extends beyond improved risk quantification to include enhanced capital allocation, more accurate pricing, and stronger regulatory compliance capabilities. As risk landscapes continue to evolve, composite risk management will become increasingly important for insurance professionals seeking to maintain effectiveness in their risk management responsibilities.

Frequently Asked Questions

Composite risk refers to an aggregated assessment of multiple individual risks into a single overall risk measurement, facilitating easier evaluation and management decisions.

The four essential components of risk assessment are:

- Hazard Identification: Recognizing potential sources of harm.

- Risk Analysis: Evaluating likelihood and severity of harm.

- Risk Evaluation: Determining risk acceptability.

- Risk Treatment/Control: Implementing measures to mitigate risk.

A composite risk indicator is a calculated metric combining multiple risk factors or metrics into a single numeric indicator, used to assess overall risk levels effectively.

The three primary types of risk assessments are:

- Qualitative Assessment: Subjective evaluation based on judgment and experience.

- Quantitative Assessment: Numeric evaluation using statistical and mathematical models.

- Semi-Quantitative Assessment: A blend of qualitative judgment and numerical scoring.

Composite risk management (CRM) is a structured, systematic approach that integrates multiple risk factors into a unified framework to identify, assess, and mitigate risks, optimizing organizational decisions and resource allocation.

Key steps include hazard identification, risk evaluation, prioritization of risks, control implementation, and continuous monitoring.